- United States

- /

- Medical Equipment

- /

- NasdaqGS:NVCR

How Investors May Respond To NovoCure (NVCR) FDA Approval of Optune Lua for Lung Cancer

Reviewed by Simply Wall St

- Earlier this month, NovoCure announced that its Optune Lua device received FDA approval for the treatment of non-small cell lung cancer, marking a significant milestone for its Tumor Treating Fields (TTFields) therapy platform.

- This approval introduces an innovative electric field-based cancer treatment option and may help advance real-world adoption of TTFields in combination with existing therapies.

- To assess the impact of this regulatory breakthrough, we'll explore how FDA approval for Optune Lua could shape NovoCure's investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

NovoCure Investment Narrative Recap

To be a NovoCure shareholder, one must believe in the long-term potential for Tumor Treating Fields (TTFields) to become a new treatment standard across major solid tumors, outpacing competition and driving broad adoption. While FDA approval for the Optune Lua device in non-small cell lung cancer is a critical scientific milestone, the most important near-term catalyst remains clear evidence of strong prescription growth with broad reimbursement. The main current risk is an uncertain adoption curve, which FDA approval alone may not immediately resolve.

Among recent announcements, NovoCure's August 1 submission for a PMA application in locally advanced pancreatic cancer stands out. With the PANOVA-3 trial showing significant overall survival improvement, this news aligns with the theme of expanding TTFields to other hard-to-treat cancers, serving as an upcoming catalyst that could further broaden the clinical and commercial footprint beyond lung cancer.

Yet, despite scientific advances, investors need to remain alert to the risk that adoption trends may lag expectations if real-world prescriptions or reimbursement milestones fall short...

Read the full narrative on NovoCure (it's free!)

NovoCure's outlook anticipates $863.5 million in revenue and $107.8 million in earnings by 2028. This scenario implies an annual revenue growth rate of 11.1% and a $278.8 million improvement in earnings from the current -$171.0 million.

Uncover how NovoCure's forecasts yield a $27.19 fair value, a 124% upside to its current price.

Exploring Other Perspectives

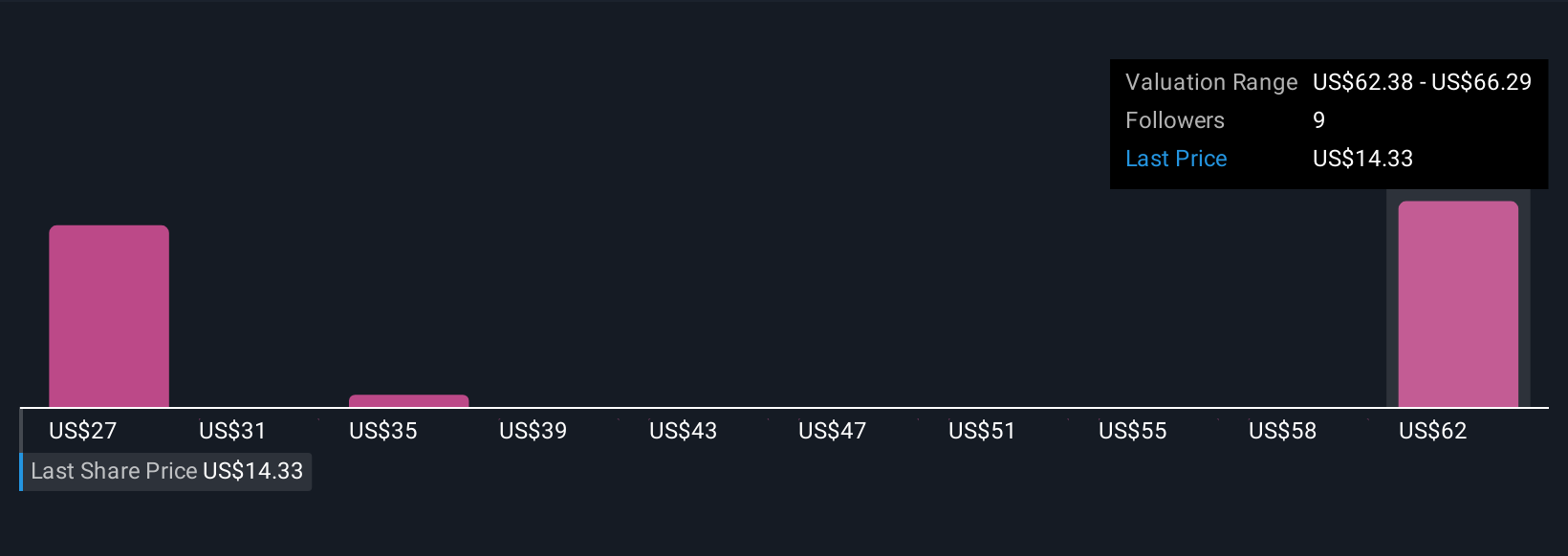

Three members of the Simply Wall St Community estimate NovoCure's fair value between US$27.19 and US$64.17 per share. Opinions vary widely while the key issue of real-world adoption and revenue visibility continues to shape the company's future, so consider how various viewpoints might affect your own expectations.

Explore 3 other fair value estimates on NovoCure - why the stock might be worth over 5x more than the current price!

Build Your Own NovoCure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NovoCure research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NovoCure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NovoCure's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NovoCure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVCR

NovoCure

An oncology company, engages in the development, manufacture, and commercialization of tumor treating fields (TTFields) devices for the treatment of solid tumor cancers in the United States, Germany, France, Japan, Greater China, and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives