- United States

- /

- Medical Equipment

- /

- NasdaqGM:STAA

Why Investors Shouldn't Be Surprised By STAAR Surgical Company's (NASDAQ:STAA) 26% Share Price Plunge

Unfortunately for some shareholders, the STAAR Surgical Company (NASDAQ:STAA) share price has dived 26% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 49% share price drop.

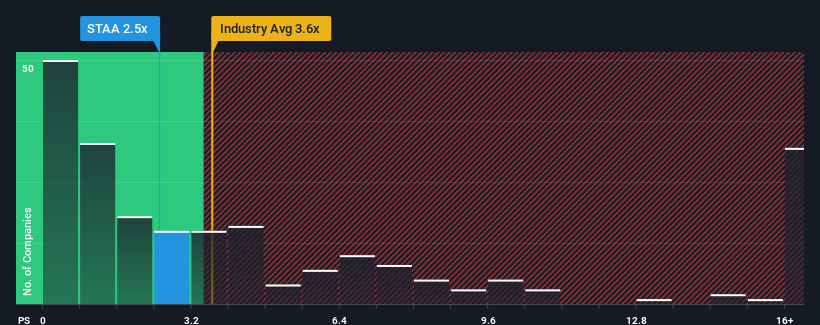

After such a large drop in price, STAAR Surgical may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2.5x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.6x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for STAAR Surgical

What Does STAAR Surgical's Recent Performance Look Like?

STAAR Surgical hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on STAAR Surgical will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For STAAR Surgical?

There's an inherent assumption that a company should underperform the industry for P/S ratios like STAAR Surgical's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.6%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 36% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 6.7% each year during the coming three years according to the twelve analysts following the company. That's shaping up to be materially lower than the 9.4% per annum growth forecast for the broader industry.

With this information, we can see why STAAR Surgical is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does STAAR Surgical's P/S Mean For Investors?

The southerly movements of STAAR Surgical's shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of STAAR Surgical's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for STAAR Surgical with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:STAA

STAAR Surgical

Designs, develops, manufactures, markets, and sells implantable lenses for the eye, and companion delivery systems to deliver the lenses into the eye.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives