- United States

- /

- Healthcare Services

- /

- NasdaqGS:OPK

OPKO Health (OPK) Is Up 7.7% After Advancing Immuno-Oncology Pipeline and CEO Boosts Stake Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- OPKO Health's ModeX division has advanced four immuno-oncology drug candidates into Phase 1 trials, including MDX2001 for solid tumors, and has also progressed a Phase 1 Epstein-Barr virus vaccine being developed with Merck, with further Phase 2 studies considered for next year.

- In addition, CEO Phillip Frost and other key investors increased their ownership during the year, signaling internal confidence in the company's therapeutic pipeline and long-term prospects.

- To assess the impact of these R&D developments, we'll explore how progress in immuno-oncology could reshape OPKO Health’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

OPKO Health Investment Narrative Recap

To be a shareholder in OPKO Health, you need to believe in the company’s ability to convert its rich R&D pipeline, and especially its ModeX immuno-oncology and vaccine candidates, into new revenue streams that offset ongoing losses and capital structure challenges. The recent progress moving multiple ModeX assets into Phase 1 studies is encouraging, but with OPKO still posting sizeable net losses and relying heavily on R&D, the biggest short term catalyst remains clear clinical advancement toward later-stage trials, while persistent unprofitability remains the largest risk. At this stage, the news does not yet appear to materially shift either dynamic.

Among OPKO’s recent announcements, continued share buybacks stand out, as the company has repurchased more than 39 million shares since July 2024. This is relevant context for investors considering the internal confidence signaled by insider buying; however, unless the underlying business becomes profitable or achieves more meaningful pipeline milestones, buybacks alone are unlikely to meaningfully change the risk-reward equation for current shareholders.

In contrast, OPKO’s dependence on ongoing R&D investment to deliver late-stage successes is something investors should keep in mind, especially if…

Read the full narrative on OPKO Health (it's free!)

OPKO Health's narrative projects $754.1 million in revenue and $40.6 million in earnings by 2028. This requires 4.3% yearly revenue growth and a $217.7 million increase in earnings from the current -$177.1 million.

Uncover how OPKO Health's forecasts yield a $3.62 fair value, a 135% upside to its current price.

Exploring Other Perspectives

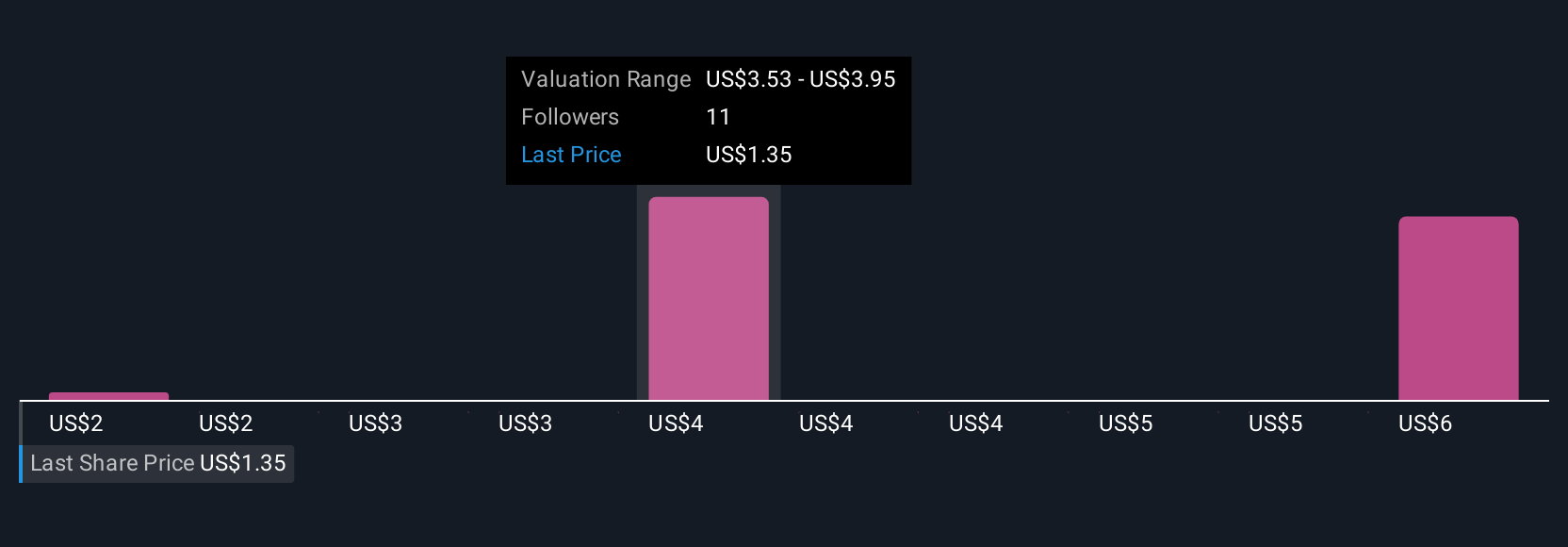

Simply Wall St Community members have published three fair value estimates for OPKO Health ranging from US$1.85 to US$6.06 per share. While opinions are diverse, many are focused on whether clinical progress in new therapies can ultimately counterbalance the company’s pattern of net losses and high cost structure.

Explore 3 other fair value estimates on OPKO Health - why the stock might be worth over 3x more than the current price!

Build Your Own OPKO Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OPKO Health research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free OPKO Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OPKO Health's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPK

OPKO Health

A healthcare company, engages in the diagnostics and pharmaceuticals businesses in the United States, Ireland, Chile, Spain, Israel, Mexico, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives