- United States

- /

- Healthcare Services

- /

- NasdaqCM:ME

23andMe Holding Co. (NASDAQ:ME) Investors Are Less Pessimistic Than Expected

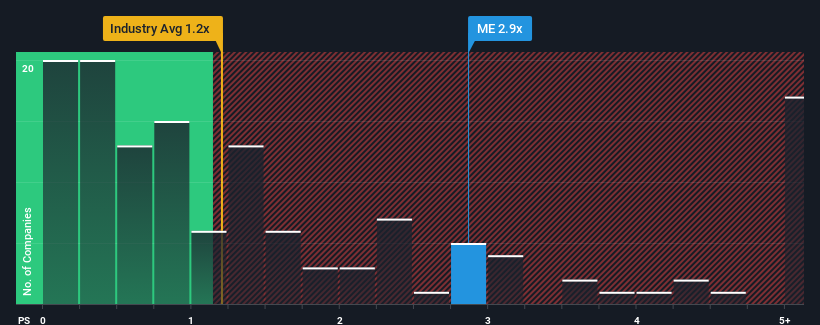

When you see that almost half of the companies in the Healthcare industry in the United States have price-to-sales ratios (or "P/S") below 1.2x, 23andMe Holding Co. (NASDAQ:ME) looks to be giving off some sell signals with its 2.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for 23andMe Holding

How 23andMe Holding Has Been Performing

Recent revenue growth for 23andMe Holding has been in line with the industry. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on 23andMe Holding will help you uncover what's on the horizon.How Is 23andMe Holding's Revenue Growth Trending?

In order to justify its P/S ratio, 23andMe Holding would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 10% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 2.0% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 5.1% each year as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 8.6% each year growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that 23andMe Holding's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've concluded that 23andMe Holding currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 3 warning signs for 23andMe Holding you should be aware of, and 1 of them can't be ignored.

If you're unsure about the strength of 23andMe Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ME

23andMe Holding

Operates as a consumer genetics testing company in the United States, the United Kingdom, Canada, and internationally.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives