- United States

- /

- Medical Equipment

- /

- NasdaqGM:RXST

With A 27% Price Drop For RxSight, Inc. (NASDAQ:RXST) You'll Still Get What You Pay For

Unfortunately for some shareholders, the RxSight, Inc. (NASDAQ:RXST) share price has dived 27% in the last thirty days, prolonging recent pain. Still, a bad month hasn't completely ruined the past year with the stock gaining 39%, which is great even in a bull market.

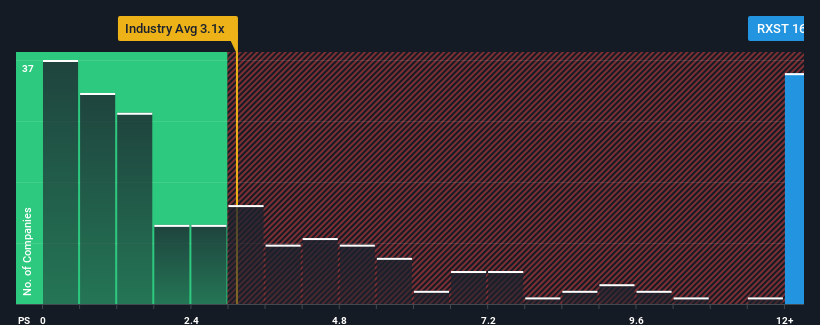

Although its price has dipped substantially, given around half the companies in the United States' Medical Equipment industry have price-to-sales ratios (or "P/S") below 3.1x, you may still consider RxSight as a stock to avoid entirely with its 16.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for RxSight

How Has RxSight Performed Recently?

RxSight certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on RxSight will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

RxSight's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 76%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 31% per year as estimated by the eight analysts watching the company. With the industry only predicted to deliver 9.8% per annum, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why RxSight's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From RxSight's P/S?

Even after such a strong price drop, RxSight's P/S still exceeds the industry median significantly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that RxSight maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Medical Equipment industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for RxSight you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RXST

RxSight

A commercial-stage medical technology company, engages in the research and development, manufacture, and sale of light adjustable intraocular lenses (LAL) used in cataract surgery in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives