- United States

- /

- Healthcare Services

- /

- NasdaqGS:SGRY

Did a $1.38 Billion Refinancing Just Shift Surgery Partners' (SGRY) Growth and Risk Narrative?

Reviewed by Simply Wall St

- In the past week, Surgery Partners completed a major refinancing by amending its credit agreement, adding a new US$1.38 billion tranche of term loans to enhance financial flexibility and stability.

- An insider sale by a senior executive and analyst feedback highlighting both the company’s ongoing growth and existing financial challenges have raised new questions about the balance between expansion and risk management.

- To assess the impact of the significant refinancing, we’ll explore how enhanced financial flexibility could influence Surgery Partners’ investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Surgery Partners Investment Narrative Recap

To be a shareholder in Surgery Partners, you need conviction in the continued migration of high-acuity surgical procedures to outpatient settings, alongside the company’s ability to execute on organic growth and acquisitions despite profitability challenges. The recent refinancing improves financial flexibility, but in the near term, it does not fundamentally change the core catalysts for growth or mitigate the biggest risk, rising interest expenses impacting net earnings and free cash flow conversion.

Among recent events, Surgery Partners’ reaffirmation of its full-year 2025 revenue guidance stands out, as it provides continuity and stability for investors tracking near-term growth. This is particularly relevant given the fresh capital and liquidity from the new term loans, which, if deployed efficiently, may support the company’s expansion goals while navigating industry headwinds.

Yet, in contrast to the promise of enhanced flexibility, investors should also be aware that rising debt service costs could still pressure future earnings and cash flows if not carefully managed...

Read the full narrative on Surgery Partners (it's free!)

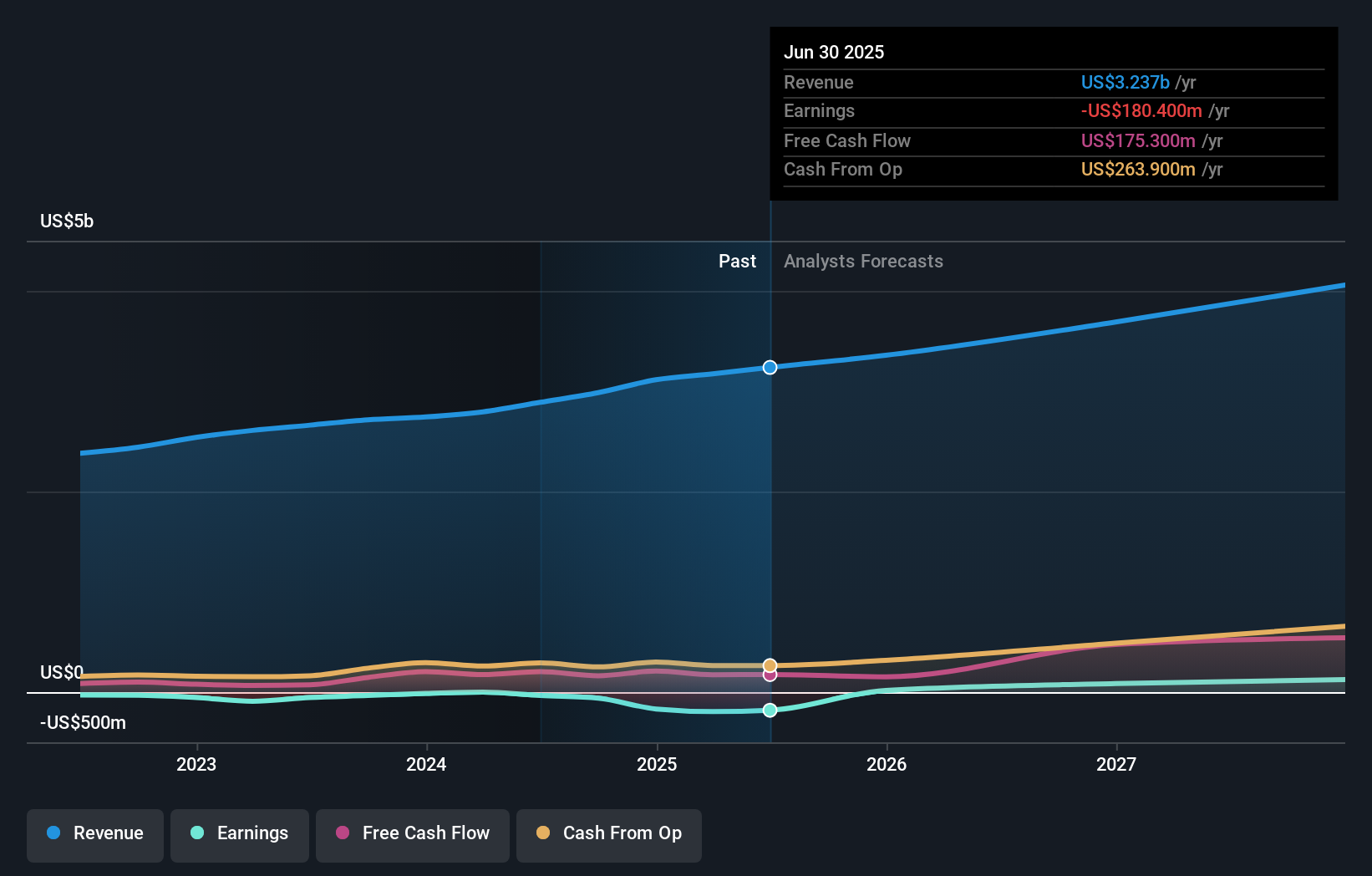

Surgery Partners' outlook projects $4.3 billion in revenue and $164.3 million in earnings by 2028. This is based on a forecast 9.9% annual revenue growth and a $344.7 million increase in earnings from the current level of -$180.4 million.

Uncover how Surgery Partners' forecasts yield a $31.00 fair value, a 42% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range widely, from US$31 to US$81.38 across two viewpoints. While refinancing addresses liquidity, persistent high leverage and interest expense risk remain critical factors influencing how these diverse valuations could play out.

Explore 2 other fair value estimates on Surgery Partners - why the stock might be worth just $31.00!

Build Your Own Surgery Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Surgery Partners research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Surgery Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Surgery Partners' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SGRY

Surgery Partners

Owns and operates a network of surgical facilities and ancillary services in the United States.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives