Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, UFP Technologies, Inc. (NASDAQ:UFPT) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for UFP Technologies

What Is UFP Technologies's Net Debt?

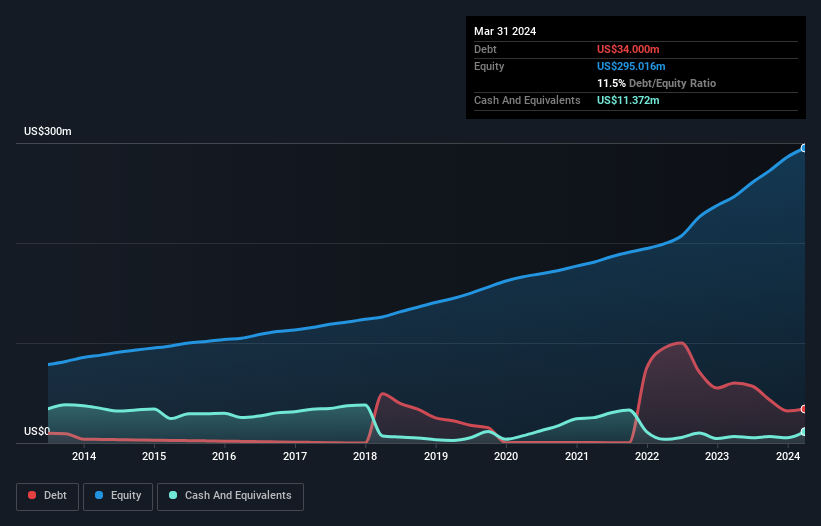

The image below, which you can click on for greater detail, shows that UFP Technologies had debt of US$34.0m at the end of March 2024, a reduction from US$60.0m over a year. However, it also had US$11.4m in cash, and so its net debt is US$22.6m.

How Strong Is UFP Technologies' Balance Sheet?

According to the last reported balance sheet, UFP Technologies had liabilities of US$52.4m due within 12 months, and liabilities of US$60.2m due beyond 12 months. Offsetting these obligations, it had cash of US$11.4m as well as receivables valued at US$61.3m due within 12 months. So it has liabilities totalling US$40.0m more than its cash and near-term receivables, combined.

Since publicly traded UFP Technologies shares are worth a total of US$1.97b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. But either way, UFP Technologies has virtually no net debt, so it's fair to say it does not have a heavy debt load!

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

UFP Technologies has a low net debt to EBITDA ratio of only 0.31. And its EBIT easily covers its interest expense, being 18.1 times the size. So we're pretty relaxed about its super-conservative use of debt. Also good is that UFP Technologies grew its EBIT at 17% over the last year, further increasing its ability to manage debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if UFP Technologies can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, UFP Technologies's free cash flow amounted to 37% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Happily, UFP Technologies's impressive interest cover implies it has the upper hand on its debt. But, on a more sombre note, we are a little concerned by its conversion of EBIT to free cash flow. It's also worth noting that UFP Technologies is in the Medical Equipment industry, which is often considered to be quite defensive. Looking at the bigger picture, we think UFP Technologies's use of debt seems quite reasonable and we're not concerned about it. While debt does bring risk, when used wisely it can also bring a higher return on equity. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that UFP Technologies insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:UFPT

UFP Technologies

Designs and manufactures solutions for medical devices, sterile packaging, and other engineered custom products in the United States.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.