- United States

- /

- Healthcare Services

- /

- NasdaqCM:TOI

The Oncology Institute, Inc. (NASDAQ:TOI) Stock's 29% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Unfortunately for some shareholders, the The Oncology Institute, Inc. (NASDAQ:TOI) share price has dived 29% in the last thirty days, prolonging recent pain. The good news is that in the last year, the stock has shone bright like a diamond, gaining 114%.

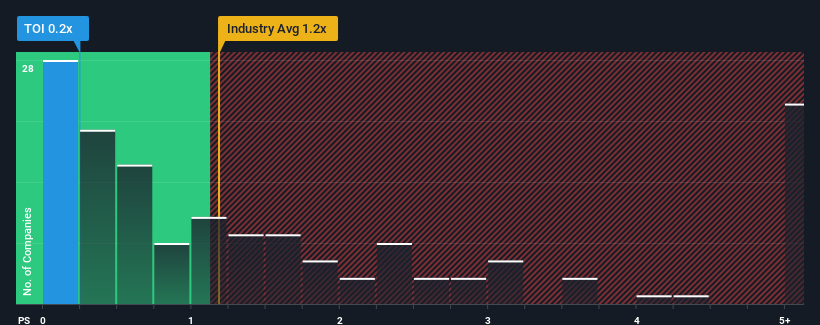

After such a large drop in price, when close to half the companies operating in the United States' Healthcare industry have price-to-sales ratios (or "P/S") above 1.2x, you may consider Oncology Institute as an enticing stock to check out with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Oncology Institute

How Oncology Institute Has Been Performing

With revenue growth that's superior to most other companies of late, Oncology Institute has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Oncology Institute will help you uncover what's on the horizon.How Is Oncology Institute's Revenue Growth Trending?

In order to justify its P/S ratio, Oncology Institute would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 73% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 27% during the coming year according to the sole analyst following the company. With the industry only predicted to deliver 7.4%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Oncology Institute is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Oncology Institute's recently weak share price has pulled its P/S back below other Healthcare companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at Oncology Institute's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Oncology Institute that you should be aware of.

If these risks are making you reconsider your opinion on Oncology Institute, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:TOI

Oncology Institute

An oncology company, provides various medical oncology services in the United States.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives