- United States

- /

- Healthcare Services

- /

- NasdaqGM:RDNT

A Look at RadNet (RDNT) Valuation Following New Breast Cancer Detection Collaboration

Reviewed by Simply Wall St

RadNet (RDNT) just teamed up with Desert Oasis Healthcare to offer enhanced breast cancer detection technology at no extra charge to local members. This move could make advanced diagnostics more accessible in the Coachella Valley.

See our latest analysis for RadNet.

RadNet’s partnership news comes after a strong run in its shares, with momentum clearly building. The stock’s 33.99% share price return over the last 90 days outpaces its 16.05% total shareholder return for the past year. Its three- and five-year total returns of over 300% and 380% respectively are hard to ignore. Investors seem increasingly optimistic about the company’s growth potential and its ability to lead in tech-driven healthcare.

If RadNet’s progress has you interested in other healthcare standouts, now’s the perfect time to see what’s happening in the sector and check out See the full list for free.

With the stock trading just below analyst targets despite robust growth and ongoing innovation, the key question now is whether there is still room for upside or if Wall Street has already priced in RadNet’s future potential.

Most Popular Narrative: 3% Undervalued

RadNet’s most widely followed narrative places its fair value just above the latest close, hinting there could still be a small upside left. The narrow gap between price and target focuses the spotlight on what could move shares next.

Ongoing investments in AI-powered imaging solutions (for example, DeepHealth, See-Mode, iCAD) are materially increasing center throughput, boosting capacity utilization, and driving more high-margin advanced procedures. This directly enhances both revenue growth and EBITDA margins as adoption scales through 2026.

Ever wonder what’s powering that bullish outlook? One ambitious revenue milestone, a margin leap, and an eye-popping future profit multiple are the bedrock behind this valuation narrative. Which forecasts are bold enough to underpin a target above today’s price? Only the full narrative reveals the numbers and logic driving this call.

Result: Fair Value of $80.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integrating new acquisitions and increased spending on digital initiatives could impact RadNet’s earnings if the expected benefits are delayed or if costs escalate.

Find out about the key risks to this RadNet narrative.

Another View: Caution from Multiples

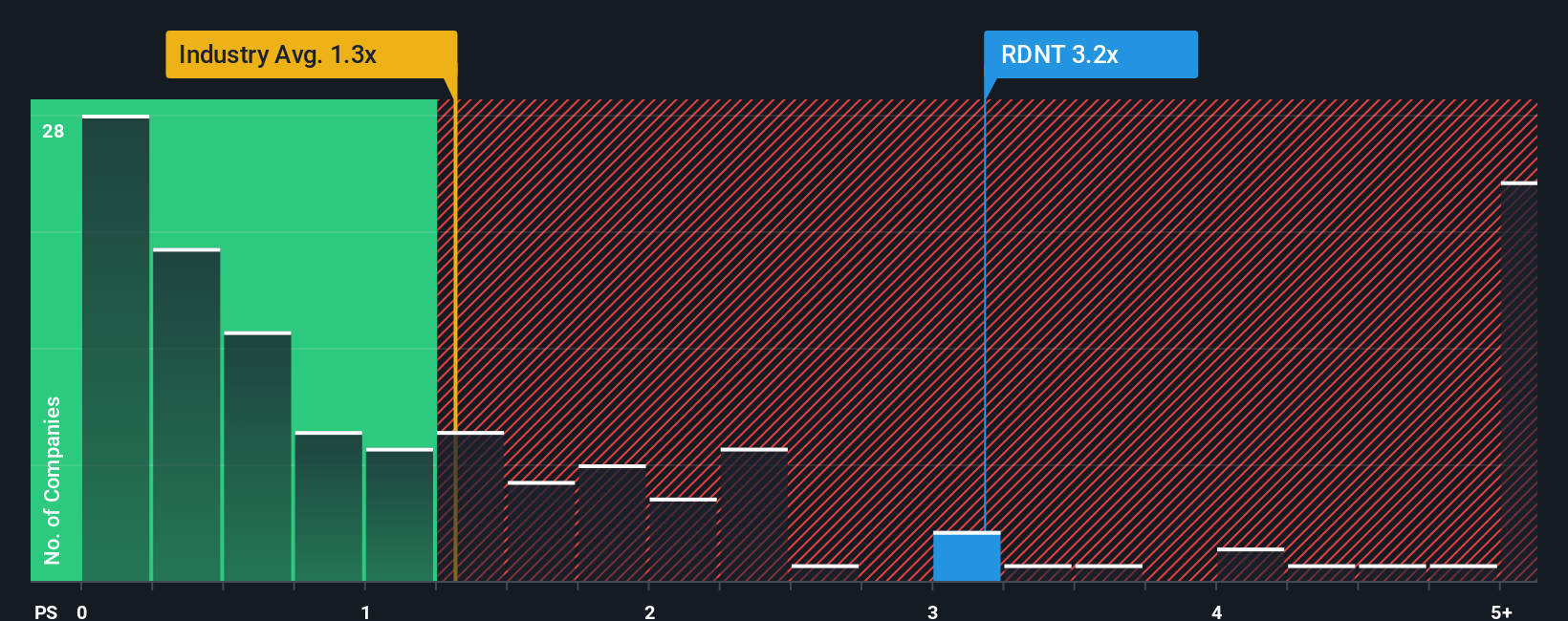

While analyst consensus calls RadNet slightly undervalued, market multiples tell a very different story. The company’s price-to-sales ratio of 3.2x is well above both the US Healthcare industry average of 1.3x and a fair ratio of just 0.9x. This signals the stock is expensive relative to sales, suggesting there is real downside risk if expectations cool. Will the market keep rewarding RadNet’s momentum, or could a valuation reset be looming?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RadNet Narrative

If you see things differently or want to dive deeper into the numbers yourself, it’s easy to put together your own RadNet story in just a few minutes. Do it your way

A great starting point for your RadNet research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Seize your edge and stay ahead of the curve by tapping into game-changing companies others might overlook. You could miss tomorrow’s winners if you don’t take action today.

- Catch the next wave of tech innovation by targeting these 24 AI penny stocks, which are reshaping industries and pushing the boundaries of artificial intelligence.

- Earn more from your investments by turning to these 17 dividend stocks with yields > 3%, which deliver steady yields above 3% and boost your portfolio’s income potential.

- Step ahead of the crowd with these 874 undervalued stocks based on cash flows, where market prices still trail behind true cash flow value and offer compelling upside opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RDNT

RadNet

Provides outpatient diagnostic imaging services in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives