- United States

- /

- Medical Equipment

- /

- NasdaqGS:SRDX

There's Reason For Concern Over Surmodics, Inc.'s (NASDAQ:SRDX) Massive 29% Price Jump

Surmodics, Inc. (NASDAQ:SRDX) shares have continued their recent momentum with a 29% gain in the last month alone. The annual gain comes to 114% following the latest surge, making investors sit up and take notice.

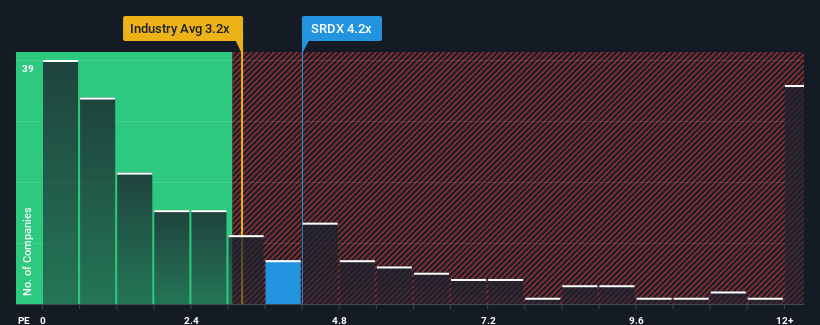

Since its price has surged higher, when almost half of the companies in the United States' Medical Equipment industry have price-to-sales ratios (or "P/S") below 3.2x, you may consider Surmodics as a stock probably not worth researching with its 4.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Surmodics

What Does Surmodics' Recent Performance Look Like?

Surmodics certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Surmodics will help you uncover what's on the horizon.How Is Surmodics' Revenue Growth Trending?

In order to justify its P/S ratio, Surmodics would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 39%. Pleasingly, revenue has also lifted 34% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue growth is heading into negative territory, declining 8.9% over the next year. With the industry predicted to deliver 9.5% growth, that's a disappointing outcome.

With this information, we find it concerning that Surmodics is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

Surmodics shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

For a company with revenues that are set to decline in the context of a growing industry, Surmodics' P/S is much higher than we would've anticipated. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You need to take note of risks, for example - Surmodics has 2 warning signs (and 1 which is concerning) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SRDX

Surmodics

Provides performance coating technologies for intravascular medical devices, and chemical and biological components for in vitro diagnostic immunoassay tests and microarrays in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives