- United States

- /

- Medical Equipment

- /

- NasdaqGS:OMCL

The past three years for Omnicell (NASDAQ:OMCL) investors has not been profitable

It's not possible to invest over long periods without making some bad investments. But really big losses can really drag down an overall portfolio. So spare a thought for the long term shareholders of Omnicell, Inc. (NASDAQ:OMCL); the share price is down a whopping 72% in the last three years. That would certainly shake our confidence in the decision to own the stock.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Omnicell

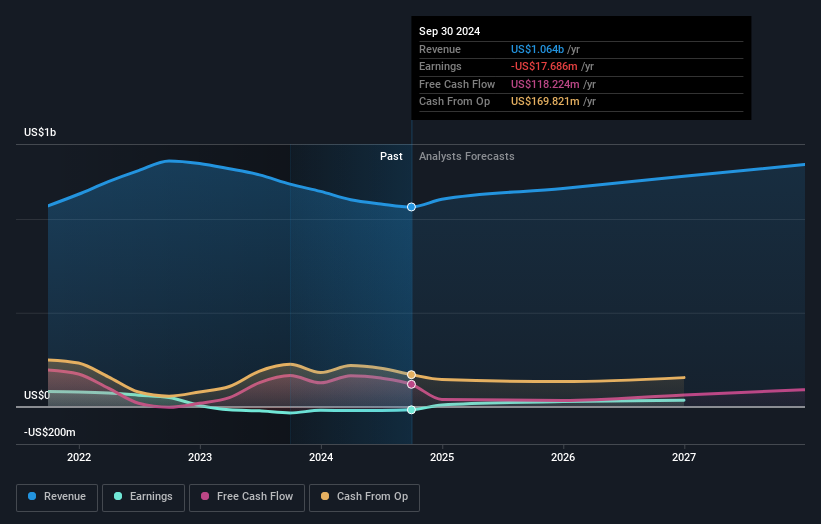

Given that Omnicell didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Omnicell's revenue dropped 2.5% per year. That is not a good result. Having said that the 20% annualized share price decline highlights the risk of investing in unprofitable companies. We're generally averse to companies with declining revenues, but we're not alone in that. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Omnicell's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Omnicell has rewarded shareholders with a total shareholder return of 34% in the last twelve months. That certainly beats the loss of about 8% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Omnicell has 2 warning signs we think you should be aware of.

But note: Omnicell may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade Omnicell, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OMCL

Omnicell

Provides medication management solutions and adherence tools for healthcare systems and pharmacies the United States and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives