- United States

- /

- Leisure

- /

- NasdaqGM:HERE

Improved Revenues Required Before QuantaSing Group Limited (NASDAQ:QSG) Stock's 33% Jump Looks Justified

The QuantaSing Group Limited (NASDAQ:QSG) share price has done very well over the last month, posting an excellent gain of 33%. Notwithstanding the latest gain, the annual share price return of 2.7% isn't as impressive.

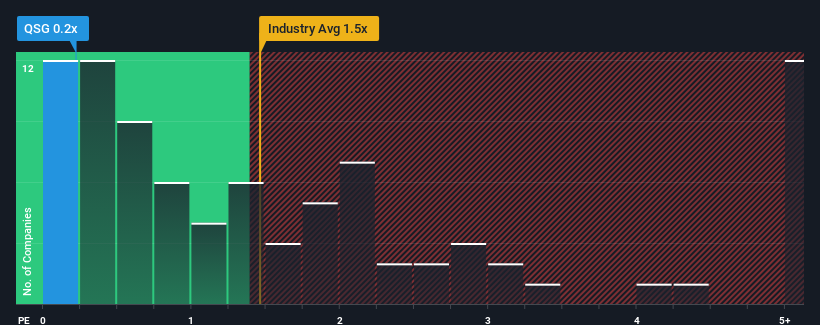

Although its price has surged higher, given about half the companies operating in the United States' Consumer Services industry have price-to-sales ratios (or "P/S") above 1.5x, you may still consider QuantaSing Group as an attractive investment with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for QuantaSing Group

How Has QuantaSing Group Performed Recently?

With revenue growth that's superior to most other companies of late, QuantaSing Group has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think QuantaSing Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For QuantaSing Group?

There's an inherent assumption that a company should underperform the industry for P/S ratios like QuantaSing Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 23% last year. The latest three year period has also seen an excellent 116% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 5.4% during the coming year according to the only analyst following the company. With the industry predicted to deliver 14% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why QuantaSing Group's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does QuantaSing Group's P/S Mean For Investors?

The latest share price surge wasn't enough to lift QuantaSing Group's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of QuantaSing Group's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with QuantaSing Group, and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Here Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:HERE

Here Group

Designs and sells pop toys in China.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Duolingo: Billion Dollar Business Hiding in Plain Sight

Kyocera: The Hidden AI Enabler

Santos: Undervalued After Takeover Fallout

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks