- United States

- /

- Healthcare Services

- /

- NasdaqGS:PINC

Premier (PINC): Exploring Current Valuation as Analyst and Model Views Diverge

Reviewed by Kshitija Bhandaru

Premier (PINC) has caught investors’ attention lately, particularly as its stock steadily climbed over the past three months. The company’s value performance invites a closer look at what is fueling this upward momentum and what it could mean for shareholders.

See our latest analysis for Premier.

Momentum around Premier has been steady rather than spectacular. The share price has shown modest positive movement in recent months. The bigger picture reveals a 1-year total shareholder return of 0.51%, suggesting that while recent optimism is building, long-term gains have so far remained limited.

If you’re looking to broaden your investing toolkit, this could be the perfect moment to discover See the full list for free.

With the recent climb in share price and only a small gap between the current price and analyst targets, the key question emerges: Is Premier undervalued, or is the market already factoring in the company’s future growth trajectory?

Most Popular Narrative: Fairly Valued

Premier's latest widely followed narrative assigns a fair value of $27.50, which is right in line with the last close of $27.90. The closeness between price and narrative value shows the market and analysts are essentially in agreement, at least for now, setting the stage for the underlying drivers that have captured attention.

Premier's focus on AI-driven analytics, SaaS expansion, and integrated solutions leverages healthcare trends, boosting recurring revenues, market share, and long-term margin stability.

Want to know the secret sauce behind this valuation? The narrative hints at transformative new revenue streams and margin expansion, built on digital disruption. Curious which future projections are powering the consensus? Uncover surprising financial bets that justify every dollar of this fair value call.

Result: Fair Value of $27.50 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid adoption of Premier's AI-driven analytics or strong new contract wins could boost recurring revenue and challenge these cautious forecasts.

Find out about the key risks to this Premier narrative.

Another View: A Very Different Story from the SWS DCF Model

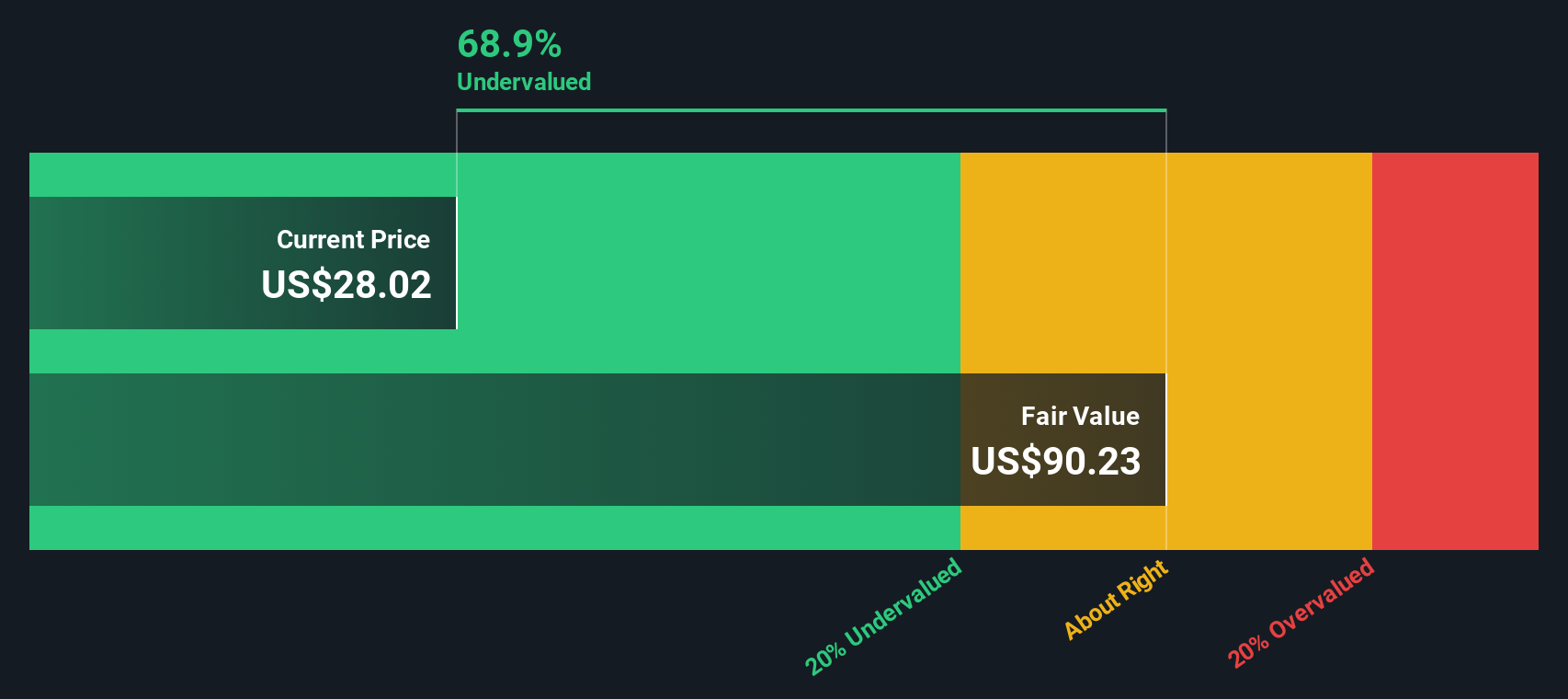

While analyst consensus points to fair value, our DCF model suggests Premier could be dramatically undervalued, with an estimated fair value nearly triple today’s share price. That is a huge gap between expectations and fundamentals. Are investors overlooking something bigger beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Premier for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Premier Narrative

If you have your own analysis to add or want to dig into the numbers yourself, you can shape your own narrative in just a few minutes. Do it your way.

A great starting point for your Premier research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Skip the guesswork and give yourself an edge by using unique stock screens that spotlight fresh opportunities before they hit the headlines. Your next winning investment might be just a click away.

- Spot high-yield potential by scanning through these 19 dividend stocks with yields > 3%. This tool highlights options offering attractive income and strong fundamentals for your portfolio.

- Uncover the companies transforming healthcare with cutting-edge technology via these 31 healthcare AI stocks. This gives you early access to tomorrow’s leaders.

- Explore digital innovation and find exposure to blockchain trends by checking out these 78 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PINC

Premier

Operates as a healthcare improvement company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives