- United States

- /

- Trade Distributors

- /

- NYSE:ZKH

ZKH Group Limited (NYSE:ZKH) Stock Rockets 27% But Many Are Still Ignoring The Company

Those holding ZKH Group Limited (NYSE:ZKH) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

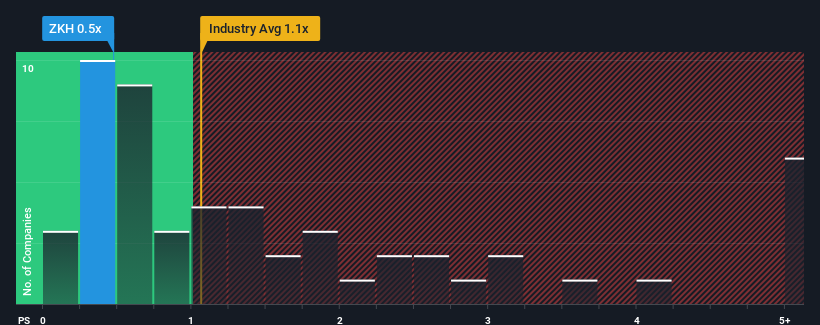

In spite of the firm bounce in price, considering around half the companies operating in the United States' Trade Distributors industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider ZKH Group as an solid investment opportunity with its 0.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for ZKH Group

How Has ZKH Group Performed Recently?

With revenue growth that's inferior to most other companies of late, ZKH Group has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on ZKH Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

ZKH Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Regardless, revenue has managed to lift by a handy 26% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 10% over the next year. With the industry only predicted to deliver 4.6%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that ZKH Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From ZKH Group's P/S?

The latest share price surge wasn't enough to lift ZKH Group's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems ZKH Group currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for ZKH Group with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if ZKH Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ZKH

ZKH Group

Develops and operates a maintenance, repair, and operating (MRO) products trading and service platform that offers spare parts, chemicals, manufacturing parts, general consumables, and office supplies in the People’s Republic of China.

Very undervalued with reasonable growth potential.

Market Insights

Community Narratives