- United States

- /

- Medical Equipment

- /

- NasdaqGS:OMCL

Does Omnicell’s (OMCL) Low Valuation With Growth Outlook Mark a Turning Point in Investor Sentiment?

Reviewed by Simply Wall St

- In recent days, Omnicell has received positive analyst attention for its strong value metrics, including a low PEG ratio and P/S ratio compared to industry averages, alongside an anticipated double-digit profit growth outlook.

- This combination of value and growth expectations has contributed to renewed investor interest and elevated optimism around the company's prospects in the healthcare automation sector.

- We'll examine how this increased investor confidence, driven by Omnicell's favorable valuation and earnings outlook, may influence its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Omnicell Investment Narrative Recap

To consider Omnicell as a shareholder, you must believe that continued demand for healthcare automation, successful SaaS platform rollout, and improved recurring revenue can outweigh margin pressures from external costs and competition. While recent analyst upgrades and positive valuation metrics have sparked investor optimism, this news does not fundamentally shift the main near-term catalyst, the pace of SaaS adoption, and does little to mitigate the ongoing risk of inflationary and tariff-driven margin compression that management has previously cited as a significant concern.

The recent appointment of Baird Radford as CFO is perhaps the most relevant announcement in the context of Omnicell’s value narrative. Leadership with substantial experience in financial operations could help maintain discipline as Omnicell executes on its platform and recurring revenue strategy, an area closely watched by market participants as the company undergoes gradual transformation efforts to strengthen its earnings base and revenue predictability.

However, investors should be mindful that, despite favorable value metrics, a meaningful risk remains from ongoing tariff impacts and related cost volatility, especially as Omnicell navigates...

Read the full narrative on Omnicell (it's free!)

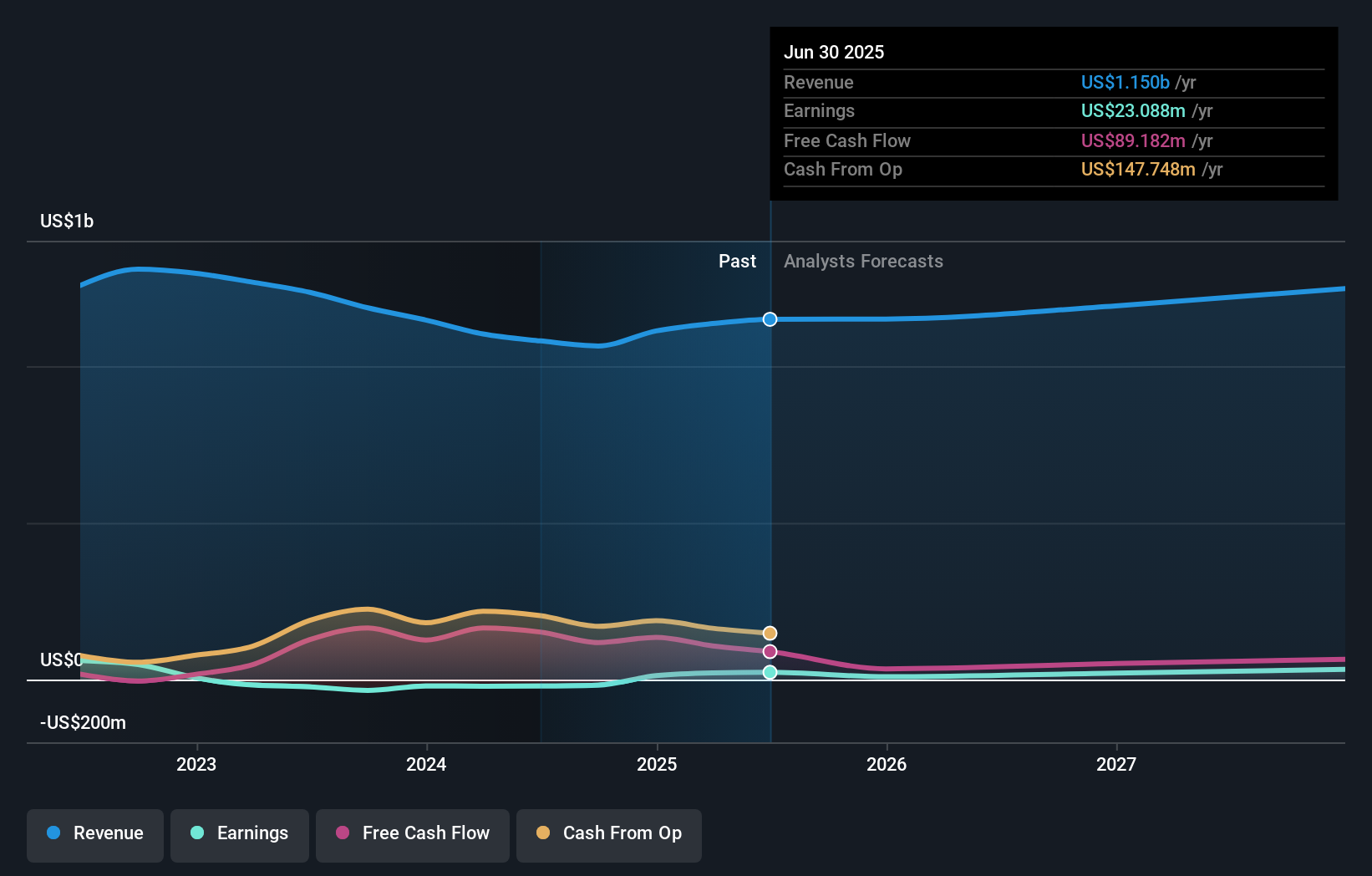

Omnicell's narrative projects $1.3 billion revenue and $30.4 million earnings by 2028. This requires 3.0% yearly revenue growth and a $7.3 million earnings increase from $23.1 million today.

Uncover how Omnicell's forecasts yield a $44.00 fair value, a 40% upside to its current price.

Exploring Other Perspectives

Community members on Simply Wall St all estimate a fair value of US$44 for Omnicell, suggesting uncommon agreement among private investors. Against this, persistent tariff and supply chain risks highlight how sentiment may shift quickly as external costs weigh on future performance, explore other viewpoints to see how these factors are weighed.

Explore another fair value estimate on Omnicell - why the stock might be worth just $44.00!

Build Your Own Omnicell Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Omnicell research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Omnicell research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Omnicell's overall financial health at a glance.

No Opportunity In Omnicell?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 31 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OMCL

Omnicell

Provides medication management solutions and adherence tools for healthcare systems and pharmacies the United States and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives