- United States

- /

- Medical Equipment

- /

- NasdaqCM:MODD

Here's Why We're A Bit Worried About Modular Medical's (NASDAQ:MODD) Cash Burn Situation

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Modular Medical (NASDAQ:MODD) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Modular Medical

When Might Modular Medical Run Out Of Money?

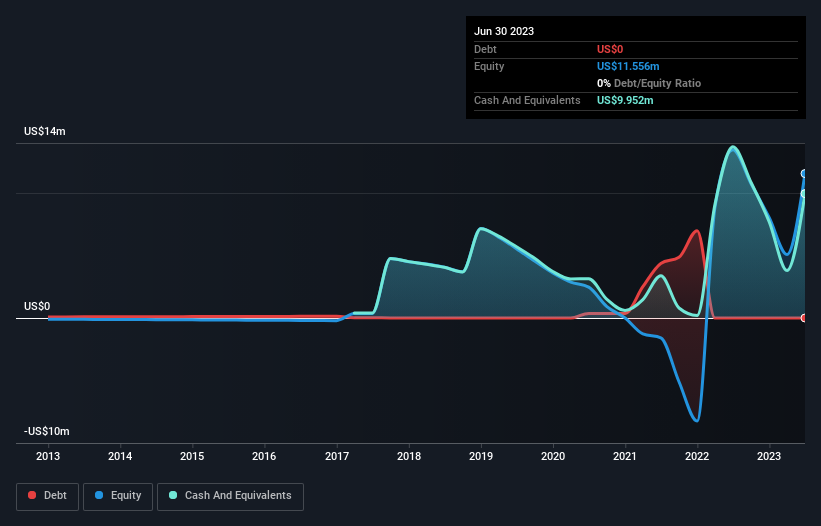

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at June 2023, Modular Medical had cash of US$10.0m and no debt. In the last year, its cash burn was US$13m. Therefore, from June 2023 it had roughly 9 months of cash runway. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. You can see how its cash balance has changed over time in the image below.

How Is Modular Medical's Cash Burn Changing Over Time?

Modular Medical didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. With the cash burn rate up 24% in the last year, it seems that the company is ratcheting up investment in the business over time. However, the company's true cash runway will therefore be shorter than suggested above, if spending continues to increase. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Modular Medical To Raise More Cash For Growth?

Since its cash burn is moving in the wrong direction, Modular Medical shareholders may wish to think ahead to when the company may need to raise more cash. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Modular Medical has a market capitalisation of US$22m and burnt through US$13m last year, which is 62% of the company's market value. Given how large that cash burn is, relative to the market value of the entire company, we'd consider it to be a high risk stock, with the real possibility of extreme dilution.

Is Modular Medical's Cash Burn A Worry?

We must admit that we don't think Modular Medical is in a very strong position, when it comes to its cash burn. While its increasing cash burn wasn't too bad, its cash burn relative to its market cap does leave us rather nervous. After considering the data discussed in this article, we don't have a lot of confidence that its cash burn rate is prudent, as it seems like it might need more cash soon. On another note, Modular Medical has 6 warning signs (and 4 which are significant) we think you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MODD

Moderate risk with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026