- United States

- /

- Medical Equipment

- /

- NasdaqGS:NVCR

How Investors Are Reacting To NovoCure (NVCR) CEO Transition as Frank Leonard Takes the Helm

Reviewed by Sasha Jovanovic

- On December 1, 2025, NovoCure announced that Ashley Cordova resigned from her role as Chief Executive Officer and Board Director, effective at the end of November, with Frank Leonard, formerly President and an established leader within the company, appointed as the new CEO.

- Frank Leonard’s long-standing experience in global operations, product development, and business growth at NovoCure may provide important continuity and insight as the company enters its next phase.

- We’ll explore how Frank Leonard’s internal promotion to CEO may shape NovoCure’s investment outlook, particularly concerning leadership stability.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

NovoCure Investment Narrative Recap

NovoCure shareholders are typically betting on the successful expansion of Tumor Treating Fields (TTFields) into new cancer indications and the company’s ability to increase real-world physician adoption, especially in non-small cell lung cancer. The recent CEO change, with Frank Leonard stepping in, is not expected to materially affect the near-term catalyst of securing broader reimbursement, nor the ongoing risk tied to challenging prescription growth in the US lung cancer market.

Among recent announcements, the release of positive METIS Phase 3 trial results for TTFields in brain metastases is particularly relevant. This readout supports NovoCure’s efforts in gaining regulatory approvals for new indications, which remains key to accelerating growth and addressing current revenue pressures as new leadership takes the helm.

However, investors should be aware that in contrast to leadership continuity, the uncertainty around broad insurance reimbursement for TTFields therapy continues to...

Read the full narrative on NovoCure (it's free!)

NovoCure's outlook anticipates $863.5 million in revenue and $107.8 million in earnings by 2028. This implies an 11.1% annual revenue growth rate and a $278.8 million increase in earnings from the current loss of $-171.0 million.

Uncover how NovoCure's forecasts yield a $24.93 fair value, a 95% upside to its current price.

Exploring Other Perspectives

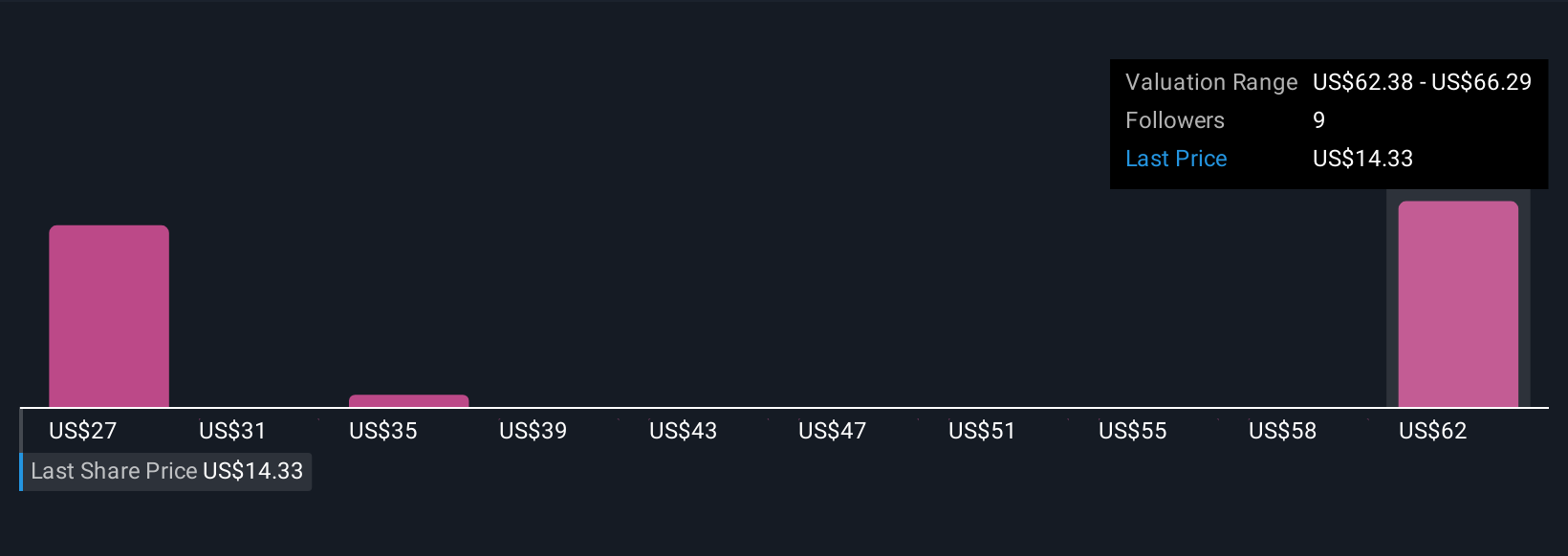

Fair value estimates from four Simply Wall St Community members span US$24.93 to US$175.80, capturing a broad range of outlooks. Against this backdrop, persistent challenges in US prescription growth could affect how quickly NovoCure delivers on expectations, so it pays to consider a variety of viewpoints.

Explore 4 other fair value estimates on NovoCure - why the stock might be a potential multi-bagger!

Build Your Own NovoCure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NovoCure research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NovoCure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NovoCure's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NovoCure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVCR

NovoCure

An oncology company, engages in the development, manufacture, and commercialization of tumor treating fields (TTFields) devices for the treatment of solid tumor cancers in the United States, Germany, France, Japan, Greater China, and internationally.

Undervalued with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026