- United States

- /

- Healthcare Services

- /

- NasdaqGS:OPCH

A Fresh Look at Option Care Health's (OPCH) Valuation After Q2 Earnings Beat and Insider Share Purchase

Reviewed by Simply Wall St

If you’re watching Option Care Health (OPCH) right now, this past week has given plenty to think about. The company posted second-quarter earnings that came in ahead of analyst expectations, driven by strong revenue growth. Alongside the solid report, a director scooped up over 3,400 shares. This is always an eye-catching move that often signals confidence from those in the know.

Coming off these announcements, Option Care Health’s stock had experienced its ups and downs over the past year, declining about 10%. The last month was quieter, with only a small uptick. The long-term picture remains impressive, as the five-year return is up over 150%. The new CFO appointment and management’s increased stake suggest leadership sees continued momentum, but markets so far appear cautious despite the strong financial performance.

So with the dust settling after Q2 and signs of growth on the table, is this a value play hiding in plain sight, or is the market already looking ahead and pricing in every bit of good news?

Most Popular Narrative: 26.6% Undervalued

According to the most widely followed narrative, Option Care Health is currently seen as significantly undervalued based on its projected earnings growth and operational improvements.

Continued expansion of the company's national suite footprint and advanced practitioner model is improving nurse productivity and enabling the treatment of higher acuity, complex, and new therapeutic cohorts, including oncology and Alzheimer's. This is driving both margin improvements and new revenue streams.

Curious about how analysts arrive at such a bullish fair value? The real story involves ambitious growth projections, margin advancements, and a forward-looking profit multiple that might surprise you. Wondering which financial levers could push Option Care Health to new highs? Dive deeper into the narrative to see the critical factors fueling this valuation.

Result: Fair Value of $38.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts toward lower-margin therapies or tougher reimbursement negotiations could quickly put pressure on Option Care Health’s growth and profit outlook.

Find out about the key risks to this Option Care Health narrative.Another View: Look at the Numbers a Different Way

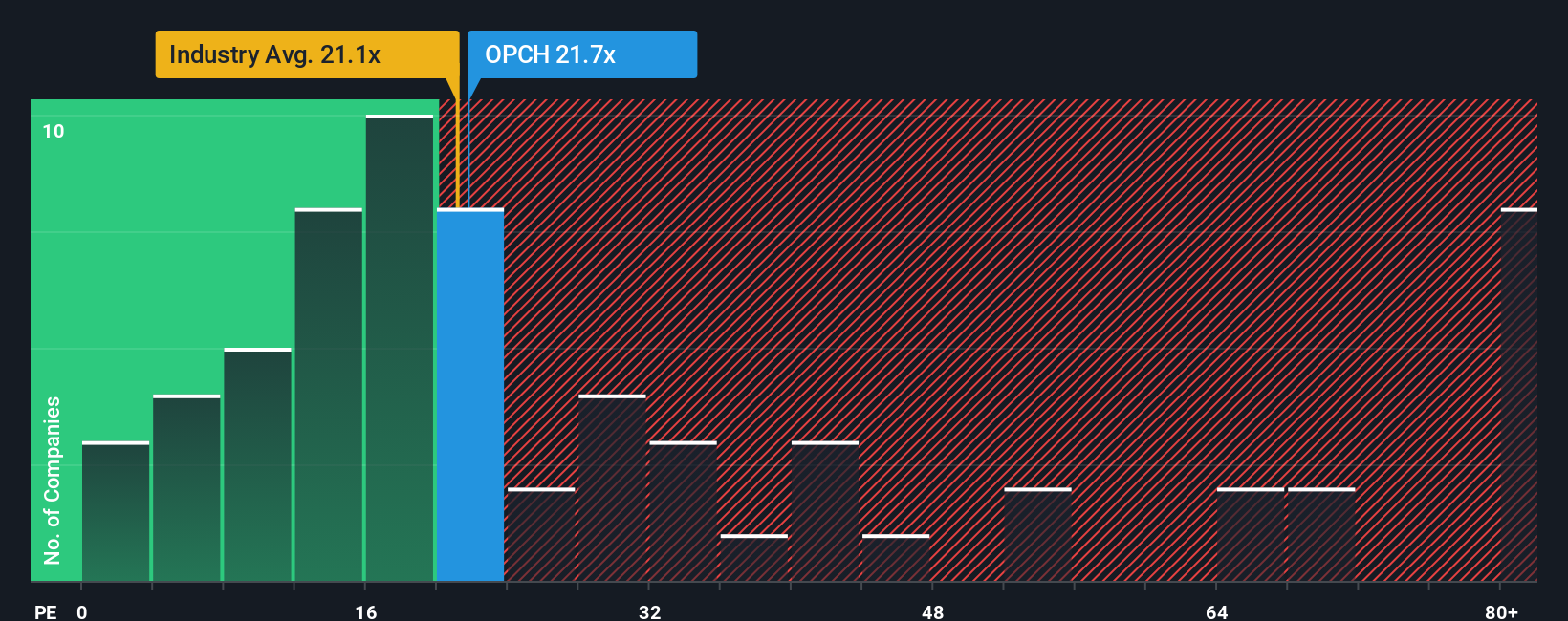

While many are optimistic about Option Care Health’s future based on its strong earnings outlook, a different approach compares the company’s valuation to the sector average. This perspective suggests the stock might actually look expensive instead of cheap. Which lens reveals the truer value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Option Care Health Narrative

If you want to dig into the details and approach the numbers from your own angle, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your Option Care Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t stop with just one outlook. Seize the opportunity to find other stand-out stocks by using the Simply Wall Street Screener’s powerful tools below.

- Spot tomorrow’s tech disruptors early by scanning the freshest AI penny stocks changing how artificial intelligence is powering profitable businesses.

- Boost your portfolio with steady performers using our top picks for dividend stocks with yields > 3% offering reliable yields above 3%.

- Get ahead of the curve by zeroing in on real bargains with our curated list of undervalued stocks based on cash flows priced below their true cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPCH

Option Care Health

Offers home and alternate site infusion services in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives