- United States

- /

- Medical Equipment

- /

- NasdaqGM:PRCT

Will Aquablation Innovation and Recurring Revenue Shift PROCEPT BioRobotics' (PRCT) Investment Story?

Reviewed by Sasha Jovanovic

- PROCEPT BioRobotics recently drew renewed attention after commentary highlighted its innovation in benign prostatic hyperplasia (BPH) therapy, with a unique Aquablation technology and recurring revenue business model supporting consistent growth.

- The company's ongoing recovery from management transitions and operational disruptions, combined with strong R&D investment and international expansion, has reinforced confidence in its long-term prospects within a specialized medical niche.

- We'll examine how Aquablation's distinctive technology and recurring revenue approach shape PROCEPT BioRobotics' investment narrative going forward.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

PROCEPT BioRobotics Investment Narrative Recap

To consider PROCEPT BioRobotics as a potential investment, you need to believe in the continued adoption of Aquablation therapy and the durability of its recurring revenue business model, especially as the company recovers from leadership transitions. The recent attention toward innovation does not fundamentally change the near-term catalysts, such as Medicare reimbursement improvements, or the main risk, which remains around broader clinical adoption and competitive threats to the Aquablation platform.

The most relevant recent development is the successful completion of procedures in the WATER IV Prostate Cancer Trial using Aquablation. This directly supports PROCEPT’s push to expand clinical indications, which could drive new adoption and addressable market growth, factors closely tied to the key catalyst of increasing system placements and procedural volumes.

By contrast, early investor optimism is only part of the picture when you consider the ongoing risk that comes if clinical adoption does not ...

Read the full narrative on PROCEPT BioRobotics (it's free!)

PROCEPT BioRobotics' narrative projects $563.8 million revenue and $70.4 million earnings by 2028. This requires 27.0% yearly revenue growth and a $154.5 million earnings increase from -$84.1 million today.

Uncover how PROCEPT BioRobotics' forecasts yield a $65.60 fair value, a 90% upside to its current price.

Exploring Other Perspectives

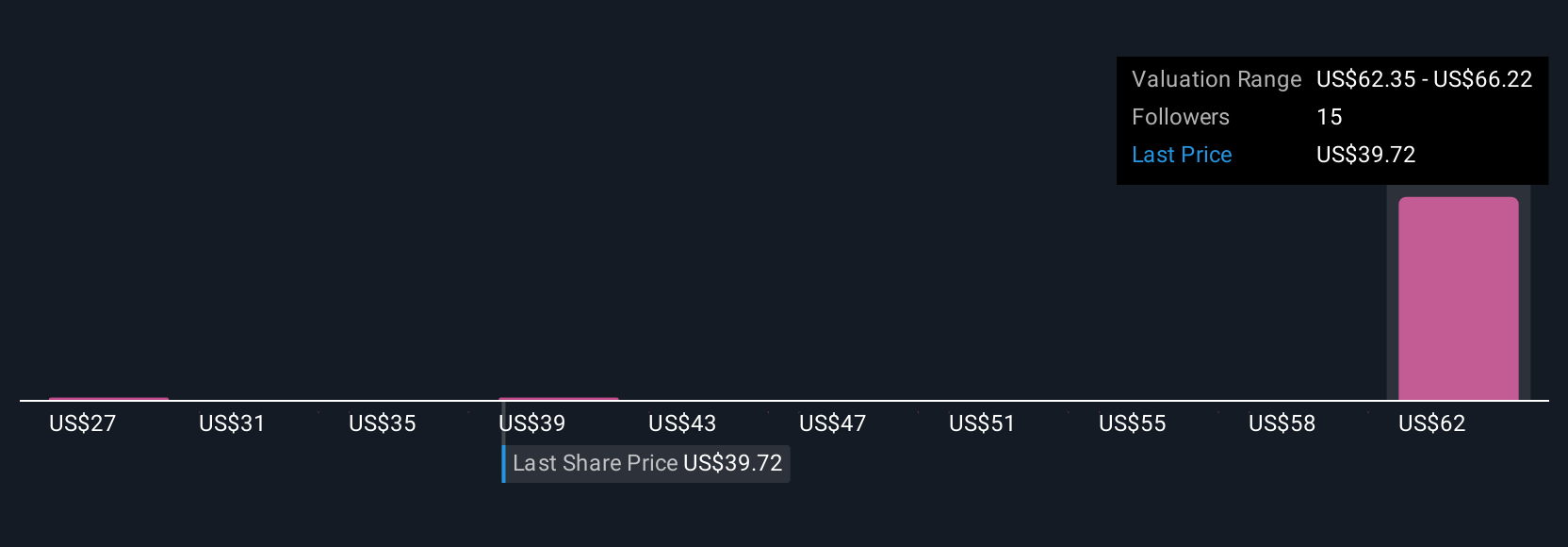

Simply Wall St Community members have set fair value targets for PROCEPT BioRobotics ranging from US$27.49 to US$65.60, based on four individual forecasts. Against this background of varied opinions, the focus on clinical adoption as a leading catalyst continues to shape the broader conversation about the company's prospects.

Explore 4 other fair value estimates on PROCEPT BioRobotics - why the stock might be worth as much as 90% more than the current price!

Build Your Own PROCEPT BioRobotics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PROCEPT BioRobotics research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free PROCEPT BioRobotics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PROCEPT BioRobotics' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PRCT

PROCEPT BioRobotics

A surgical robotics company, focuses on developing transformative solutions in urology in the United States and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives