- United States

- /

- Medical Equipment

- /

- OTCPK:SDCC.Q

Why SmileDirectClub (NASDAQ:SDC) may Have Even Less Time to Turn Things Around

The last time we wrote on SmileDirectClub ( NASDAQ:SDC ), we focused on the technology and the lowered cost of distribution, which benefited consumers by allowing them to better their teeth at a lower price. However, SDC seems to have issues with execution, and today we will go over some risks for investors. If SDC manages to turn the business around, then investors will be privy to "Deep Value", however the business has some risk of failing that can't be overlooked.

First Mover Disadvantage

SmileDirectClub utilized 3D printing and online communication to create and ship teeth aligners to customers. The assumption is that both the company and clients can cut costs for this expensive service - the traditional approach requires more full time technicians to measure, prepare and adjust aligners, while SDC utilizes their telehealth platform with doctor-directed care - significantly reducing costs, you can view their approach HERE .

The technology is working, but it likely has room for improvement potential in order to excel in the industry. Think of the first cars, they worked, but have improved massively since then.

Prototyping, improvements and refining cost time and money. Unfortunately, investors cannot always afford to wait without results, which is partly why the stock dropped 80% from a year ago .

It is clear that management has made some changes, and hopefully they will start turning the business around, but for now, we will assess how much time they have to do so, and the numbers don't look good.

Check out our latest analysis for SmileDirectClub

When Might SmileDirectClub Run Out Of Money?

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate.

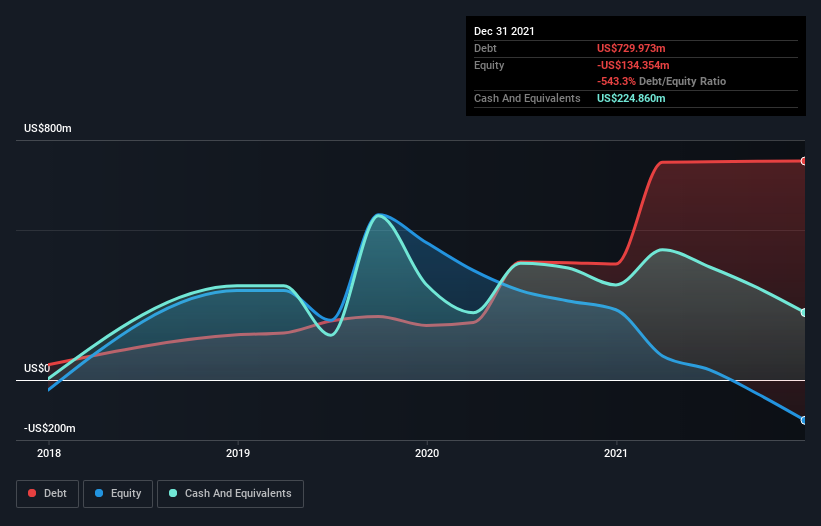

As of December 2021, SmileDirectClub had cash of US$225m and a debt of US$730m.

Importantly, its cash burn was US$248m over the trailing twelve months. So it had a cash runway of approximately 11 months from December 2021. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash.

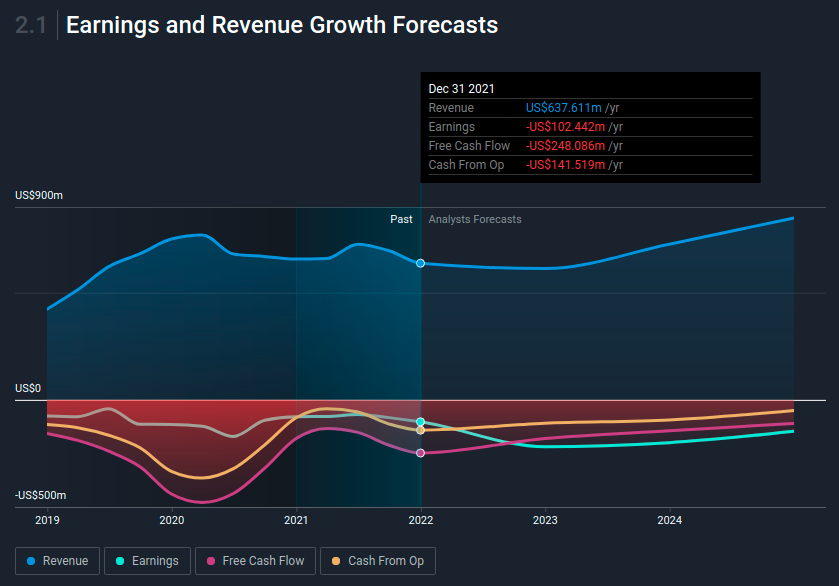

The chart below illustrates the average analyst estimates for the future of the company. These estimates are based on how analysts view the company and may or may not take into account management's guidance.

In order to address this, in January 2022 management issued (p. 26) future cost saving items, aimed to stabilize the financing with which they estimate to reduce the cost and capital spending by US$120m in 2022. They also estimate (p. 31) to make the company cash flow positive by 2024-2025.

While debt can be one possible way to replenish cash, it is quite hard to get a loan for a consistently unprofitable business… So this might be worrying for investors. Additionally, the stock has dropped so much, that raising equity will be quite costly for the company.

The image below shows how its cash balance has been changing over the last few years.

NasdaqGS:SDC Debt to Equity History March 10th 2022

At first glance, it's a bit worrying to see that SmileDirectClub actually boosted its cash burn by 37%, year-on-year. Also concerning, operating revenue was actually down by 2.1% in that time.

SmileDirectClub's revenue is declining, or at best stabilizing, and its cash burn is increasing. The company might have difficulties raising cash to invest in future growth at this stage. One possibly viable solution is for them to shrink to the point where they are most efficient and can service their customers best. That way, the company will cut inefficiencies and focus on scaling efficiently. The downside to this is that this approach takes years and investors will likely see an even further drop in the stock, but will ultimately emerge on the surface in due time.

Brand & Customer Satisfaction

While review interpretation is highly subjective, it helps to see what main concerns are coming from customers.

If we refer to Yelp we can see customer satisfaction for SDC. These are their Beverly Hills Office Reviews. The overall rating is 3.5 stars, however when digging a bit deeper, we see that there are many 1-star and 5-star reviews, rarely something in-between.

In this case reviewers seem to express concerns with both the product and getting late feedback/followup from the business

Investors need to know that there are legitimate concerns for the execution and quality of SDC's services. It seems that management is pushing for sales, while possibly sacrificing quality, which can have issues long term in regards to customer retention

Another site - centered in Australia, has more positive reviews which are centered around the initial appointment experience, however the negatives seem to be concerned with followup, service clarity and feedback time.

Google reviews are localized, and you can view them from searching for a local SDC store. Alternatively, Trustpilot has 6k reviews in the last 12 months, with an average rating of 4.8.

Key Takeaways

SmileDirectClub has some legitimate survival risk, and the company may need to make significant changes or find funding if the business is to survive. If it keeps posting negative cash flows, the company will quickly find itself in some serious financial difficulties.

While their vision and tech is great and meant to create a better service by cutting costs, the execution currently isn't panning out in reality. Investors need to be aware that given all the possible risks associated with the business’ current cash burn situation, the market might be appropriately valuing the business due to the uncertainty.

Analysts also see a negative near term performance, and it may take some years for the business to generate value. View the fundamental forecasts for SDC HERE .

On another note, we conducted an in-depth investigation of the company, and identified 5 warning signs for SmileDirectClub (2 can't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About OTCPK:SDCC.Q

SmileDirectClub

SmileDirectClub, Inc., an oral care company, offers clear aligner therapy treatment.

Fair value with concerning outlook.

Similar Companies

Market Insights

Community Narratives