- United States

- /

- Medical Equipment

- /

- NasdaqGS:NUVA

Why We Think NuVasive, Inc.'s (NASDAQ:NUVA) CEO Compensation Is Not Excessive At All

The share price of NuVasive, Inc. (NASDAQ:NUVA) has increased significantly over the past few years. However, the earnings growth has not kept up with the share price momentum, suggesting that some other factors may be driving the price direction. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 18 May 2021. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

Check out our latest analysis for NuVasive

Comparing NuVasive, Inc.'s CEO Compensation With the industry

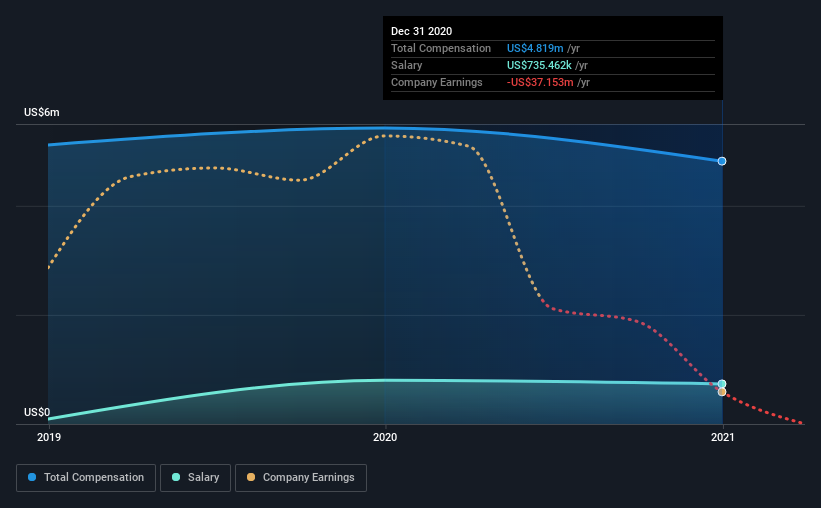

At the time of writing, our data shows that NuVasive, Inc. has a market capitalization of US$3.5b, and reported total annual CEO compensation of US$4.8m for the year to December 2020. Notably, that's a decrease of 11% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$735k.

For comparison, other companies in the same industry with market capitalizations ranging between US$2.0b and US$6.4b had a median total CEO compensation of US$5.5m. This suggests that NuVasive remunerates its CEO largely in line with the industry average. Moreover, Chris Barry also holds US$1.4m worth of NuVasive stock directly under their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$735k | US$800k | 15% |

| Other | US$4.1m | US$4.6m | 85% |

| Total Compensation | US$4.8m | US$5.4m | 100% |

On an industry level, roughly 20% of total compensation represents salary and 80% is other remuneration. In NuVasive's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

NuVasive, Inc.'s Growth

Over the last three years, NuVasive, Inc. has shrunk its earnings per share by 63% per year. It saw its revenue drop 7.9% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has NuVasive, Inc. Been A Good Investment?

We think that the total shareholder return of 40%, over three years, would leave most NuVasive, Inc. shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for NuVasive that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading NuVasive or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NuVasive might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:NUVA

NuVasive

NuVasive, Inc., a medical technology company, develops, manufactures, and sells procedural solutions for spine surgery.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives