- United States

- /

- Capital Markets

- /

- NasdaqGM:MAAS

March 2025's Promising Penny Stocks To Consider

Reviewed by Simply Wall St

As of March 2025, the U.S. markets have shown resilience with the S&P 500 and Nasdaq Composite experiencing gains following an encouraging Consumer Price Index inflation report, despite recent concerns about economic health and policy uncertainties. Amidst this backdrop, investors continue to explore diverse opportunities for growth in various market segments. Penny stocks, although often considered speculative investments due to their lower price points and smaller company size, can still offer potential value when backed by solid financial fundamentals. In this article, we'll explore a selection of penny stocks that are currently attracting attention for their promising prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.82485 | $5.96M | ★★★★★★ |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.58 | $73.4M | ★★★★★★ |

| Safe Bulkers (NYSE:SB) | $3.79 | $388.97M | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $132.38M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.47 | $71.58M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.93 | $141.3M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.869 | $77.59M | ★★★★★☆ |

| TETRA Technologies (NYSE:TTI) | $3.34 | $432.93M | ★★★★☆☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.7087 | $19.07M | ★★★★☆☆ |

Click here to see the full list of 757 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Highest Performances Holdings (NasdaqGM:HPH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Highest Performances Holdings Inc. provides financial technology services in China and has a market cap of $37.55 million.

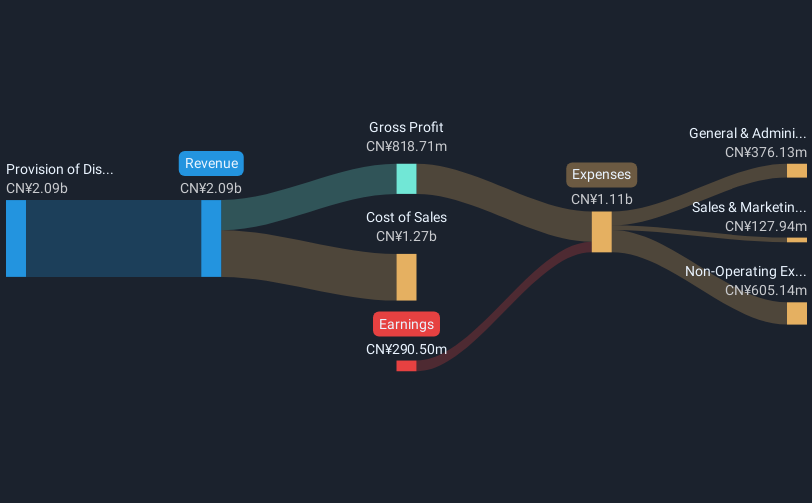

Operations: The company generates CN¥2.09 billion from its distribution and management of wealth management services in China.

Market Cap: $37.55M

Highest Performances Holdings Inc., with a market cap of $37.55 million, operates in the financial technology sector in China and generates CN¥2.09 billion from wealth management services. Despite being unprofitable, it maintains a positive cash flow runway for over three years. The company has experienced significant executive changes recently, including the appointment of Ms. Min Zhou as CEO and several board member resignations and appointments, which may impact governance stability. Additionally, recent private placements have shifted major shareholding to Moonlit Group and Sea Synergy Limited, affecting voting power dynamics within the company.

- Unlock comprehensive insights into our analysis of Highest Performances Holdings stock in this financial health report.

- Understand Highest Performances Holdings' track record by examining our performance history report.

SOPHiA GENETICS (NasdaqGS:SOPH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SOPHiA GENETICS SA is a cloud-native software technology company in the healthcare sector with a market cap of $206.51 million.

Operations: The company generates revenue from its healthcare software segment, which amounted to $65.17 million.

Market Cap: $206.51M

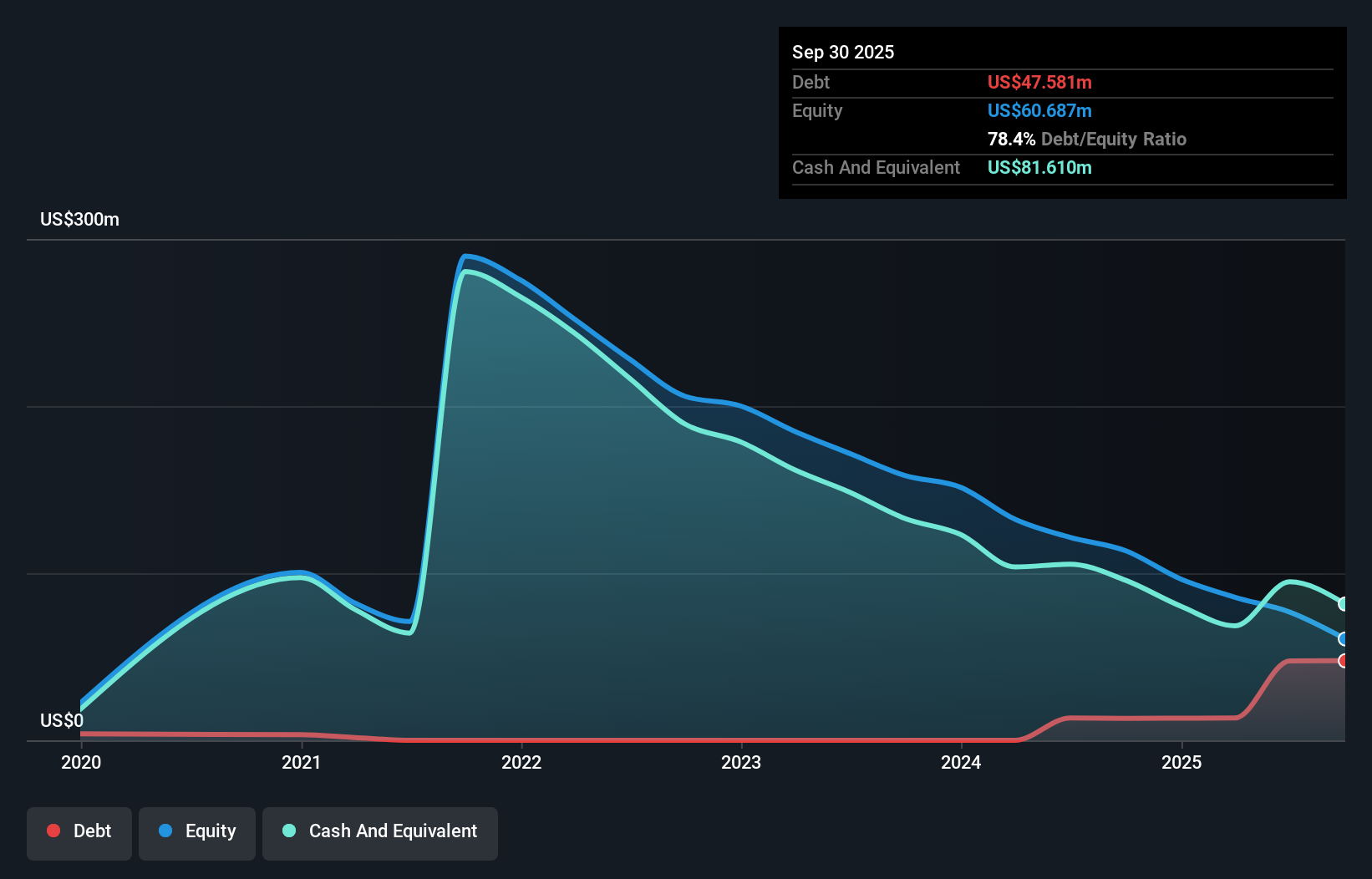

SOPHiA GENETICS, with a market cap of US$206.51 million, operates in the healthcare software sector and reported annual revenue of US$65.17 million. Despite being unprofitable, its cash reserves exceed total debt, providing a runway for over a year based on current free cash flow trends. The company forecasts 2025 revenue growth between 10% and 17%. Recent innovations like the OncoPortal™ Mutation Tracker enhance its data-driven oncology capabilities, potentially boosting long-term value. However, high share price volatility remains a concern for investors seeking stability in this penny stock investment landscape.

- Navigate through the intricacies of SOPHiA GENETICS with our comprehensive balance sheet health report here.

- Gain insights into SOPHiA GENETICS' outlook and expected performance with our report on the company's earnings estimates.

Vasta Platform (NasdaqGS:VSTA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vasta Platform Limited offers educational printed and digital solutions to private schools in Brazil's K-12 sector, with a market cap of $265.37 million.

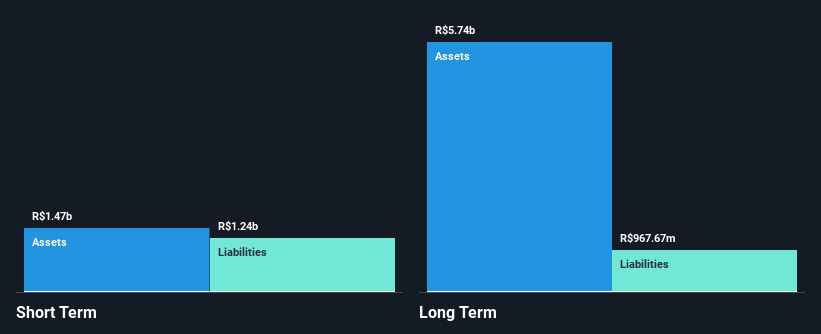

Operations: The company's revenue is primarily derived from its Educational Services segment, specifically Education & Training Services, totaling R$1.53 billion.

Market Cap: $265.37M

Vasta Platform Limited, with a market cap of $265.37 million, operates in Brazil's K-12 educational sector and reported revenue of R$1.67 billion for 2024, reflecting growth from the previous year. Despite being unprofitable, the company has a sufficient cash runway exceeding three years due to positive free cash flow. Its debt-to-equity ratio has significantly improved over five years to 23.7%, indicating better financial management. Vasta's short-term assets cover its short-term liabilities but not its long-term obligations. Recent earnings announcements showed a net income turnaround to BRL 486.49 million, suggesting potential positive momentum for this penny stock.

- Click here and access our complete financial health analysis report to understand the dynamics of Vasta Platform.

- Examine Vasta Platform's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Jump into our full catalog of 757 US Penny Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Highest Performances Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Highest Performances Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MAAS

Highest Performances Holdings

Engages in the provision of financial technology services in China.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives