- United States

- /

- Healthcare Services

- /

- OTCPK:PMDI

We Think Psychemedics Corporation's (NASDAQ:PMD) CEO Compensation Package Needs To Be Put Under A Microscope

The results at Psychemedics Corporation (NASDAQ:PMD) have been quite disappointing recently and CEO Ray Kubacki bears some responsibility for this. At the upcoming AGM on 13 May 2021, shareholders can hear from the board including their plans for turning around performance. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. The data we present below explains why we think CEO compensation is not consistent with recent performance.

See our latest analysis for Psychemedics

How Does Total Compensation For Ray Kubacki Compare With Other Companies In The Industry?

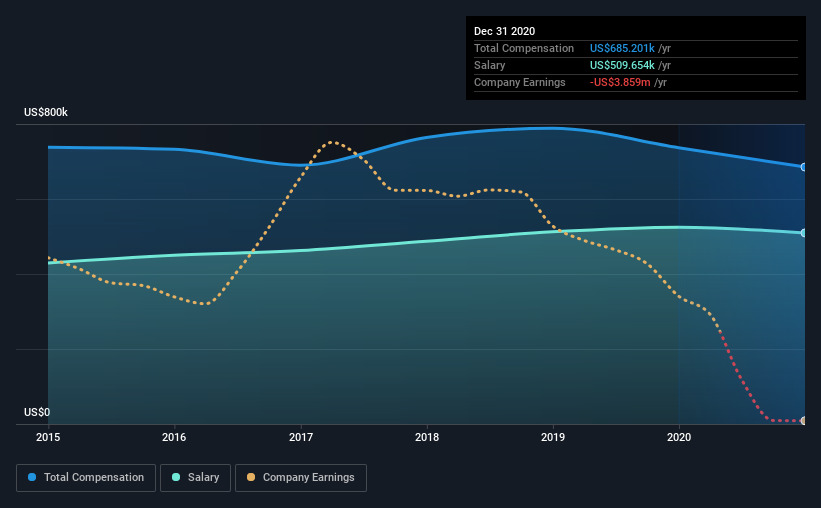

According to our data, Psychemedics Corporation has a market capitalization of US$37m, and paid its CEO total annual compensation worth US$685k over the year to December 2020. That's slightly lower by 7.0% over the previous year. Notably, the salary which is US$509.7k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under US$200m, the reported median total CEO compensation was US$276k. Hence, we can conclude that Ray Kubacki is remunerated higher than the industry median. Moreover, Ray Kubacki also holds US$1.2m worth of Psychemedics stock directly under their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$510k | US$525k | 74% |

| Other | US$176k | US$212k | 26% |

| Total Compensation | US$685k | US$737k | 100% |

Talking in terms of the industry, salary represented approximately 19% of total compensation out of all the companies we analyzed, while other remuneration made up 81% of the pie. Psychemedics pays out 74% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Psychemedics Corporation's Growth

Over the last three years, Psychemedics Corporation has shrunk its earnings per share by 92% per year. It saw its revenue drop 43% over the last year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Psychemedics Corporation Been A Good Investment?

With a total shareholder return of -62% over three years, Psychemedics Corporation shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 2 warning signs for Psychemedics (of which 1 is a bit unpleasant!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Psychemedics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:PMDI

Psychemedics

Engages in the provision of testing services for the detection of drugs of abuse and other health markers through the analysis of hair samples in the United States and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives