- United States

- /

- Healthcare Services

- /

- NasdaqGM:SBC

3 Undiscovered Gems in the United States with Strong Potential

Reviewed by Simply Wall St

In the last week, the market has been flat, but it is up 33% over the past year with earnings forecast to grow by 15% annually. In this environment, identifying stocks with strong potential can be particularly rewarding for investors looking to capitalize on growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| First National Bank Alaska | 221.06% | 2.98% | 1.82% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| QDM International | 36.42% | 107.08% | 78.76% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

SBC Medical Group Holdings (NasdaqGM:SBC)

Simply Wall St Value Rating: ★★★★★☆

Overview: SBC Medical Group Holdings Incorporated offers management services to cosmetic treatment centers in Japan, Vietnam, and internationally, with a market cap of $968.14 million.

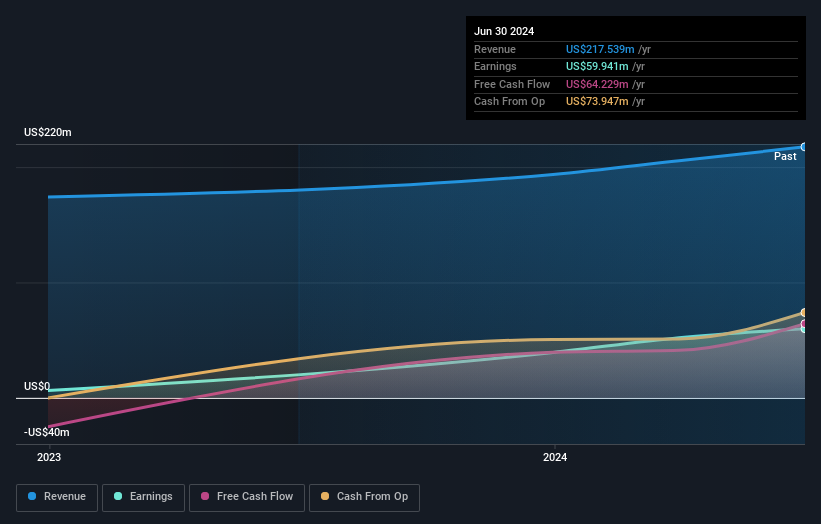

Operations: SBC Medical Group Holdings generates revenue primarily from its healthcare facilities and services segment, which amounted to $217.54 million.

SBC Medical Group Holdings, a small cap healthcare player, has shown impressive growth with earnings up 164% over the past year, outpacing the industry’s 8%. Despite shareholders experiencing substantial dilution recently, SBC trades at a significant discount of 92.9% below estimated fair value. The company was added to the NASDAQ Composite Index on September 20, 2024. With high-quality earnings and more cash than total debt, SBC's financial health appears robust.

- Click to explore a detailed breakdown of our findings in SBC Medical Group Holdings' health report.

Understand SBC Medical Group Holdings' track record by examining our Past report.

Valhi (NYSE:VHI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Valhi, Inc. operates in the chemicals, component products, and real estate management and development sectors across Europe, North America, the Asia Pacific, and internationally with a market cap of $953.53 million.

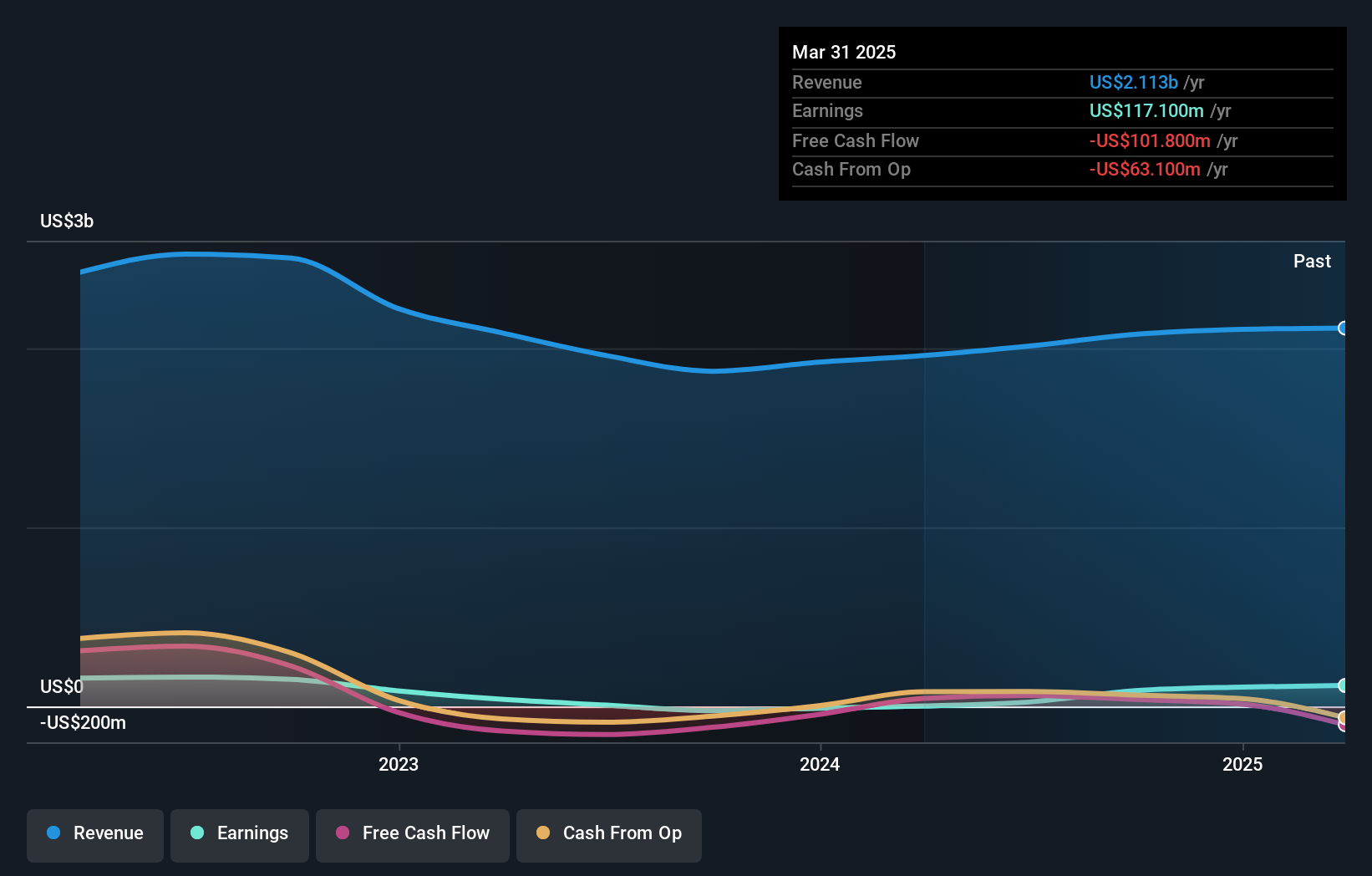

Operations: Valhi, Inc. generates revenue primarily from its chemicals segment ($1.78 billion), followed by component products ($157.40 million) and real estate management and development ($78.50 million). The company's net profit margin is a key metric to evaluate its profitability across these diverse revenue streams.

Valhi has demonstrated impressive earnings growth of 215.4% over the past year, significantly outpacing the Chemicals industry average of -4.8%. The company's net debt to equity ratio stands at a satisfactory 8.6%, and its interest payments are well-covered by EBIT with a coverage ratio of 4.7x. Despite earnings declining by an average of 19.8% annually over the last five years, Valhi's recent quarterly revenue reached US$559.7 million, up from US$507.1 million in the previous year, highlighting its potential for future growth amidst volatility in share price and reduced debt levels from 78% to 38.7%.

- Unlock comprehensive insights into our analysis of Valhi stock in this health report.

Explore historical data to track Valhi's performance over time in our Past section.

Yiren Digital (NYSE:YRD)

Simply Wall St Value Rating: ★★★★★★

Overview: Yiren Digital Ltd. offers financial services via an AI-powered platform in China and has a market cap of approximately $451.19 million.

Operations: Yiren Digital Ltd. generates revenue primarily from its Financial Services Business (CN¥3.04 billion), followed by its Consumption & Lifestyle Business (CN¥1.84 billion) and Insurance Brokerage Business (CN¥579.22 million).

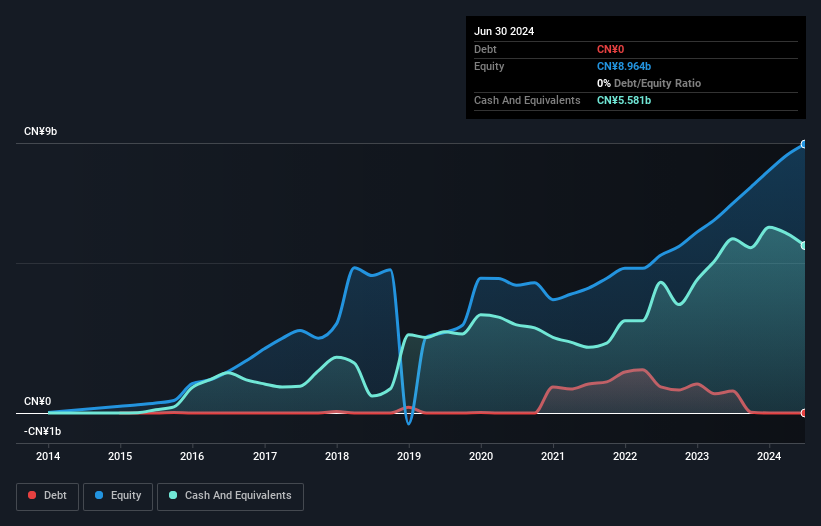

Yiren Digital is trading at 83.8% below its fair value estimate, making it an intriguing option in the consumer finance sector. The company has seen earnings grow by 18.2% over the past year, outpacing the industry’s -8.4%. Notably, Yiren Digital is debt-free and has maintained high-quality earnings throughout this period. Recently, they repurchased 815,522 shares for US$4 million and announced a semi-annual dividend policy with a planned payout of US$0.2 per ADS on October 15, 2024.

Turning Ideas Into Actions

- Discover the full array of 207 US Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SBC

SBC Medical Group Holdings

Provides management services to cosmetic treatment centers in Japan, Vietnam, and internationally.

Excellent balance sheet and good value.