- United States

- /

- Healthtech

- /

- NasdaqCM:STRM

Streamline Health Solutions, Inc. (NASDAQ:STRM) Looks Inexpensive After Falling 28% But Perhaps Not Attractive Enough

Streamline Health Solutions, Inc. (NASDAQ:STRM) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 81% share price decline.

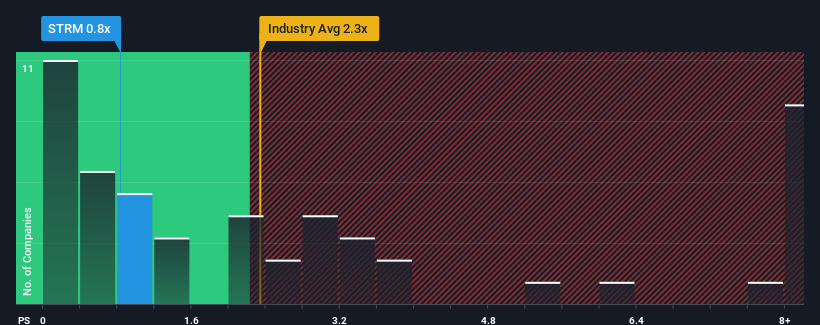

Since its price has dipped substantially, given about half the companies operating in the United States' Healthcare Services industry have price-to-sales ratios (or "P/S") above 2.3x, you may consider Streamline Health Solutions as an attractive investment with its 0.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Streamline Health Solutions

What Does Streamline Health Solutions' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Streamline Health Solutions' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Streamline Health Solutions.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Streamline Health Solutions' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 9.2% decrease to the company's top line. Even so, admirably revenue has lifted 99% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 0.5% each year over the next three years. That's shaping up to be materially lower than the 13% each year growth forecast for the broader industry.

With this in consideration, its clear as to why Streamline Health Solutions' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Streamline Health Solutions' P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Streamline Health Solutions' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Streamline Health Solutions (1 can't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of Streamline Health Solutions' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:STRM

Streamline Health Solutions

Provides health information technology solutions and associated services for hospitals and health systems in North America.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives