- United States

- /

- Healthcare Services

- /

- NasdaqGS:PINC

Premier’s Rising Share Price and New Partnership Spark Fresh Valuation Questions for 2025

Reviewed by Bailey Pemberton

If you’ve been contemplating what to do with Premier stock, you’re not alone. The last year has been a rollercoaster for investors, and Premier’s share price has been quietly impressive even when some competitors sputtered. Just check out the numbers: up 0.7% in the past week, a small dip over the last month, but a striking 31.2% jump year-to-date and a whopping 46.5% surge over the past year. That alone has started turning heads, and for good reason.

This recent momentum can be traced to a string of strategic moves and industry buzz. Premier has been ramping up its digital initiatives, sparking optimism that it could carve out a bigger slice of its market. Meanwhile, a fresh partnership deal announced last quarter reinforced confidence in Premier’s growth prospects and may have nudged risk perceptions lower. However, if you zoom out to three- and five-year trends, you’ll spot a mixed track record. This serves as a reminder to stay clear-eyed about both the company’s progress and its hurdles.

Of course, the big question still stands: is Premier actually undervalued, or is the stock already pricing in all this growth? Our latest valuation analysis gives Premier a score of 3 out of 6, meaning it appears undervalued according to about half of the checks we use. But before we get into a full breakdown of those methods, there’s an even better perspective on valuation you’ll want to hear by the end of this article.

Approach 1: Premier Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a business by projecting its future cash flows and discounting them back to today's dollars. This approach helps investors gauge what a company's shares are truly worth, based on its ability to generate cash in the future.

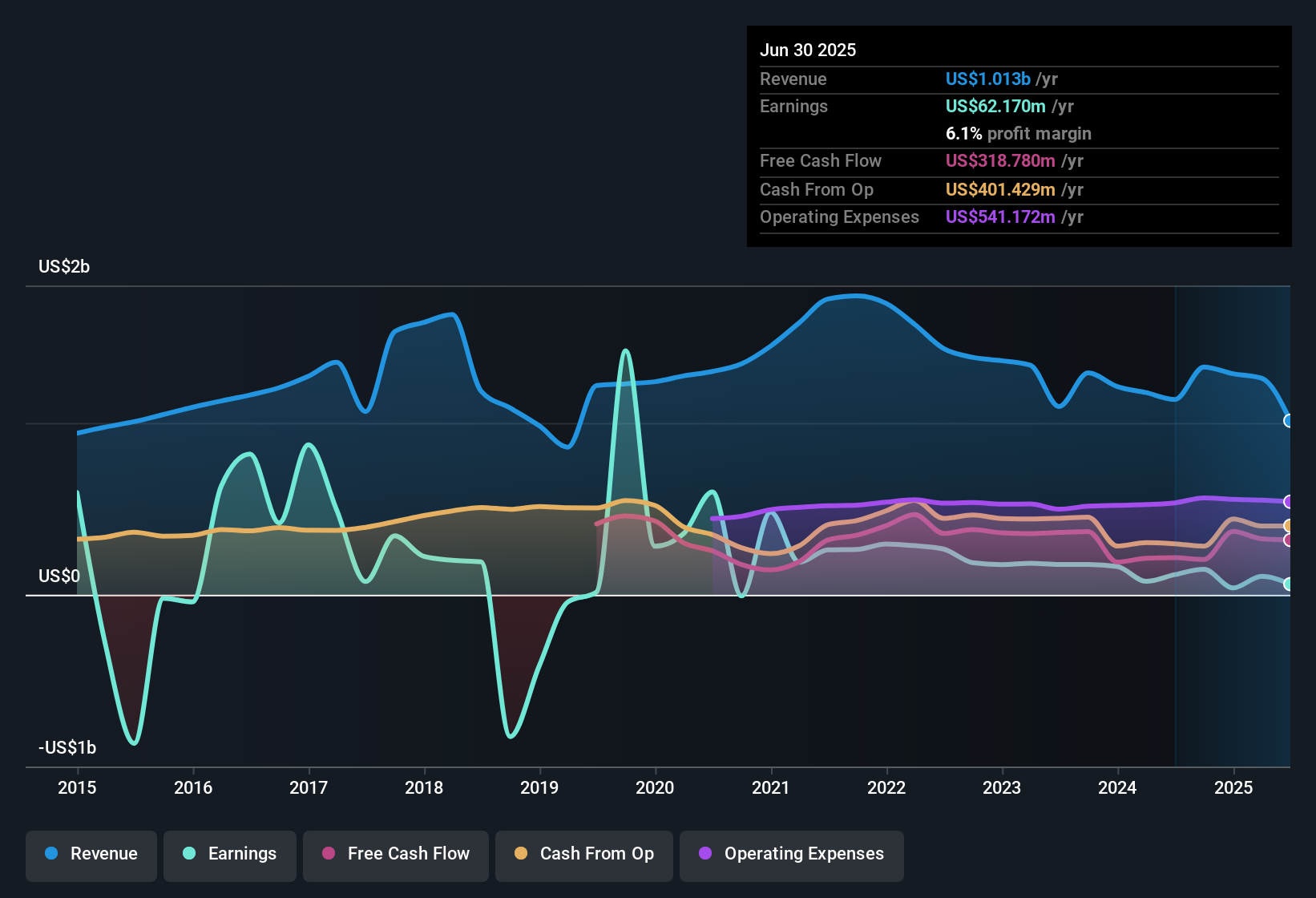

For Premier, the latest trailing twelve-month Free Cash Flow sits at $324.59 million. Looking ahead, analysts project Free Cash Flow of $315 million for the next year. Further out, Simply Wall St extrapolates these forecasts, expecting Free Cash Flow to decline modestly before gradually recovering and reaching approximately $357.17 million a decade from now.

- 2026 projected Free Cash Flow: $313.55 million

- 2030 projected Free Cash Flow: $316.07 million

- 2035 projected Free Cash Flow: $357.17 million

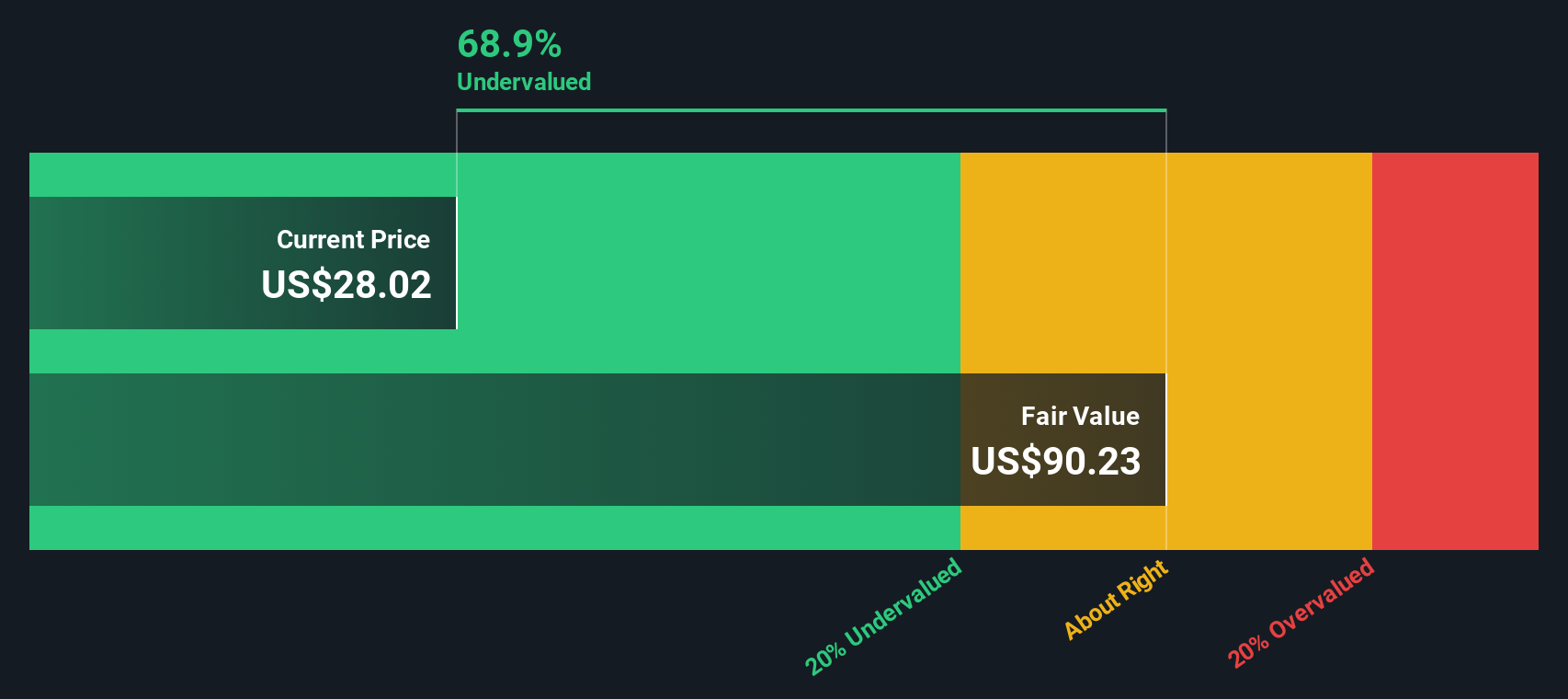

Applying the DCF valuation, Premier’s intrinsic value is calculated at $90.23 per share. This represents a 68.9% discount compared to the current market price, which suggests that the stock is notably undervalued at today’s levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Premier is undervalued by 68.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Premier Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing profitable companies like Premier. It gauges how much investors are willing to pay for each dollar of earnings, making it especially useful for companies with a steady profit track record. Because the PE ratio reflects both future growth expectations and perceived risk, higher growth or lower risk typically supports a higher "normal" PE, while lower growth or higher risk justifies a lower one.

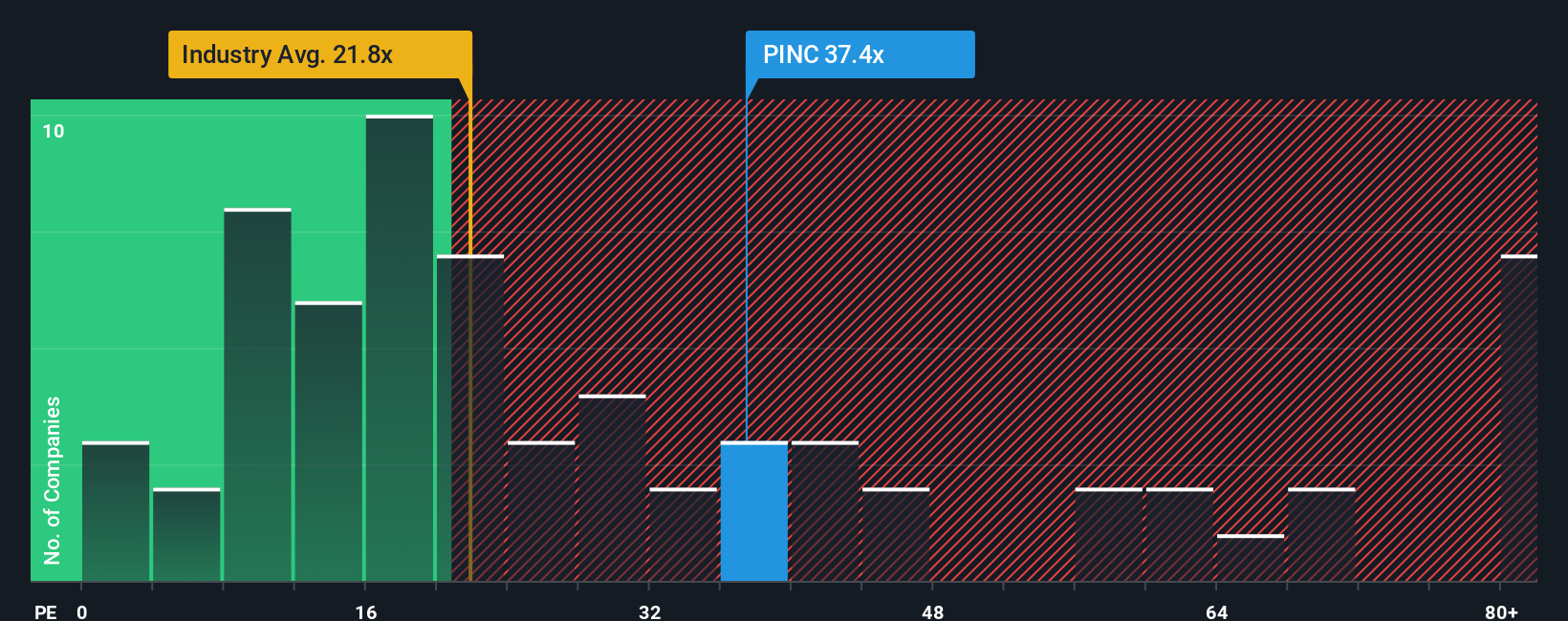

Premier’s current PE ratio stands at 37.3x. Compared to the broader Healthcare industry average of 21.8x, and even the average for its peers at 46.3x, Premier looks relatively elevated, though it does not stand out as excessive versus its direct competition.

To take the assessment one step further, Simply Wall St calculates a bespoke "Fair Ratio" for Premier, which comes in at 17.3x. The Fair Ratio goes beyond basic comparisons by factoring in Premier’s earnings growth outlook, risks, profit margin, market cap, and its position within the industry. This makes it a more balanced benchmark than simply comparing industry averages or peer trading levels, as those measures often miss critical company-specific factors.

With Premier’s actual PE of 37.3x well above the Fair Ratio, the stock currently appears overvalued by this measure and may be pricing in more future growth than is justified based on these fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Premier Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a powerful, user-friendly tool that lets investors create their own “story” about a company by combining their unique perspective with financial forecasts and a fair value estimate. Rather than relying only on broad metrics or consensus figures, Narratives link what you believe about Premier’s future (like where revenue, margins, and earnings are heading) to a specific fair value, letting you see the direct impact of your assumptions.

Narratives are available to everyone on Simply Wall St’s Community page, where millions of investors use them to visualize their reasoning, compare with others, and decide if a stock is worth buying or selling. These Narratives update automatically as new data or events such as earnings results or breaking news emerge, keeping your analysis relevant and current. For example, among Premier investors, some expect robust SaaS and AI-driven growth, supporting price targets above $26, while others see pressure from hospital budget constraints, leading to more cautious fair values closer to $19. Narratives make it easier than ever to align your investment decisions with both your convictions and the latest information.

Do you think there's more to the story for Premier? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PINC

Premier

Operates as a healthcare improvement company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives