- United States

- /

- Medical Equipment

- /

- NasdaqGS:NEOG

Optimism around Neogen (NASDAQ:NEOG) delivering new earnings growth may be shrinking as stock declines 4.4% this past week

Neogen Corporation (NASDAQ:NEOG) shareholders should be happy to see the share price up 21% in the last month. But that doesn't change the fact that the returns over the last three years have been disappointing. Tragically, the share price declined 65% in that time. So it's good to see it climbing back up. After all, could be that the fall was overdone.

With the stock having lost 4.4% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Neogen

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Neogen moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

We note that, in three years, revenue has actually grown at a 28% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Neogen further; while we may be missing something on this analysis, there might also be an opportunity.

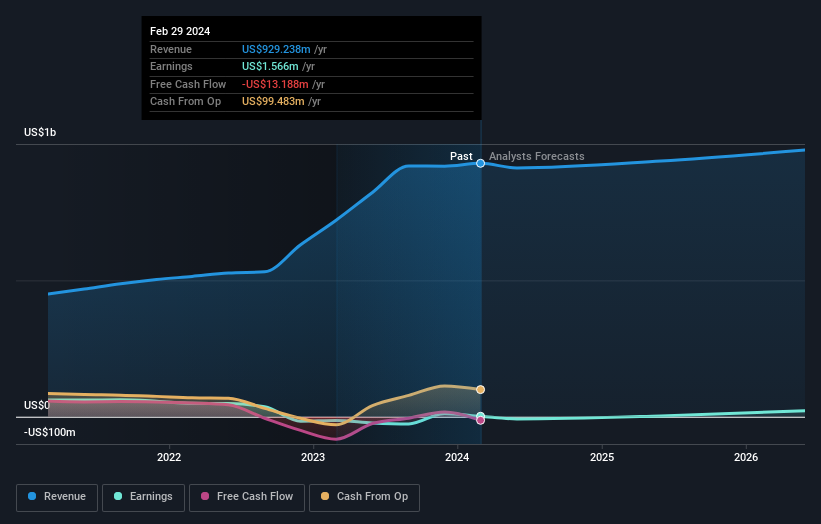

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free report showing analyst forecasts should help you form a view on Neogen

A Different Perspective

Investors in Neogen had a tough year, with a total loss of 25%, against a market gain of about 24%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Neogen better, we need to consider many other factors. Even so, be aware that Neogen is showing 1 warning sign in our investment analysis , you should know about...

Neogen is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Neogen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NEOG

Neogen

Engages in the development, manufacture, and marketing of various products and services dedicated to food and animal safety worldwide.

Moderate growth potential with imperfect balance sheet.