- United States

- /

- Healthtech

- /

- NasdaqCM:OPRX

Why We Think OptimizeRx Corporation's (NASDAQ:OPRX) CEO Compensation Is Not Excessive At All

CEO Will Febbo has done a decent job of delivering relatively good performance at OptimizeRx Corporation (NASDAQ:OPRX) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 19 August 2021. We present our case of why we think CEO compensation looks fair.

See our latest analysis for OptimizeRx

Comparing OptimizeRx Corporation's CEO Compensation With the industry

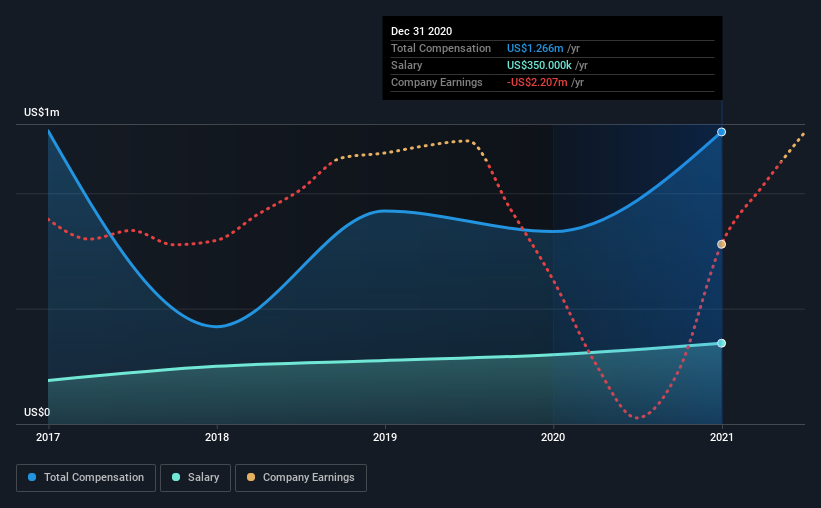

At the time of writing, our data shows that OptimizeRx Corporation has a market capitalization of US$1.1b, and reported total annual CEO compensation of US$1.3m for the year to December 2020. We note that's an increase of 52% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$350k.

On examining similar-sized companies in the industry with market capitalizations between US$400m and US$1.6b, we discovered that the median CEO total compensation of that group was US$1.3m. This suggests that OptimizeRx remunerates its CEO largely in line with the industry average. What's more, Will Febbo holds US$35m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$350k | US$300k | 28% |

| Other | US$916k | US$534k | 72% |

| Total Compensation | US$1.3m | US$834k | 100% |

Speaking on an industry level, nearly 13% of total compensation represents salary, while the remainder of 87% is other remuneration. OptimizeRx pays out 28% of remuneration in the form of a salary, significantly higher than the industry average. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at OptimizeRx Corporation's Growth Numbers

Over the last three years, OptimizeRx Corporation has shrunk its earnings per share by 39% per year. It achieved revenue growth of 80% over the last year.

The decrease in EPS could be a concern for some investors. On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has OptimizeRx Corporation Been A Good Investment?

Boasting a total shareholder return of 405% over three years, OptimizeRx Corporation has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Although the company has performed relatively well, we still think there are some areas that could be improved. Despite robust revenue growth, until EPS growth improves, shareholders may be hesitant to increase CEO pay by too much.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 3 warning signs for OptimizeRx that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade OptimizeRx, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:OPRX

OptimizeRx

A digital health technology company, enables care-focused engagement between life sciences organizations, healthcare providers, and patients at critical junctures throughout the patient care journey.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives