- United States

- /

- Medical Equipment

- /

- NasdaqGS:SGHT

Sight Sciences, Inc. (NASDAQ:SGHT) Surges 44% Yet Its Low P/S Is No Reason For Excitement

Sight Sciences, Inc. (NASDAQ:SGHT) shareholders would be excited to see that the share price has had a great month, posting a 44% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 37% over that time.

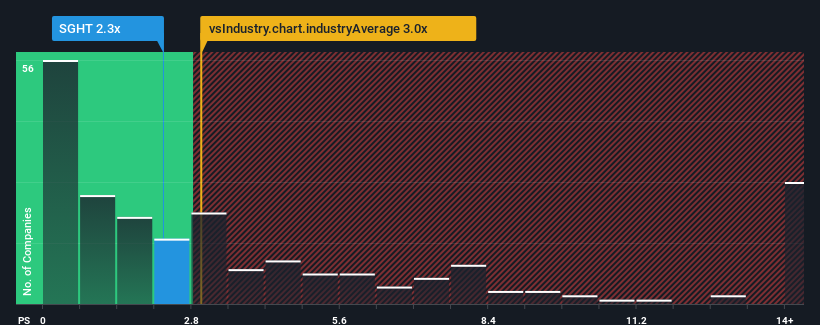

In spite of the firm bounce in price, Sight Sciences may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2.3x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3x and even P/S higher than 7x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Our free stock report includes 3 warning signs investors should be aware of before investing in Sight Sciences. Read for free now.See our latest analysis for Sight Sciences

What Does Sight Sciences' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Sight Sciences' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Sight Sciences will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Sight Sciences' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.2%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 41% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 7.2% each year during the coming three years according to the eight analysts following the company. That's shaping up to be materially lower than the 9.7% per year growth forecast for the broader industry.

In light of this, it's understandable that Sight Sciences' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Despite Sight Sciences' share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Sight Sciences' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Sight Sciences, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Sight Sciences, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SGHT

Sight Sciences

An ophthalmic medical device company, focuses on the development and commercialization of surgical and nonsurgical technologies for the treatment of eye prevalent diseases.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives