- United States

- /

- Medical Equipment

- /

- NasdaqCM:RSLS

It's A Story Of Risk Vs Reward With ReShape Lifesciences Inc. (NASDAQ:RSLS)

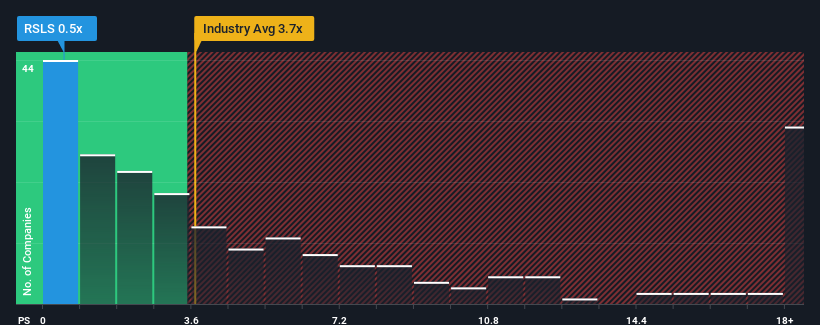

With a price-to-sales (or "P/S") ratio of 0.5x ReShape Lifesciences Inc. (NASDAQ:RSLS) may be sending very bullish signals at the moment, given that almost half of all the Medical Equipment companies in the United States have P/S ratios greater than 3.7x and even P/S higher than 9x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for ReShape Lifesciences

What Does ReShape Lifesciences' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, ReShape Lifesciences' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think ReShape Lifesciences' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For ReShape Lifesciences?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like ReShape Lifesciences' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 1.9% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 30% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 6.1%, which is noticeably less attractive.

In light of this, it's peculiar that ReShape Lifesciences' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On ReShape Lifesciences' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems ReShape Lifesciences currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for ReShape Lifesciences (4 don't sit too well with us) you should be aware of.

If these risks are making you reconsider your opinion on ReShape Lifesciences, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RSLS

ReShape Lifesciences

Provides products and services that manage and treat obesity and metabolic diseases in the United States, Australia, Europe, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026