- United States

- /

- Healthcare Services

- /

- NasdaqGS:OPCH

Did Option Care Health’s (OPCH) Credit Refinance and Conference Boost Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- In September 2025, Option Care Health amended its First Lien Credit Agreement to refinance existing term loans at a lower interest rate, secure new incremental term loans of approximately US$49.6 million, and extend the maturity of its credit facilities, resulting in a total First Lien Term Loan balance of about US$678 million.

- This financial move was announced alongside analyst commentaries recognizing Option Care Health's strong value metrics, earnings outlook, and leadership in the home infusion therapy market, further reinforced during its presentation at the Jefferies 2025 Healthcare Services Conference.

- We'll now explore how Option Care Health's refinancing and industry conference presence influence its investment narrative and forward-looking outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Option Care Health Investment Narrative Recap

To be a shareholder in Option Care Health, you typically need to believe in the sustained expansion of home infusion therapy and the company's ability to outpace market growth through payer partnerships, geographic coverage, and a robust care model. The recent refinancing of its term loans at a lower interest rate and extended maturities supports financial flexibility but is not expected to materially change the main short-term catalyst, continued acute and chronic therapy growth, or offset the biggest risk: future reimbursement pressure from payers or regulatory changes.

Among recent announcements, Option Care Health's ongoing share repurchase program stands out as particularly relevant, signaling confidence in the company's value and its ongoing commitment to delivering shareholder returns. This complements the improved debt terms by indicating management’s focus on capital efficiency, though neither is likely to significantly alter the immediate revenue and reimbursement-driven catalysts at play.

On the other hand, investors should be aware that policy-related reimbursement risk could quickly overshadow...

Read the full narrative on Option Care Health (it's free!)

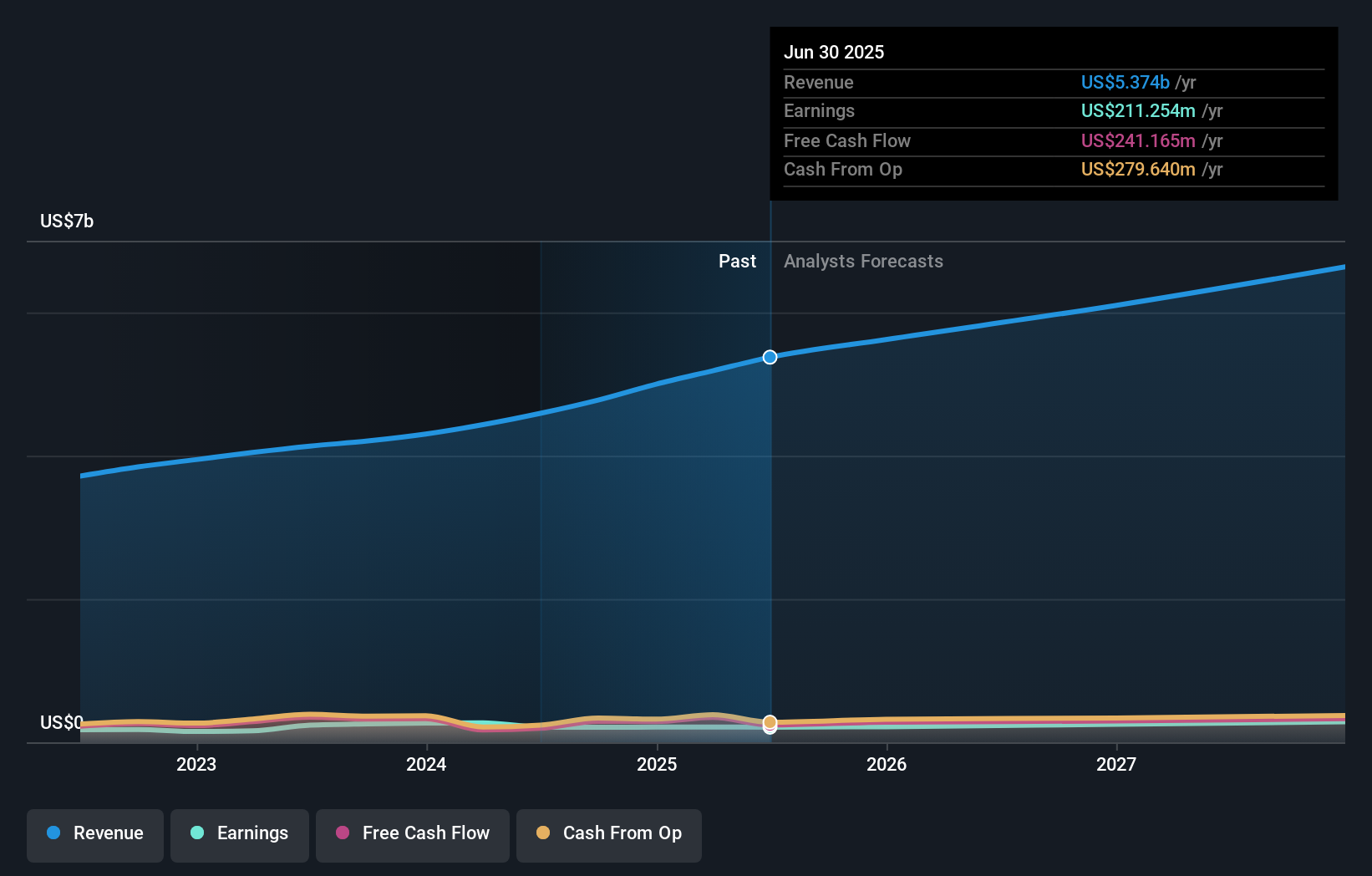

Option Care Health's outlook anticipates $6.9 billion in revenue and $306.2 million in earnings by 2028. This scenario assumes 8.8% annual revenue growth and an earnings increase of $94.9 million from the current $211.3 million.

Uncover how Option Care Health's forecasts yield a $38.78 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community estimates place fair value for Option Care Health between US$29.19 and US$65.03 per share. While opinions about future growth and value vary, keep in mind that reimbursement policy changes can affect the earnings outlook and spark fresh debate about the company’s prospects.

Explore 3 other fair value estimates on Option Care Health - why the stock might be worth just $29.19!

Build Your Own Option Care Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Option Care Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Option Care Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Option Care Health's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPCH

Option Care Health

Offers home and alternate site infusion services in the United States.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives