- United States

- /

- Healthtech

- /

- NasdaqGS:SDGR

Schrödinger (SDGR) Valuation Check After B of A Upgrade and Growing Bullish Analyst Consensus

Reviewed by Simply Wall St

B of A Securities’ recent upgrade of Schrödinger (SDGR) to Buy, together with a broadly upbeat brokerage consensus, has pushed this computational drug discovery name back onto many investors’ radar.

See our latest analysis for Schrödinger.

The upbeat call from B of A comes after a choppy stretch, with the share price now at $17.94 and a year to date share price return of minus 12.06 percent alongside a one year total shareholder return of minus 16.01 percent. This suggests sentiment may be stabilising rather than breaking out.

If Schrödinger’s mix of software and drug discovery has caught your eye, it could be worth scanning other innovative healthcare names through healthcare stocks to see what else is setting up for the next leg higher.

With the stock still trading at a steep discount to analyst targets despite improving growth metrics, the key question now is whether Schrödinger is quietly undervalued or if the market has already priced in its next wave of progress.

Most Popular Narrative: 34.3% Undervalued

With Schrödinger last closing at $17.94, the most followed narrative implies a materially higher fair value, framing the stock as a long term compounder in waiting.

Strong pipeline advancement and early clinical success, such as positive Phase I data for SGR 1505, positions the company to secure additional milestone payments, royalties, and out licensing deals, creating potential for substantial long term revenue growth and more predictable future cash flows.

Curious how steady double digit growth forecasts, margin turnarounds, and a punchy future earnings multiple can all coexist in one narrative? Unlock the full story behind this ambitious valuation path.

Result: Fair Value of $27.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained pressure on software margins and continued reliance on volatile milestone revenues could easily derail the path to those ambitious earnings targets.

Find out about the key risks to this Schrödinger narrative.

Another View: Rich On Sales, Despite The Discount Story

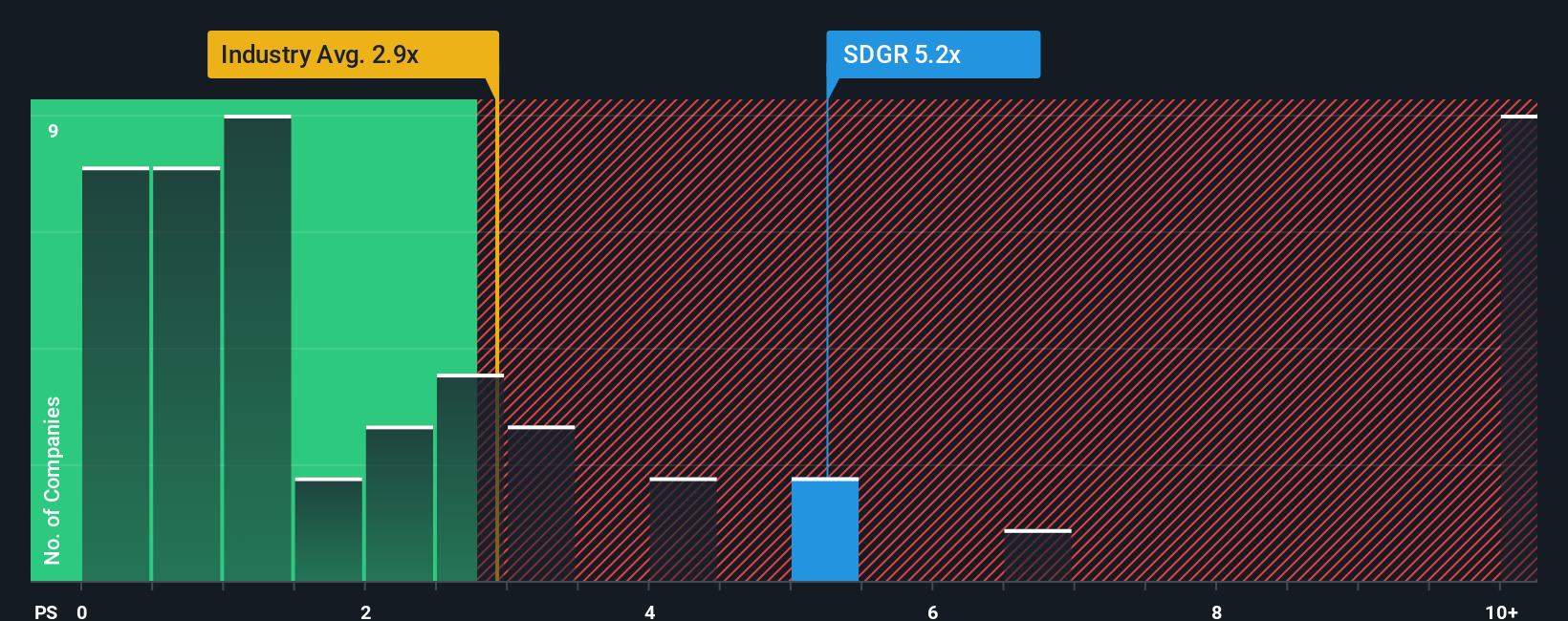

On a simple price to sales lens, Schrödinger looks far less forgiving. The shares trade around 5.1 times sales, more than double the US Healthcare Services average of 2.4 times and well above the 2.6 times fair ratio that our work suggests the market could ultimately gravitate toward.

Against peers on roughly 1.8 times sales, that premium implies investors are already paying up for future execution, leaving less room for error if growth or margins slip. Is this a mispricing you lean into, or a signal to wait for a better entry?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Schrödinger Narrative

If you see the story differently or prefer to test the numbers yourself, you can build a fresh take in minutes using Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Schrödinger.

Ready for your next investing move?

Schrödinger might be compelling, but do not stop there. Use the Simply Wall St Screener to uncover other high conviction opportunities before the market catches on.

- Capitalize on early stage momentum by scanning these 3636 penny stocks with strong financials that already back their potential with solid balance sheets and improving fundamentals.

- Ride structural growth tailwinds by targeting these 30 healthcare AI stocks transforming diagnostics, treatment, and patient outcomes with real world clinical adoption.

- Lock in income potential by tracking these 13 dividend stocks with yields > 3% that combine resilient cash flows with yields strong enough to meaningfully support long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SDGR

Schrödinger

Develops physics-based computational platform that enables discovery of novel molecules for drug development and materials applications.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion