- United States

- /

- Healthcare Services

- /

- NasdaqGS:OPK

Why OPKO Health (OPK) Is Up 7.7% After Advancing Immuno-Oncology Pipeline and Notable Insider Buying

Reviewed by Sasha Jovanovic

- OPKO Health recently announced that its ModeX division has progressed four immuno-oncology drug candidates into Phase 1 trials and is testing a Phase 1 Epstein-Barr virus vaccine in partnership with Merck, with the potential for Phase 2 trials next year.

- The company also saw CEO Phillip Frost and other key investors increase their holdings, highlighting insider confidence in OPKO Health’s growing pipeline of therapies and long-term potential.

- We'll examine how the combination of pipeline advancements and insider buying strengthens OPKO Health’s evolving investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

OPKO Health Investment Narrative Recap

To be a shareholder in OPKO Health, you need confidence in the company’s ability to translate its deep pipeline of therapies and diagnostic solutions into sustainable revenue growth, against a backdrop of persistent net losses and high R&D spend. While the recent push of immuno-oncology and vaccine candidates into early-stage trials signals real progress in innovation, it does not materially change the company’s immediate need to improve profitability and limit dilution, which remain key near-term catalysts and risks to watch.

Of the latest announcements, the partnership with Merck to develop a Phase 1 Epstein-Barr virus vaccine is especially relevant, as it could open the door to recurring milestone payments and long-term revenue streams if subsequent trial phases succeed. Access to capital and effective management of clinical development timelines will be crucial for OPKO’s ability to turn pipeline milestones into meaningful shareholder value.

However, for all the promise, investors should be aware that persistent net losses continue to weigh on OPKO’s capacity to deliver sustained returns if new products fail to reach commercial success …

Read the full narrative on OPKO Health (it's free!)

OPKO Health's outlook estimates $754.1 million in revenue and $40.6 million in earnings by 2028. This is based on a 4.3% annual revenue growth rate and a $217.7 million increase in earnings from the current level of -$177.1 million.

Uncover how OPKO Health's forecasts yield a $3.62 fair value, a 135% upside to its current price.

Exploring Other Perspectives

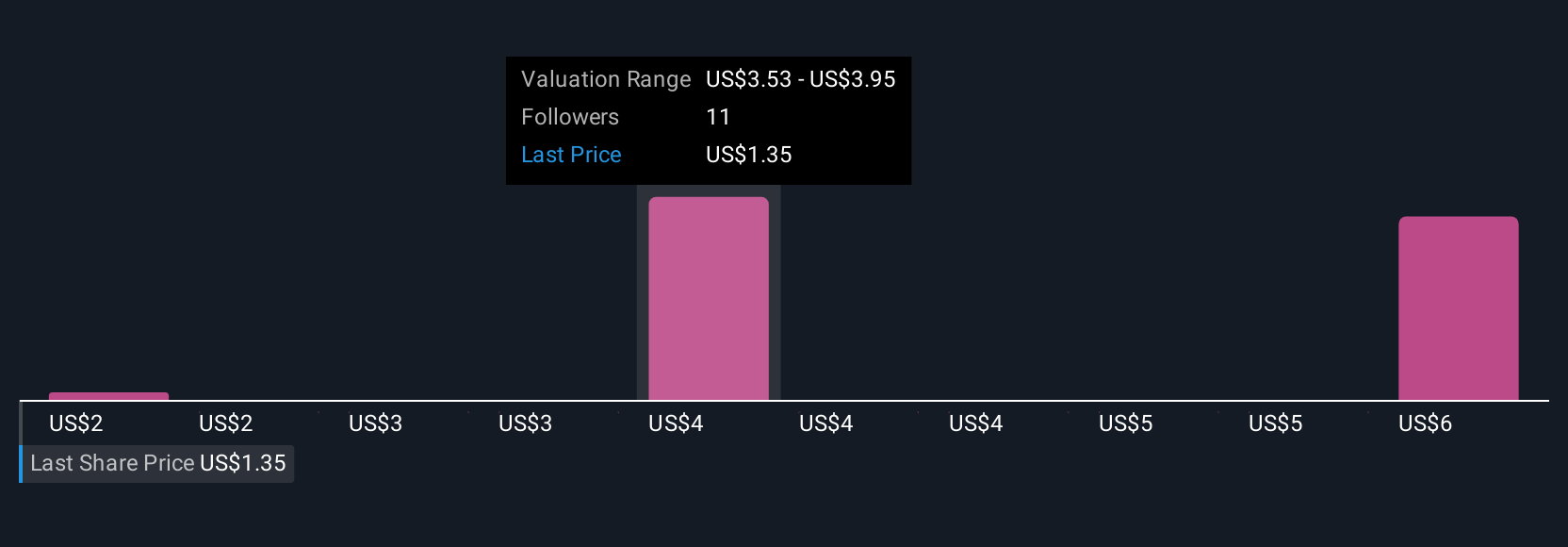

Three retail investors in the Simply Wall St Community estimate OPKO’s fair value between US$1.85 and US$6.06 per share. Ongoing high R&D expenditure and profitability challenges remain central to the wider debate over the company’s longer-term earnings potential, explore these varied viewpoints to inform your own assessment.

Explore 3 other fair value estimates on OPKO Health - why the stock might be worth over 3x more than the current price!

Build Your Own OPKO Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OPKO Health research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free OPKO Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OPKO Health's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPK

OPKO Health

A healthcare company, engages in the diagnostics and pharmaceuticals businesses in the United States, Ireland, Chile, Spain, Israel, Mexico, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives