- United States

- /

- Medical Equipment

- /

- NasdaqGS:OMCL

Omnicell (OMCL): Exploring Valuation After Recent Analyst Optimism Boosts Investor Sentiment

Reviewed by Kshitija Bhandaru

Omnicell (OMCL) is catching more attention from value-driven investors after recent analyst commentary pointed to stronger estimate revisions and appealing valuation metrics compared to sector peers. This is stirring interest in the stock.

See our latest analysis for Omnicell.

Omnicell’s share price has faced persistent pressure this year, reflecting a cautious outlook after customer spending delays weighed on revenues and profitability. However, recent analyst optimism around its valuation and estimate revisions is sparking renewed interest among value-focused investors. Despite near-term headwinds, the long-term total shareholder returns point to lingering investor skepticism, with momentum only starting to turn as sentiment quietly shifts.

If you’re weighing up where the next opportunity might be, consider broadening your search and discover fast growing stocks with high insider ownership.

With shares still trading well below analyst price targets and estimate revisions shifting positive, the question arises: does Omnicell now represent a compelling value, or is the market already pricing in a potential recovery?

Most Popular Narrative: 29.7% Undervalued

Omnicell’s widely followed narrative places its fair value at $44, which is well above the last close of $30.95. This framing sets up a crucial question: just how ambitious are the assumptions driving this target?

“The continued rollout and adoption of the cloud-native OmniSphere platform across Omnicell's customer base will simplify enterprise-wide medication management, make adding new features and integrating advanced analytics much easier, and accelerate the company's transition to higher-margin, recurring SaaS-based revenues, supporting improved revenue predictability and net margins.”

What’s really fuelling this steep upside? The fair value hinges on bold growth projections and margin expansion for Omnicell’s next phase. Curious what financial leap is being forecast to justify such a premium? Dig into the full story and see what’s driving this eye-opening valuation.

Result: Fair Value of $44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff impacts and slowing product adoption could limit profit margin improvements and undermine Omnicell’s long-term narrative if these issues are not addressed.

Find out about the key risks to this Omnicell narrative.

Another View: Caution from Market Comparisons

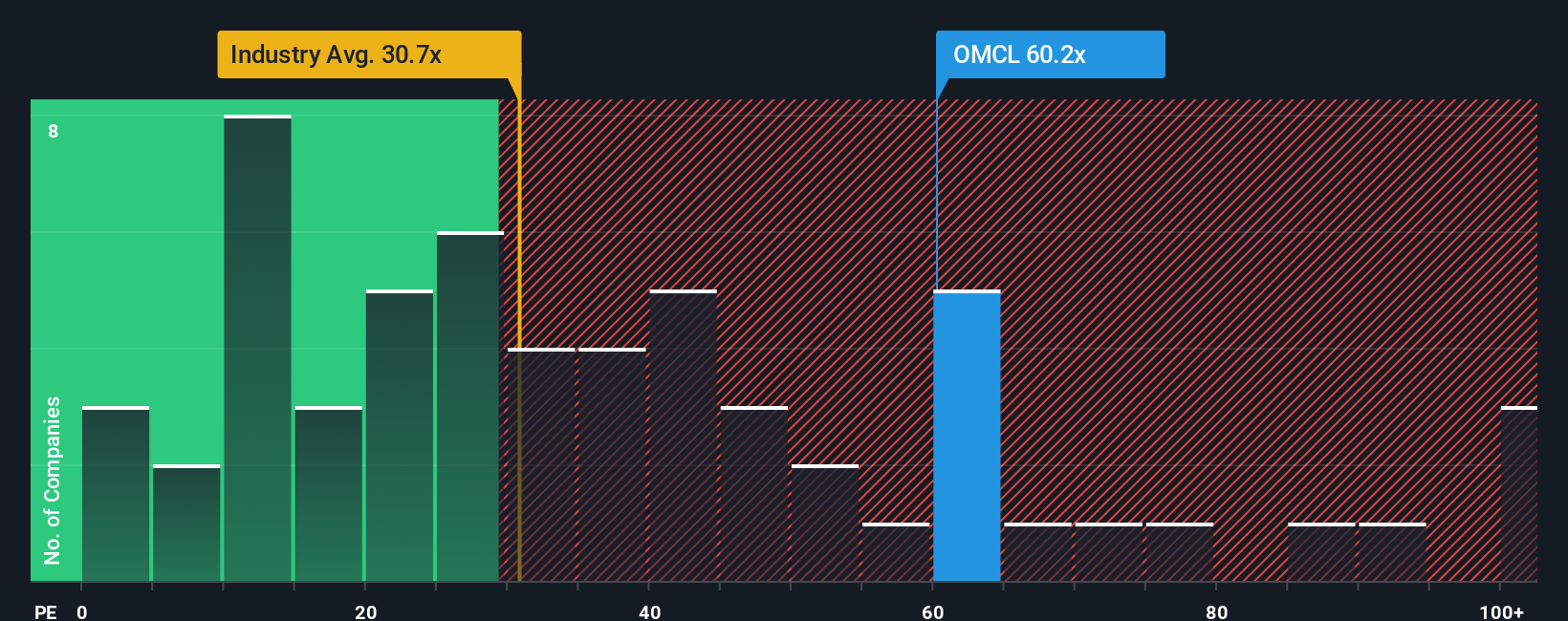

Although the first approach suggests Omnicell is undervalued, a look at its price-to-earnings ratio tells a different story. Shares currently trade at 61.6 times earnings, which is much higher than both the US Medical Equipment industry average of 30.4x and the peer average of 26.2x. The market’s fair ratio for Omnicell could be just 23.1x, signaling that investors are already paying a notable premium for future growth. What if the anticipated upside does not materialize?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Omnicell Narrative

If you see things differently or want to shape your own perspective, you can dive into the numbers and craft a unique take in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Omnicell.

Looking for More Smart Investment Ideas?

Don’t settle for just one opportunity. The market is filled with fresh angles and sector trends—expand your search and find your next financial edge today.

- Uncover steady income potential as you target these 19 dividend stocks with yields > 3%, offering attractive yields and reliable cash flow.

- Spot emerging tech trends early by examining these 24 AI penny stocks, which are making significant moves in artificial intelligence advancements and market disruption.

- Capitalize on mispriced gems and act quickly with these 896 undervalued stocks based on cash flows, relying on solid fundamentals and long-term potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OMCL

Omnicell

Provides medication management solutions and adherence tools for healthcare systems and pharmacies the United States and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives