- United States

- /

- Healthcare Services

- /

- NasdaqGS:SGRY

How Slower Acquisitions and Rising Debt at Surgery Partners (SGRY) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In recent weeks, Surgery Partners has faced pressure as investors raised concerns about the company's elevated debt levels, disappointing sales, and rising interest expenses.

- An important development is that slower-than-expected acquisitions and poor free cash flow margins are now seen as limiting the company's ability to invest in growth or support shareholder-friendly activities.

- To understand the investment implications, we'll assess how concerns over Surgery Partners’ growing leverage could reshape its future outlook and narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Surgery Partners Investment Narrative Recap

To invest in Surgery Partners, the core belief is in the company’s ability to accelerate the shift of complex surgeries to outpatient care, helping drive organic growth and operating leverage across its expanding facility network. However, the latest update deepens focus on a key risk: despite reaffirmed growth ambitions, rising interest expenses and slower M&A activity are now clearly front and center, threatening to overshadow the prospects for higher case volumes and margin expansion in the near term.

Among recent announcements, the cancellation of Bain Capital’s proposed $2 billion buyout stands out for its relevance. Instead of taking the company private, management’s decision to remain independent signals confidence in long-term growth, but also leaves Surgery Partners solely responsible for managing the balance sheet and delivering on acquisition and cash flow promises at a time when near-term financial flexibility is a concern.

Yet, before assuming these share price risks are isolated, keep in mind that rising interest expenses are starting to drive...

Read the full narrative on Surgery Partners (it's free!)

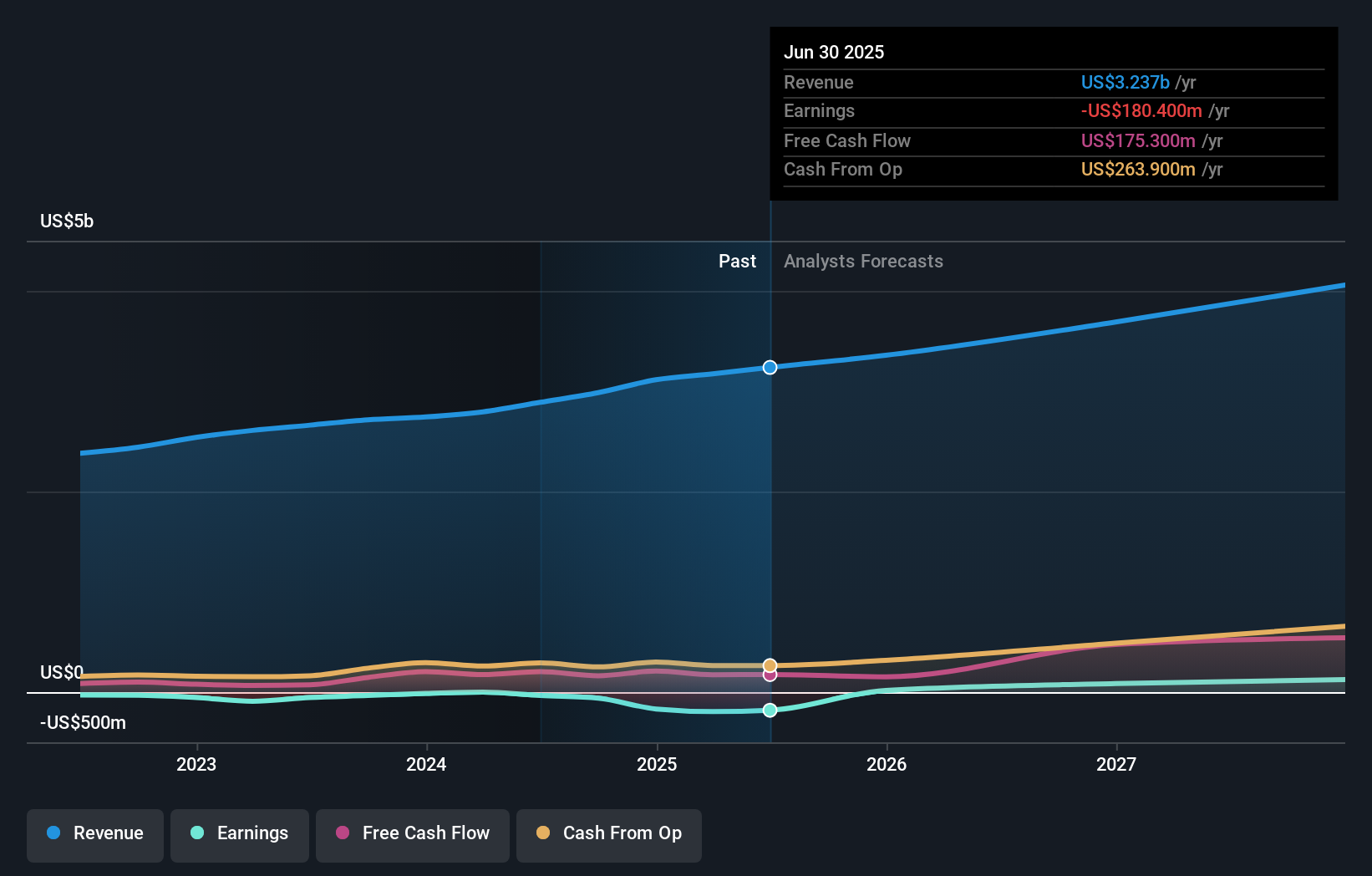

Surgery Partners' narrative projects $4.3 billion revenue and $164.3 million earnings by 2028. This requires 9.9% yearly revenue growth and a $344.7 million earnings increase from -$180.4 million today.

Uncover how Surgery Partners' forecasts yield a $31.00 fair value, a 51% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair values for Surgery Partners between US$31 and US$77.94, based on two distinct viewpoints. In light of current concerns about elevated debt and cash flow, these varying outlooks show how widely opinions can differ on the company’s future performance.

Explore 2 other fair value estimates on Surgery Partners - why the stock might be worth just $31.00!

Build Your Own Surgery Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Surgery Partners research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Surgery Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Surgery Partners' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SGRY

Surgery Partners

Owns and operates a network of surgical facilities and ancillary services in the United States.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives