- United States

- /

- Medical Equipment

- /

- NasdaqGS:NVCR

Why NovoCure (NVCR) Is Up 9.9% After Phase 3 METIS Trial Success in Brain Metastases

Reviewed by Sasha Jovanovic

- Novocure announced that final results from its Phase 3 METIS trial showed Tumor Treating Fields (TTFields) therapy combined with best supportive care significantly delayed intracranial progression in patients with brain metastases from non-small cell lung cancer, with the findings presented at the 2025 American Society for Radiation Oncology Annual Meeting and published in a leading medical journal.

- This pivotal trial supports TTFields as an emerging treatment approach for a major unmet need in lung cancer care and may inform upcoming regulatory filings.

- Let's examine how the METIS trial's successful outcome could reshape NovoCure's oncology growth and regulatory approval prospects.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

NovoCure Investment Narrative Recap

To be a NovoCure shareholder, you need to believe that Tumor Treating Fields (TTFields) can transform cancer care and win adoption across new oncology markets. The positive Phase 3 METIS trial results, showing significant delay in intracranial progression for brain metastases from non-small cell lung cancer, may serve as the most important short-term catalyst for regulatory approval, but reimbursement uncertainty remains the biggest near-term risk as payor coverage can directly affect revenue predictability.

Recent momentum is reinforced by NovoCure’s September 15 announcement of Japanese approval for Optune Lua in combination with immunotherapies in non-small cell lung cancer, showing progress in regulatory expansion. This builds on the METIS news, highlighting potential for TTFields therapy to gain traction in multiple markets and settings, increasing the relevance of upcoming regulatory and reimbursement decisions as catalysts for growth.

In contrast, investors should be aware that success in clinical trials does not guarantee widespread payor adoption or profitability, especially if...

Read the full narrative on NovoCure (it's free!)

NovoCure's outlook anticipates $863.5 million in revenue and $107.8 million in earnings by 2028. This projection assumes an annual revenue growth rate of 11.1% and a $278.8 million increase in earnings from the current level of -$171.0 million.

Uncover how NovoCure's forecasts yield a $27.19 fair value, a 94% upside to its current price.

Exploring Other Perspectives

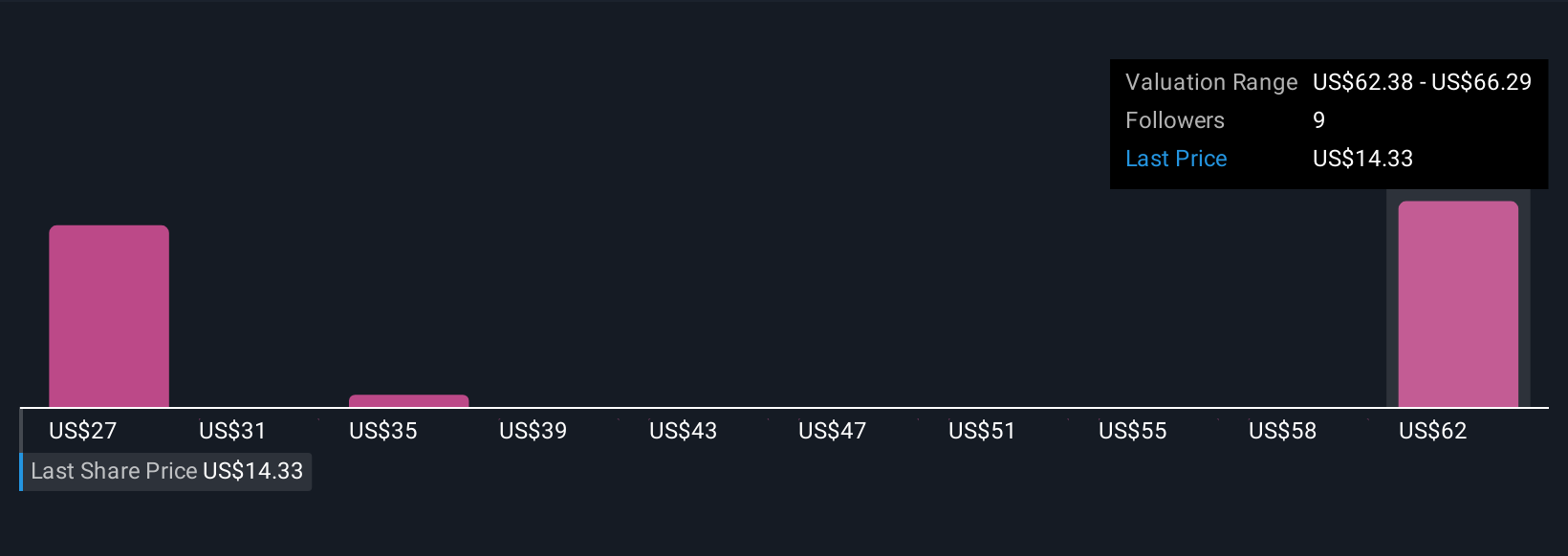

Three fair value estimates from the Simply Wall St Community span from US$27.19 up to US$66.07. With regulatory and reimbursement momentum a key catalyst, opinions on future potential swing widely so consider reviewing several viewpoints.

Explore 3 other fair value estimates on NovoCure - why the stock might be worth over 4x more than the current price!

Build Your Own NovoCure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NovoCure research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NovoCure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NovoCure's overall financial health at a glance.

No Opportunity In NovoCure?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NovoCure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVCR

NovoCure

An oncology company, engages in the development, manufacture, and commercialization of tumor treating fields (TTFields) devices for the treatment of solid tumor cancers in the United States, Germany, France, Japan, Greater China, and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives