- United States

- /

- Medical Equipment

- /

- NasdaqGS:PODD

Insulet Corporation's (NASDAQ:PODD) Earnings Haven't Escaped The Attention Of Investors

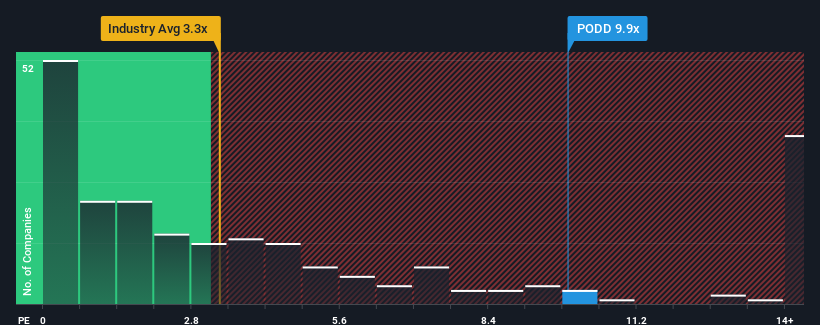

You may think that with a price-to-sales (or "P/S") ratio of 9.9x Insulet Corporation (NASDAQ:PODD) is a stock to avoid completely, seeing as almost half of all the Medical Equipment companies in the United States have P/S ratios under 3.3x and even P/S lower than 1.3x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Insulet

What Does Insulet's Recent Performance Look Like?

Recent times have been advantageous for Insulet as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Insulet will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Insulet's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 25% gain to the company's top line. Pleasingly, revenue has also lifted 79% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 20% each year as estimated by the analysts watching the company. With the industry only predicted to deliver 9.8% each year, the company is positioned for a stronger revenue result.

With this information, we can see why Insulet is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Insulet's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Insulet maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Medical Equipment industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Insulet (1 can't be ignored!) that you need to take into consideration.

If you're unsure about the strength of Insulet's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PODD

Insulet

Develops, manufactures, and sells insulin delivery systems for people with insulin-dependent diabetes.

Solid track record with excellent balance sheet.