- United States

- /

- Medical Equipment

- /

- NasdaqCM:MDAI

Market Cool On Spectral AI, Inc.'s (NASDAQ:MDAI) Revenues Pushing Shares 25% Lower

Spectral AI, Inc. (NASDAQ:MDAI) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 36% in the last year.

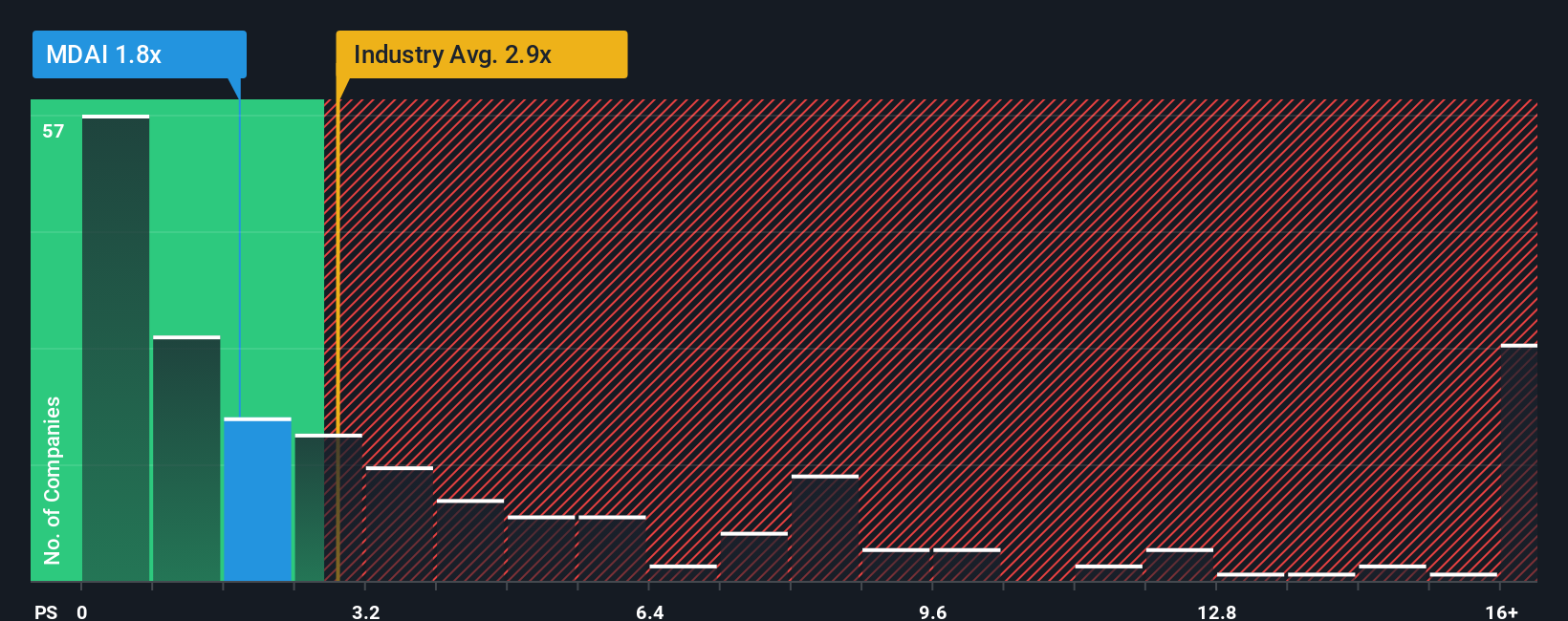

Since its price has dipped substantially, Spectral AI's price-to-sales (or "P/S") ratio of 1.8x might make it look like a buy right now compared to the Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 2.9x and even P/S above 8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Spectral AI

What Does Spectral AI's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Spectral AI has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Spectral AI's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Spectral AI would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The latest three year period has also seen an excellent 35% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 21% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 9.2% per annum, which is noticeably less attractive.

In light of this, it's peculiar that Spectral AI's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Spectral AI's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Spectral AI's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 4 warning signs for Spectral AI (2 are potentially serious!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MDAI

Spectral AI

An artificial intelligence (AI) company, focuses on predictive medical diagnostics in the United States.

Good value with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026