- United States

- /

- Biotech

- /

- NasdaqGM:KOD

Talkspace And 2 Other Compelling Penny Stocks To Consider

Reviewed by Simply Wall St

Over the last 7 days, the market has risen 1.4%, and in the past year, it has climbed 12%, with earnings forecasted to grow by 15% annually. In such a climate, identifying stocks with solid financials is crucial for uncovering potential investment opportunities. Although 'penny stock' might sound outdated, these smaller or newer companies can still offer significant value when they possess strong balance sheets and growth potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Imperial Petroleum (IMPP) | $3.02 | $104.28M | ✅ 4 ⚠️ 1 View Analysis > |

| New Horizon Aircraft (HOVR) | $0.97 | $28.55M | ✅ 4 ⚠️ 5 View Analysis > |

| Greenland Technologies Holding (GTEC) | $2.02 | $36.88M | ✅ 2 ⚠️ 5 View Analysis > |

| WM Technology (MAPS) | $1.05 | $174.9M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.80 | $183.33M | ✅ 4 ⚠️ 0 View Analysis > |

| Table Trac (TBTC) | $4.8375 | $22.78M | ✅ 2 ⚠️ 2 View Analysis > |

| Flexible Solutions International (FSI) | $4.36 | $57.04M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.84 | $5.96M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.40 | $79.12M | ✅ 3 ⚠️ 2 View Analysis > |

| TETRA Technologies (TTI) | $2.86 | $396.56M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 715 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Talkspace (TALK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Talkspace, Inc. is a virtual behavioral healthcare company that facilitates connections between patients and licensed mental health providers in the United States, with a market cap of approximately $570.54 million.

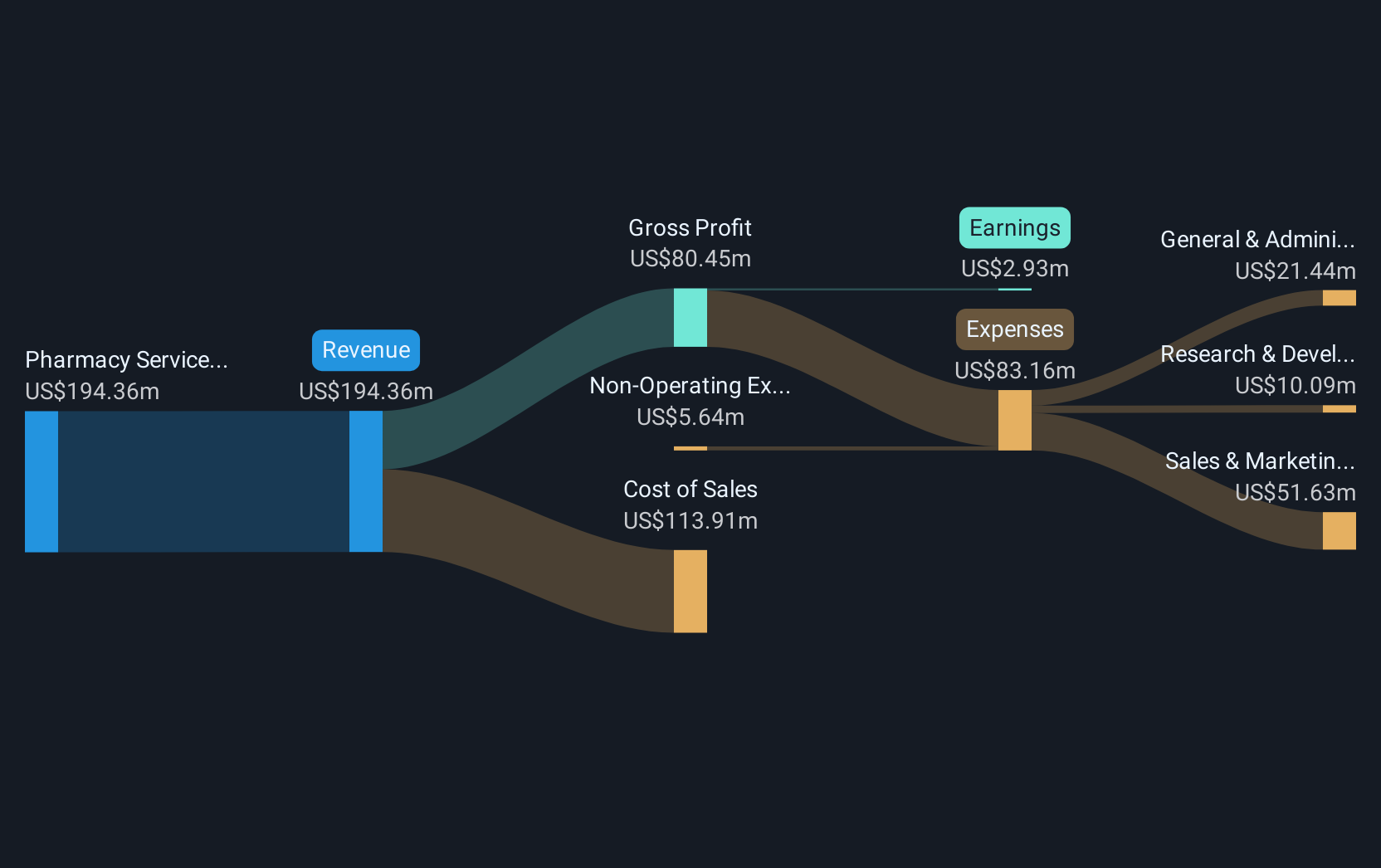

Operations: The company's revenue is primarily generated from its Pharmacy Services segment, which accounted for $194.36 million.

Market Cap: $570.54M

Talkspace, Inc., a virtual behavioral healthcare company, has demonstrated financial stability with short-term assets of US$124.1 million exceeding its liabilities and no debt on its balance sheet. The firm recently reported a net income of US$0.318 million for Q1 2025, marking profitability after previous losses. Strategic collaborations with Amazon Pharmacy and Bark Technologies aim to enhance service delivery and accessibility in mental health care. Additionally, Talkspace's share buyback program reflects confidence in its valuation while trading significantly below estimated fair value could attract interest from penny stock investors seeking potential upside.

- Get an in-depth perspective on Talkspace's performance by reading our balance sheet health report here.

- Learn about Talkspace's future growth trajectory here.

Kodiak Sciences (KOD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kodiak Sciences Inc. is a clinical-stage biopharmaceutical company focused on developing and commercializing therapeutics for retinal diseases, with a market cap of approximately $207.36 million.

Operations: Kodiak Sciences does not currently report any revenue segments.

Market Cap: $207.36M

Kodiak Sciences, a clinical-stage biopharmaceutical company, remains pre-revenue with no significant revenue streams. Despite its seasoned management and board, the firm faces financial challenges with short-term assets of US$142.7 million not covering long-term liabilities of US$158.2 million. The company's stock exhibits high volatility compared to most U.S. stocks, and it has been unprofitable with increasing losses over the past five years. Recent developments include ongoing Phase 3 trials for its lead product candidate tarcocimab tedromer in retinal diseases, though auditors have expressed doubts about Kodiak's ability to continue as a going concern due to persistent financial losses and cash runway concerns.

- Click here to discover the nuances of Kodiak Sciences with our detailed analytical financial health report.

- Gain insights into Kodiak Sciences' future direction by reviewing our growth report.

United States Antimony (UAMY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: United States Antimony Corporation is engaged in the production and sale of antimony, zeolite, and precious metals in the United States and Canada, with a market capitalization of approximately $313.68 million.

Operations: The company's revenue is primarily derived from its antimony segment, which generated $15.43 million, and its zeolite segment, contributing $3.43 million.

Market Cap: $313.68M

United States Antimony Corporation, with a market cap of US$313.68 million, is primarily driven by its antimony segment, generating US$15.43 million in revenue. Despite being unprofitable and experiencing increased losses over five years at 11.5% annually, the company maintains a strong cash position exceeding its total debt and has more than three years of cash runway based on current free cash flow. While the management team is relatively new with an average tenure of 1.3 years, recent conference presentations suggest active engagement with investors to potentially address volatility concerns and align future growth strategies.

- Dive into the specifics of United States Antimony here with our thorough balance sheet health report.

- Understand United States Antimony's earnings outlook by examining our growth report.

Seize The Opportunity

- Investigate our full lineup of 715 US Penny Stocks right here.

- Interested In Other Possibilities? Uncover 18 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kodiak Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:KOD

Kodiak Sciences

A clinical stage biopharmaceutical company, engages in the research, development, and commercialization of therapeutics to treat retinal diseases.

Moderate with adequate balance sheet.

Market Insights

Community Narratives