- United States

- /

- Healthcare Services

- /

- NasdaqGS:OPK

BioReference Lab Sale Might Change The Case For Investing In OPKO Health (OPK)

Reviewed by Sasha Jovanovic

- OPKO Health recently sold its BioReference Lab assets, marking a move to sharpen its focus on drug development and pipeline innovation.

- This shift toward a co-development and royalty model is intended to boost long-term profitability by reducing risk and strengthening the balance sheet.

- We'll now explore how the transition away from diagnostics may alter OPKO Health's investment narrative and future financial trajectory.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

OPKO Health Investment Narrative Recap

To own OPKO Health stock today, you need confidence in its pivot to a leaner, innovation-driven pharmaceutical business, banking on royalty and co-development models after exiting diagnostics. The recent BioReference Lab sale materially addresses OPKO's most immediate catalyst, controlling cash burn and improving its balance sheet, while also reducing the ongoing risk of negative earnings from the underperforming diagnostics unit.

Most relevant here is OPKO's substantial share buyback activity, highlighted by the April increase of its repurchase authorization to US$200,000,000 and the acquisition of over 39 million shares by June. This capital allocation can provide near-term support as OPKO works to stabilize margins and rebuild investor confidence following asset sales and persistent losses.

Yet, investors must be aware that, in contrast, reliance on successful commercialization of a narrow portfolio still leaves OPKO exposed to significant concentration risk if key pipeline products stumble...

Read the full narrative on OPKO Health (it's free!)

OPKO Health's outlook projects $754.1 million in revenue and $40.6 million in earnings by 2028. This requires 4.3% annual revenue growth and an increase in earnings of $217.7 million from current earnings of -$177.1 million.

Uncover how OPKO Health's forecasts yield a $3.62 fair value, a 138% upside to its current price.

Exploring Other Perspectives

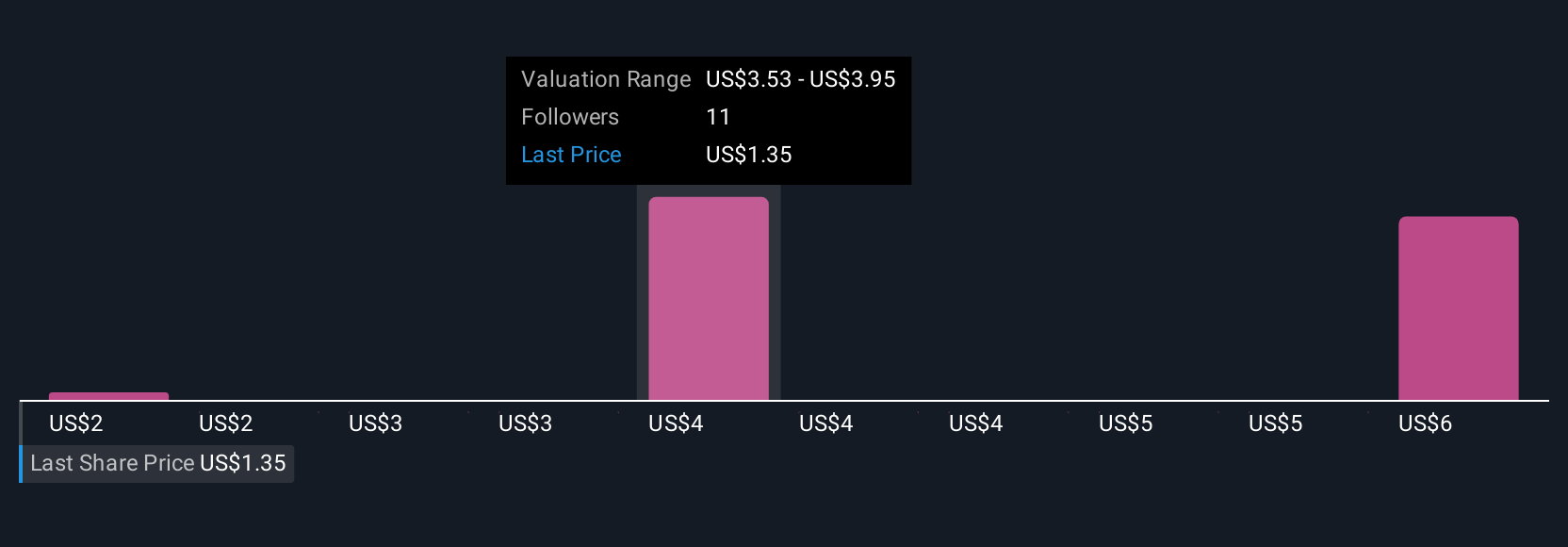

Community fair value estimates for OPKO Health (US$1.85 to US$6.06) from three Simply Wall St Community members reflect widely differing outlooks on future returns. Ongoing concentration risk, amplified by the diagnostics exit, means your own assessment of the pipeline's prospects could make a major difference in your view.

Explore 3 other fair value estimates on OPKO Health - why the stock might be worth over 3x more than the current price!

Build Your Own OPKO Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free OPKO Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OPKO Health's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPK

OPKO Health

A healthcare company, engages in the diagnostics and pharmaceuticals businesses in the United States, Ireland, Chile, Spain, Israel, Mexico, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives