- United States

- /

- Medical Equipment

- /

- NasdaqGS:PODD

A Fresh Look at Insulet (PODD) Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

Insulet (PODD) shares have seen a steady climb recently. The stock has posted a gain of around 5% over the past month. Investors seem interested in how the company’s growth story may evolve from here.

See our latest analysis for Insulet.

The recent 5% jump in Insulet's share price over the past month follows a broader upswing, with the stock now boasting a strong year-to-date share price return of 31.4%. Momentum appears to be building again, underpinning an impressive 1-year total shareholder return of 26.6% and hinting at renewed investor confidence in the company’s growth outlook.

If the latest rally has you watching the sector more closely, consider exploring other healthcare stock opportunities. See the full list for free with See the full list for free..

But with shares up strongly in recent months and trading just below analyst price targets, the key question is whether Insulet is undervalued or if the market is already pricing in the company’s future growth prospects.

Most Popular Narrative: 10.8% Undervalued

Insulet’s most widely cited narrative places its fair value at $378 per share, which is notably above the last close price of $337.43. This gap highlights a belief that the company’s growth and profitability prospects are greater than the market currently assumes.

Rapidly rising adoption of Omnipod 5 in both the U.S. and international markets, driven by strong clinical evidence, ease of use, and superior integration with the latest glucose sensors, is positioning Insulet to capture a disproportionately large share of the expanding global diabetes device market. This is supporting significant top-line revenue growth for several years.

Want a glimpse inside the engine room of this valuation? The playbook includes bold growth forecasts and a profit trajectory more ambitious than you might expect. Surprised by what financial milestones are priced in? Uncover the key levers propelling this fair value and find out what sets this market narrative apart.

Result: Fair Value of $378 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued reliance on a single core product and intensifying competition could create pressure on Insulet’s growth trajectory and challenge the bullish outlook.

Find out about the key risks to this Insulet narrative.

Another View: Valuation Based on Profit Multiples

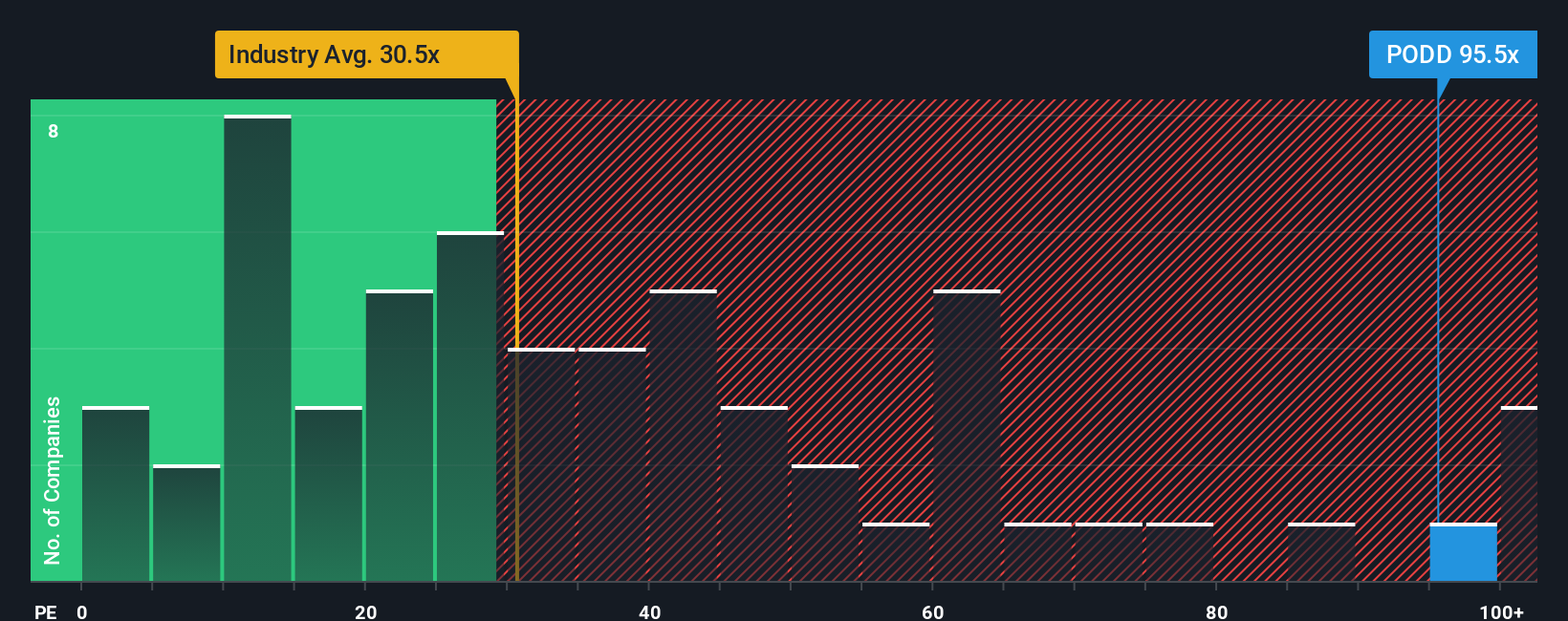

Switching gears, let's consider how the company's share price looks through profit multiples. Insulet currently trades at a price-to-earnings ratio of 96.4x, which is much higher than the industry average of 27.7x and the peer average of 29.8x. Even compared to the fair ratio of 38x, the stock comes across as expensive, suggesting investors may be paying up for growth expectations. Is the premium justified, or are expectations set unrealistically high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Insulet Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can easily build your own take in just a few minutes. Do it your way.

A great starting point for your Insulet research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let unique opportunities pass by while others move ahead. Use the Simply Wall Street Screener to find stocks meeting criteria most investors overlook and unlock potential you might have missed.

- Boost your portfolio’s growth potential by spotting strong up-and-comers through these 3588 penny stocks with strong financials with solid financials and unexpected momentum.

- Maximize your returns with the best cash-flow bargains when you access these 926 undervalued stocks based on cash flows to see stocks that may be trading well below their true value.

- Capture market trends early by exploring these 81 cryptocurrency and blockchain stocks for opportunities at the forefront of digital finance innovation and blockchain advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PODD

Insulet

Develops, manufactures, and sells insulin delivery systems for people with insulin-dependent diabetes in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.