- United States

- /

- Healthtech

- /

- NasdaqGS:SOPH

With A 25% Price Drop For SOPHiA GENETICS SA (NASDAQ:SOPH) You'll Still Get What You Pay For

SOPHiA GENETICS SA (NASDAQ:SOPH) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 39% in that time.

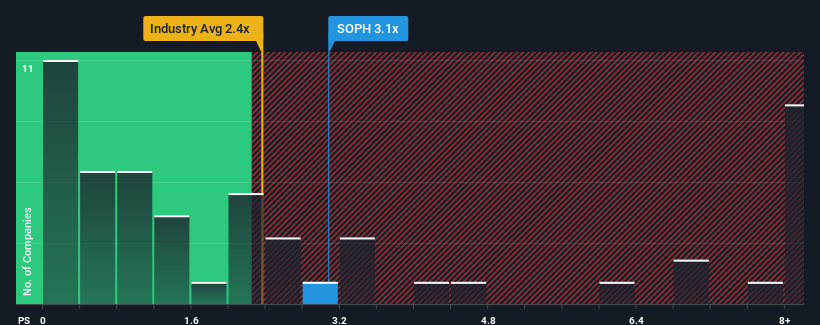

In spite of the heavy fall in price, given close to half the companies operating in the United States' Healthcare Services industry have price-to-sales ratios (or "P/S") below 2.4x, you may still consider SOPHiA GENETICS as a stock to potentially avoid with its 3.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for SOPHiA GENETICS

What Does SOPHiA GENETICS' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, SOPHiA GENETICS has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on SOPHiA GENETICS will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For SOPHiA GENETICS?

In order to justify its P/S ratio, SOPHiA GENETICS would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 4.5% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 61% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 22% per year as estimated by the six analysts watching the company. With the industry only predicted to deliver 11% per annum, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why SOPHiA GENETICS' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From SOPHiA GENETICS' P/S?

SOPHiA GENETICS' P/S remain high even after its stock plunged. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of SOPHiA GENETICS' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you take the next step, you should know about the 2 warning signs for SOPHiA GENETICS that we have uncovered.

If these risks are making you reconsider your opinion on SOPHiA GENETICS, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SOPH

SOPHiA GENETICS

Operates as a cloud-native software technology company in the healthcare space.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026