- United States

- /

- Healthcare Services

- /

- NasdaqGM:PRE

Prenetics Global Limited's (NASDAQ:PRE) 36% Cheaper Price Remains In Tune With Revenues

The Prenetics Global Limited (NASDAQ:PRE) share price has fared very poorly over the last month, falling by a substantial 36%. For any long-term shareholders, the last month ends a year to forget by locking in a 73% share price decline.

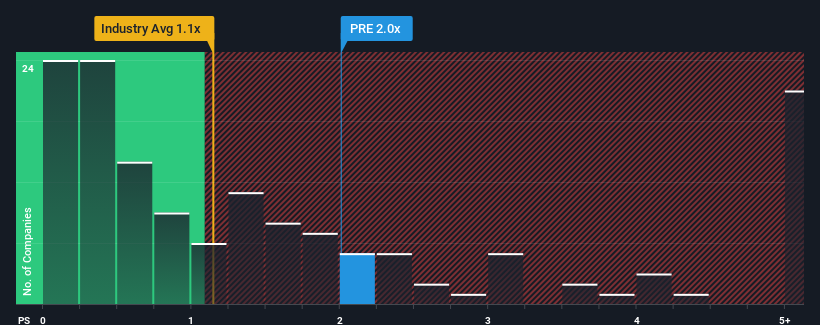

Although its price has dipped substantially, you could still be forgiven for thinking Prenetics Global is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2x, considering almost half the companies in the United States' Healthcare industry have P/S ratios below 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Prenetics Global

How Has Prenetics Global Performed Recently?

Prenetics Global could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Prenetics Global.What Are Revenue Growth Metrics Telling Us About The High P/S?

Prenetics Global's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 92%. As a result, revenue from three years ago have also fallen 67% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 62% over the next year. That's shaping up to be materially higher than the 8.1% growth forecast for the broader industry.

With this information, we can see why Prenetics Global is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Prenetics Global's P/S remain high even after its stock plunged. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Prenetics Global shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 4 warning signs for Prenetics Global you should be aware of.

If you're unsure about the strength of Prenetics Global's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PRE

Prenetics Global

A health sciences company, focuses on advancing consumer and clinical health.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives