- United States

- /

- Healthtech

- /

- NasdaqCM:OPRX

OptimizeRx Corporation (NASDAQ:OPRX) Shares May Have Slumped 38% But Getting In Cheap Is Still Unlikely

OptimizeRx Corporation (NASDAQ:OPRX) shareholders won't be pleased to see that the share price has had a very rough month, dropping 38% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

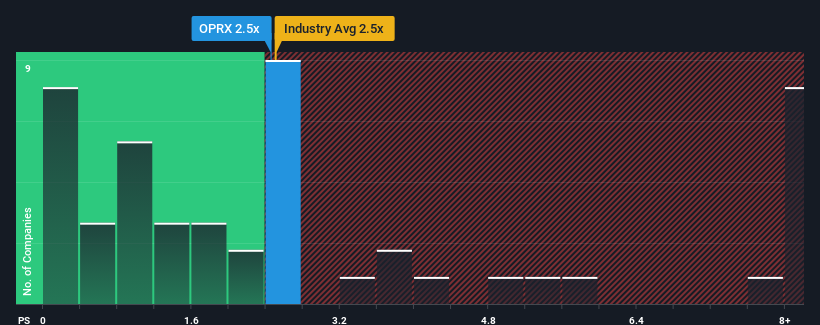

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about OptimizeRx's P/S ratio of 2.5x, since the median price-to-sales (or "P/S") ratio for the Healthcare Services industry in the United States is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for OptimizeRx

How Has OptimizeRx Performed Recently?

While the industry has experienced revenue growth lately, OptimizeRx's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on OptimizeRx.Is There Some Revenue Growth Forecasted For OptimizeRx?

The only time you'd be comfortable seeing a P/S like OptimizeRx's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 4.0% decrease to the company's top line. Still, the latest three year period has seen an excellent 114% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 5.2% during the coming year according to the six analysts following the company. That's shaping up to be materially lower than the 13% growth forecast for the broader industry.

With this information, we find it interesting that OptimizeRx is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does OptimizeRx's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for OptimizeRx looks to be in line with the rest of the Healthcare Services industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that OptimizeRx's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Plus, you should also learn about this 1 warning sign we've spotted with OptimizeRx.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:OPRX

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026