- United States

- /

- Medical Equipment

- /

- NasdaqCM:NXGL

It's A Story Of Risk Vs Reward With NEXGEL, Inc. (NASDAQ:NXGL)

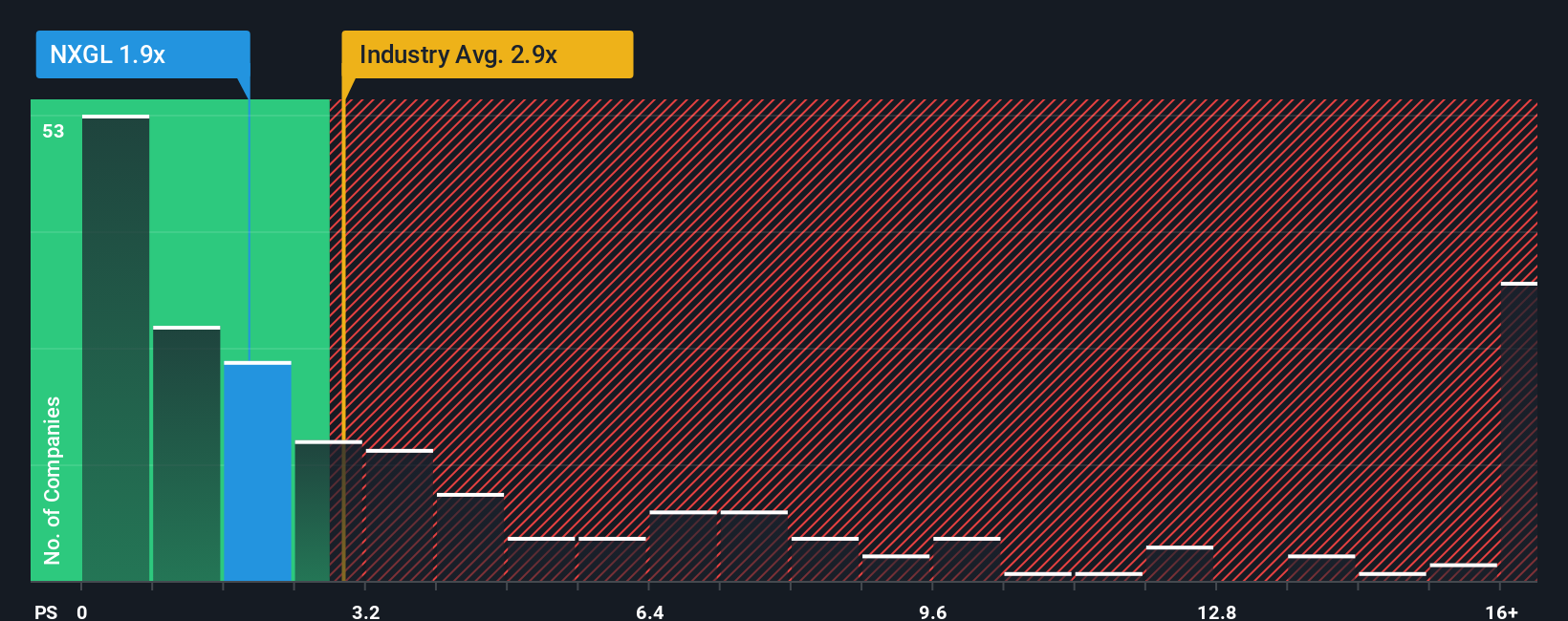

You may think that with a price-to-sales (or "P/S") ratio of 1.9x NEXGEL, Inc. (NASDAQ:NXGL) is a stock worth checking out, seeing as almost half of all the Medical Equipment companies in the United States have P/S ratios greater than 2.9x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for NEXGEL

What Does NEXGEL's P/S Mean For Shareholders?

Recent times have been advantageous for NEXGEL as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on NEXGEL.Do Revenue Forecasts Match The Low P/S Ratio?

NEXGEL's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 133% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 37% per year during the coming three years according to the lone analyst following the company. That's shaping up to be materially higher than the 9.2% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that NEXGEL's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From NEXGEL's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at NEXGEL's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for NEXGEL that you need to be mindful of.

If you're unsure about the strength of NEXGEL's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if NEXGEL might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NXGL

NEXGEL

Manufactures and sells high water content, electron beam cross-linked, and aqueous polymer hydrogels and gels for wound care, medical diagnostics, transdermal drug delivery, and cosmetics in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives