- United States

- /

- Medical Equipment

- /

- NasdaqGM:RXST

RxSight (NASDAQ:RXST) Is In A Strong Position To Grow Its Business

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

Given this risk, we thought we'd take a look at whether RxSight (NASDAQ:RXST) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

When Might RxSight Run Out Of Money?

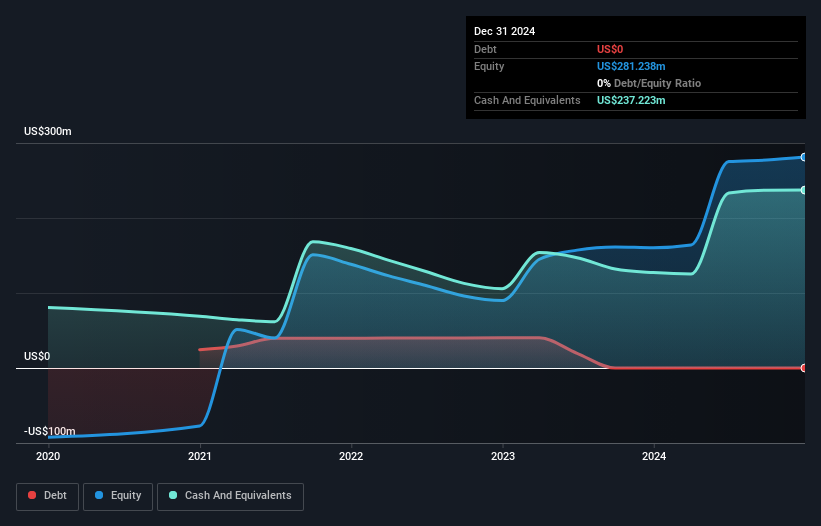

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at December 2024, RxSight had cash of US$237m and no debt. In the last year, its cash burn was US$22m. That means it had a cash runway of very many years as of December 2024. Importantly, though, analysts think that RxSight will reach cashflow breakeven before then. In that case, it may never reach the end of its cash runway. Depicted below, you can see how its cash holdings have changed over time.

View our latest analysis for RxSight

How Well Is RxSight Growing?

We reckon the fact that RxSight managed to shrink its cash burn by 52% over the last year is rather encouraging. And arguably the operating revenue growth of 57% was even more impressive. Considering these factors, we're fairly impressed by its growth trajectory. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company .

How Hard Would It Be For RxSight To Raise More Cash For Growth?

While RxSight seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

RxSight has a market capitalisation of US$1.1b and burnt through US$22m last year, which is 2.1% of the company's market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

So, Should We Worry About RxSight's Cash Burn?

As you can probably tell by now, we're not too worried about RxSight's cash burn. In particular, we think its revenue growth stands out as evidence that the company is well on top of its spending. But it's fair to say that its cash burn reduction was also very reassuring. There's no doubt that shareholders can take a lot of heart from the fact that analysts are forecasting it will reach breakeven before too long. After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 2 warning signs for RxSight that potential shareholders should take into account before putting money into a stock.

Of course RxSight may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:RXST

RxSight

A commercial-stage medical technology company, engages in the research and development, manufacture, and sale of light adjustable intraocular lenses (LAL) used in cataract surgery in the United States.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026