- United States

- /

- Medical Equipment

- /

- NasdaqGS:OMCL

The Bull Case For Omnicell (OMCL) Could Change Following Titan XT AI Medication Platform Launch

Reviewed by Sasha Jovanovic

- Earlier this month, Omnicell, Inc. launched Titan XT, an enterprise-scale automated dispensing system powered by its cloud-based OmniSphere platform, aimed at unifying medication management and enhancing safety and efficiency across health systems.

- A particularly important element is Titan XT’s AI-enabled inventory intelligence and FiveRights safeguards, which together target both cost control for pharmacy leaders and error reduction for nursing teams.

- We’ll now explore how Titan XT’s cloud- and AI-driven medication management capabilities may influence Omnicell’s existing investment narrative and future prospects.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Omnicell Investment Narrative Recap

To own Omnicell, you need to believe that hospitals will keep investing in automation and cloud-based medication management, and that Omnicell’s OmniSphere platform can steadily grow higher-margin, recurring revenue. Titan XT reinforces that thesis in the near term by pushing more intelligence and connectivity onto nursing floors, but it does not materially change the key short term catalyst, which is broader OmniSphere adoption, or the biggest risk, which is intensifying competition in automated dispensing and software.

The most relevant recent announcement alongside Titan XT is Omnicell’s raised full year 2025 revenue guidance to US$1,177.7 million to US$1,187.0 million on 30 October 2025, which reflected improving execution and demand trends ahead of this launch. Together, the higher guidance and Titan XT highlight how Omnicell is leaning on OmniSphere centric innovation to support the gradual shift toward more predictable SaaS and services revenue, a core pillar in the current investment story.

Yet, while OmniSphere centralization can be a strength, it also heightens cybersecurity and regulatory exposure that investors should be aware of...

Read the full narrative on Omnicell (it's free!)

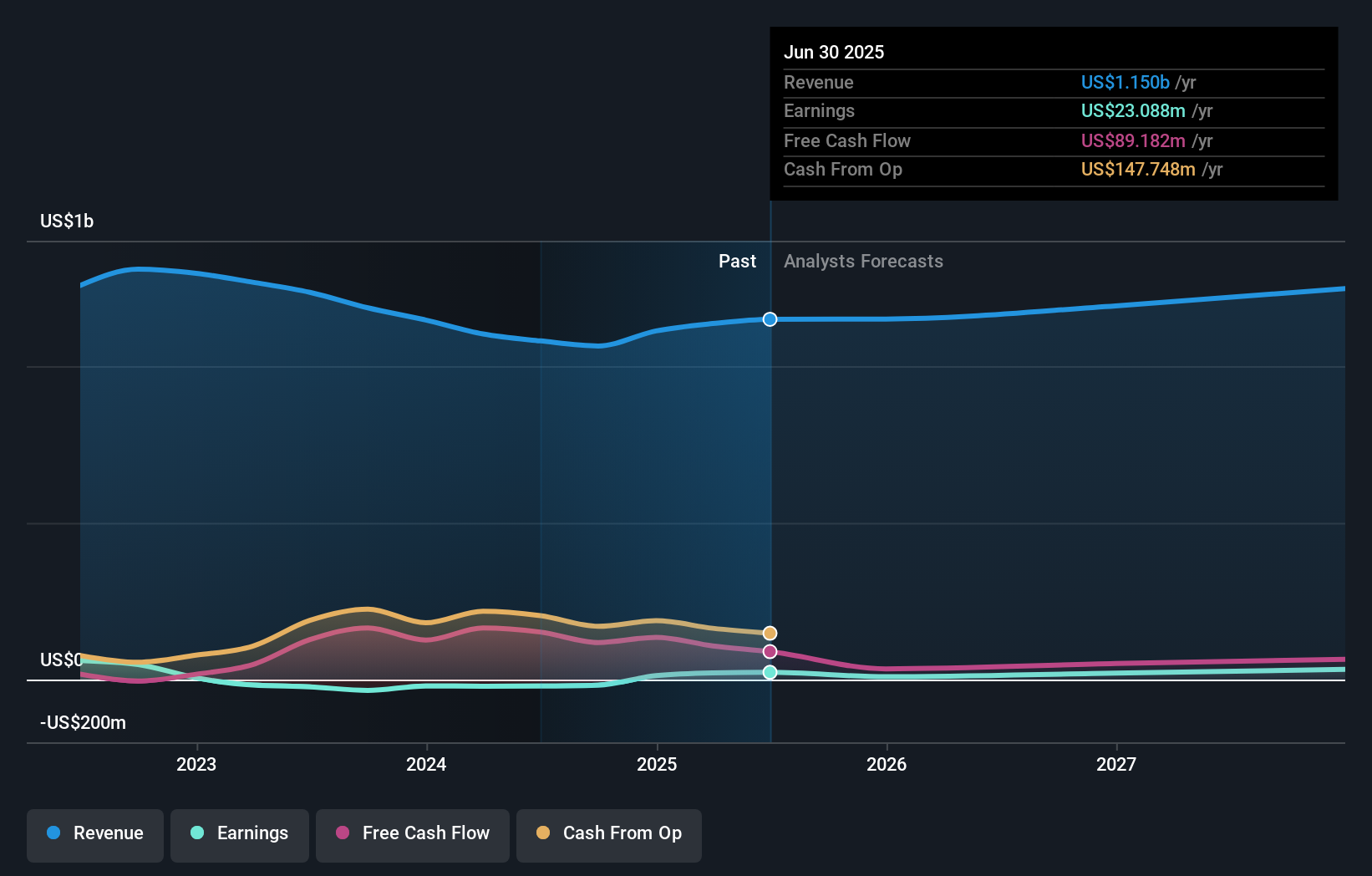

Omnicell's narrative projects $1.3 billion revenue and $30.4 million earnings by 2028. This requires 3.0% yearly revenue growth and about a $7.3 million earnings increase from $23.1 million today.

Uncover how Omnicell's forecasts yield a $51.50 fair value, a 12% upside to its current price.

Exploring Other Perspectives

The single fair value estimate from the Simply Wall St Community sits at US$51.50, leaving plenty of room for different views on Omnicell’s worth. When you set that against the company’s push to scale OmniSphere powered offerings like Titan XT, it is worth considering how faster recurring revenue adoption could influence both expectations and longer term company performance.

Explore another fair value estimate on Omnicell - why the stock might be worth just $51.50!

Build Your Own Omnicell Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Omnicell research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Omnicell research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Omnicell's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OMCL

Omnicell

Provides medication management solutions and adherence tools for healthcare systems and pharmacies the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)