- United States

- /

- Medical Equipment

- /

- NasdaqCM:SSII

Is SSII’s Budget-Friendly Surgical Robot Rerouting Its Long-Term Competitive Trajectory in Medtech?

Reviewed by Sasha Jovanovic

- SS Innovations International recently reported rapid growth in installations and procedures for its SSi Mantra 3 surgical robotic system, driven by its design features and affordability compared with existing options.

- Management highlighted that the system’s unique configuration and lower cost are helping it win surgeon adoption in procedures traditionally dominated by higher-priced robotic platforms.

- We’ll now examine how this expanding demand for the SSi Mantra 3 could shape SS Innovations International’s broader investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is SS Innovations International's Investment Narrative?

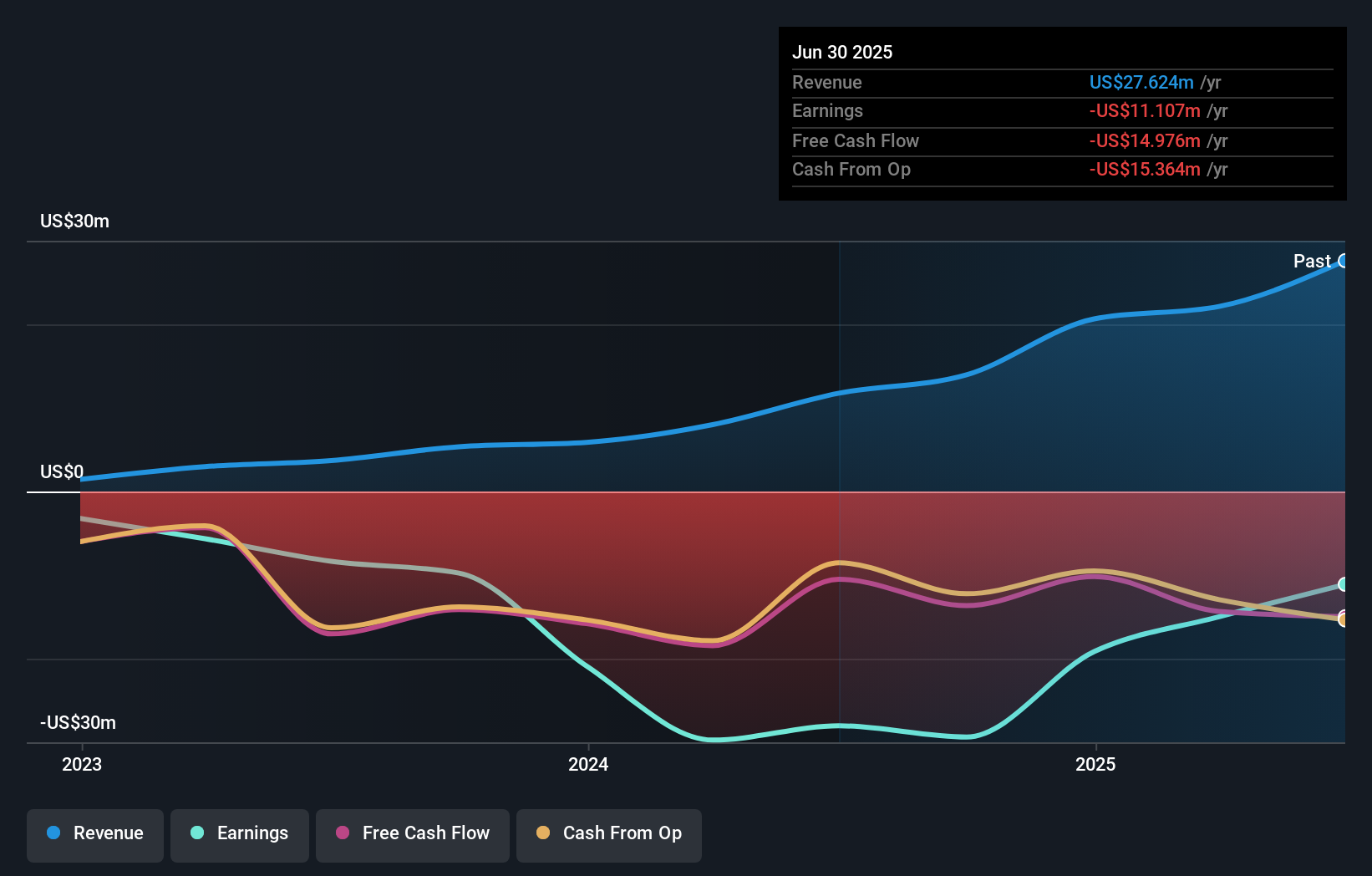

To own SS Innovations International, you really have to believe that the SSi Mantra 3 can carve out a durable position in surgical robotics by combining lower cost with capabilities that keep surgeons using it across multiple specialties and geographies. The latest update on rapid growth in installations and procedures supports that thesis and, in the near term, reinforces the key catalyst around expanding the installed base ahead of a planned FDA 510(k) filing. At the same time, it sharpens a few risks rather than removing them: the company is still loss making, trades at a rich sales multiple, has less than a year of cash runway, and is led by a relatively new team with high CEO pay. Recent share price weakness after a very large 1‑year gain suggests expectations may already be sensitive to any stumble in execution.

However, there is one issue around funding and valuation that investors should not overlook. The valuation report we've compiled suggests that SS Innovations International's current price could be inflated.Exploring Other Perspectives

Explore another fair value estimate on SS Innovations International - why the stock might be worth less than half the current price!

Build Your Own SS Innovations International Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SS Innovations International research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free SS Innovations International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SS Innovations International's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SSII

SS Innovations International

Operates as a commercial-stage surgical robotics company in India and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026