- United States

- /

- Medical Equipment

- /

- NasdaqGM:TMDX

TransMedics Group (TMDX) Valuation in Focus as Profits and Reinvestment Signal Long-Term Growth Potential

Reviewed by Kshitija Bhandaru

TransMedics Group (TMDX) is drawing attention as it begins generating pre-tax profits and ramps up capital reinvestment, signaling its ambitions for future growth even as some warn of possible short-term revenue softness.

See our latest analysis for TransMedics Group.

TransMedics Group’s share price has seen some volatility recently, dipping over 5% in the latest session. Its year-to-date share price return stands out at more than 61%, far outpacing many healthcare peers. Still, the 1-year total shareholder return is down 21%, which highlights both strong underlying growth and the swings that come with high expectations and industry change.

If you’re curious about what other innovative healthcare companies are gaining momentum, check out the full list with See the full list for free.

With the stock trading well below analyst price targets but coming off recent volatility, investors are left to wonder if TransMedics Group represents an undervalued opportunity or if the market has already priced in its ambitious growth outlook.

Most Popular Narrative: 22.7% Undervalued

With TransMedics Group closing at $107.29 and the most widely followed narrative suggesting a fair value of $138.88, bulls see a significant gap between current price and long-term potential.

Expansion into new organ types (notably kidney) and next-generation product launches (Gen 3 OCS platforms for heart, lung, and liver) are expected to materially grow TransMedics' total addressable market, improve product mix, and support higher average selling prices, benefiting earnings and longer-term net margins.

Want to see what growth story justifies this premium price? The most popular narrative leans heavily on radical expansion plans and ambitious profit targets. Find out what blend of growth projections and margin upgrades are driving this bullish outlook. Dive in for the full numbers and key assumptions.

Result: Fair Value of $138.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing innovation hurdles and potential regulatory changes remain key risks. These factors could disrupt TransMedics Group’s ambitious growth projections and pricing power.

Find out about the key risks to this TransMedics Group narrative.

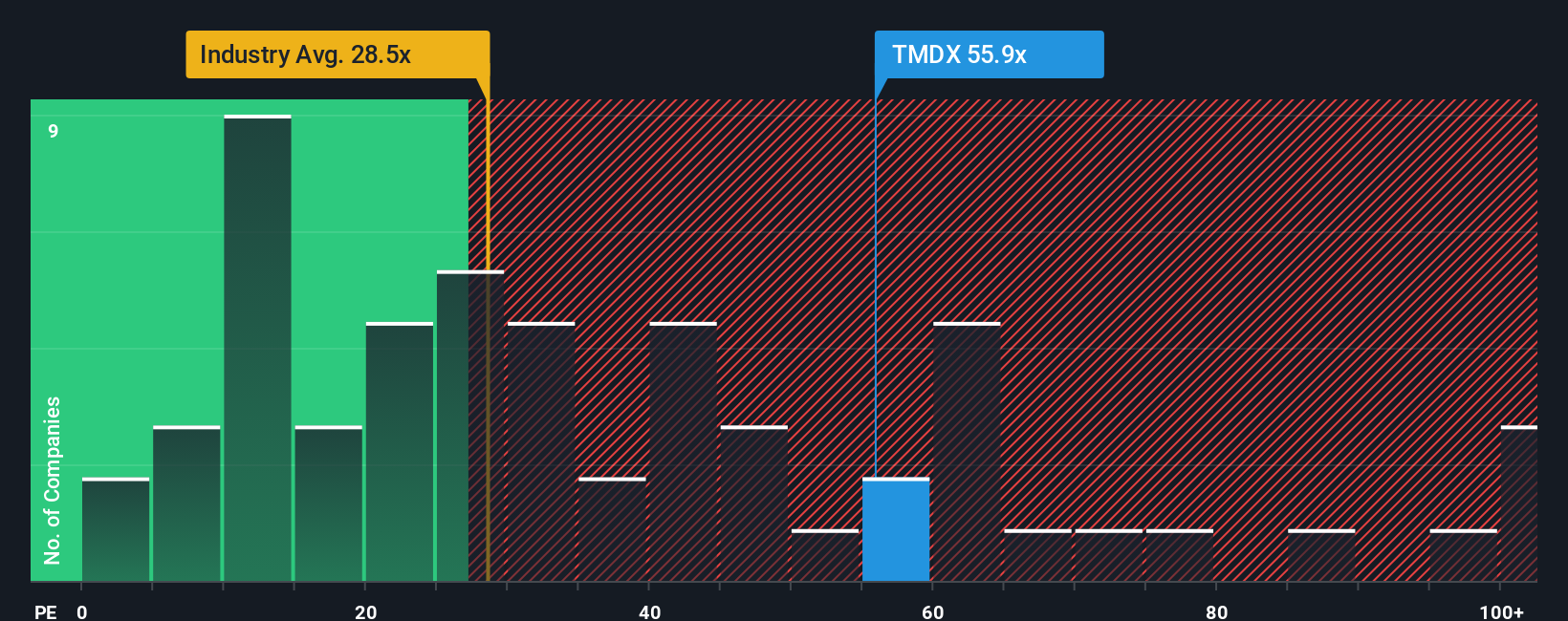

Another View: Market Multiples Paint a Pricier Picture

While fair value estimates suggest TransMedics Group is well undervalued, the market's favored metric tells a more cautious story. The company's price-to-earnings ratio is currently 51x, higher than both peers (41.1x) and the industry average (30.1x), and well above the fair ratio of 37x. That premium hints at high expectations, which could signal greater risk if growth falls short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TransMedics Group Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized outlook in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding TransMedics Group.

Looking for more investment ideas?

Don't miss out on the next big opportunities. Expand your watchlist by targeting companies with unique growth, income, or technology advantages using these hand-picked stock screens:

- Boost your returns by targeting stocks that offer yields over 3% using these 19 dividend stocks with yields > 3% to add a reliable income stream to your portfolio.

- Get ahead of the curve and spot innovation early by checking out these 24 AI penny stocks, which are transforming industries with advanced artificial intelligence.

- Capitalize on future breakthroughs by finding these 26 quantum computing stocks that could benefit from revolutionary advances in quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransMedics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TMDX

TransMedics Group

A commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives