- United States

- /

- Healthcare Services

- /

- NasdaqCM:NEO

The past three years for NeoGenomics (NASDAQ:NEO) investors has not been profitable

While it may not be enough for some shareholders, we think it is good to see the NeoGenomics, Inc. (NASDAQ:NEO) share price up 14% in a single quarter. But that doesn't change the fact that the returns over the last three years have been disappointing. In that time, the share price dropped 51%. So it is really good to see an improvement. The rise has some hopeful, but turnarounds are often precarious.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

See our latest analysis for NeoGenomics

NeoGenomics wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, NeoGenomics saw its revenue grow by 11% per year, compound. That's a fairly respectable growth rate. That contrasts with the weak share price, which has fallen 15% compounded, over three years. The market must have had really high expectations to be disappointed with this progress. So this is one stock that might be worth investigating further, or even adding to your watchlist.

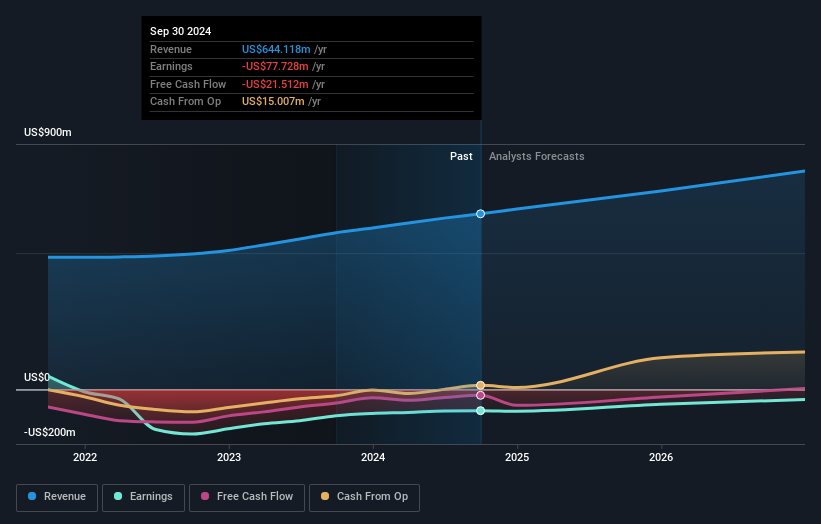

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

NeoGenomics is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

NeoGenomics provided a TSR of 4.0% over the last twelve months. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 7% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand NeoGenomics better, we need to consider many other factors. For instance, we've identified 1 warning sign for NeoGenomics that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if NeoGenomics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NEO

NeoGenomics

Operates a network of cancer-focused testing laboratories in the United States and the United Kingdom.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives